With Fed intervention interrupting “normal” market activity, Jeff Greenblatt shares short-term opportunities for profit.

Last week I discussed the trap being set up as a result of the impending reopening of the economy. Now that day is upon us. There is one condition I’ve noticed that is an iron rule of financial markets. Like credit cards, its buy now and pay later. Regardless of what you think of the unprecedented times, I’m going to limit my views to what happens in financial markets. Unfortunately, politicians and the Federal Reserve have been messing with the free flow of financial markets for a long time.

There are unintended consequences to policy decisions made by people who have no clue how the economy works and the bill is starting to come due. Dr. Anthony Fauci even admitted a lockdown was only one of several scenarios they considered but he went with it anyway. Thus, they created the worst economic conditions since the Great Depression. Not being content with destroying the global economy, policymakers are now doubling down. Yes, restaurants are reopening in parts of the country, along with many retail outlets, which will only be allowed to maintain 25% of capacity. Do people like Dr. Fauci understand a business is there to make a profit because the owner must keep a roof over his head and feed his family?

That’s not going to happen when any business is only allowed to run at 25% capacity. That’s a problem for all small business owners. But it also creates a dilemma for the stock market. What we have now is a market being propped up by the Fed. I’ve lost count of how many trillions banks have been given to buy stocks which is on top of the trillions they were given to keep the repo market from shutting down the financial system for good.

The market has been rising since the Gann master turning point bottom in March. It’s rising at the same time we arguably have the worst economic data in the history of the republic. It doesn’t make sense, does it? If you want to understand what is going on, look at the last decade. Lots of you went short at various points because you thought the market would top despite the fact quantitative easing (QE) kept the markets going throughout the decade. It dropped in 2018 only because it was a rising rate environment.

QE on Steroids

Now we have something similar. Markets are being kept afloat because the Fed has created QE on steroids. I don’t know what you would call this, for the Fed to backstop everything, including our $1200 stimulus payment is beyond anything I thought I’d ever see in my life.

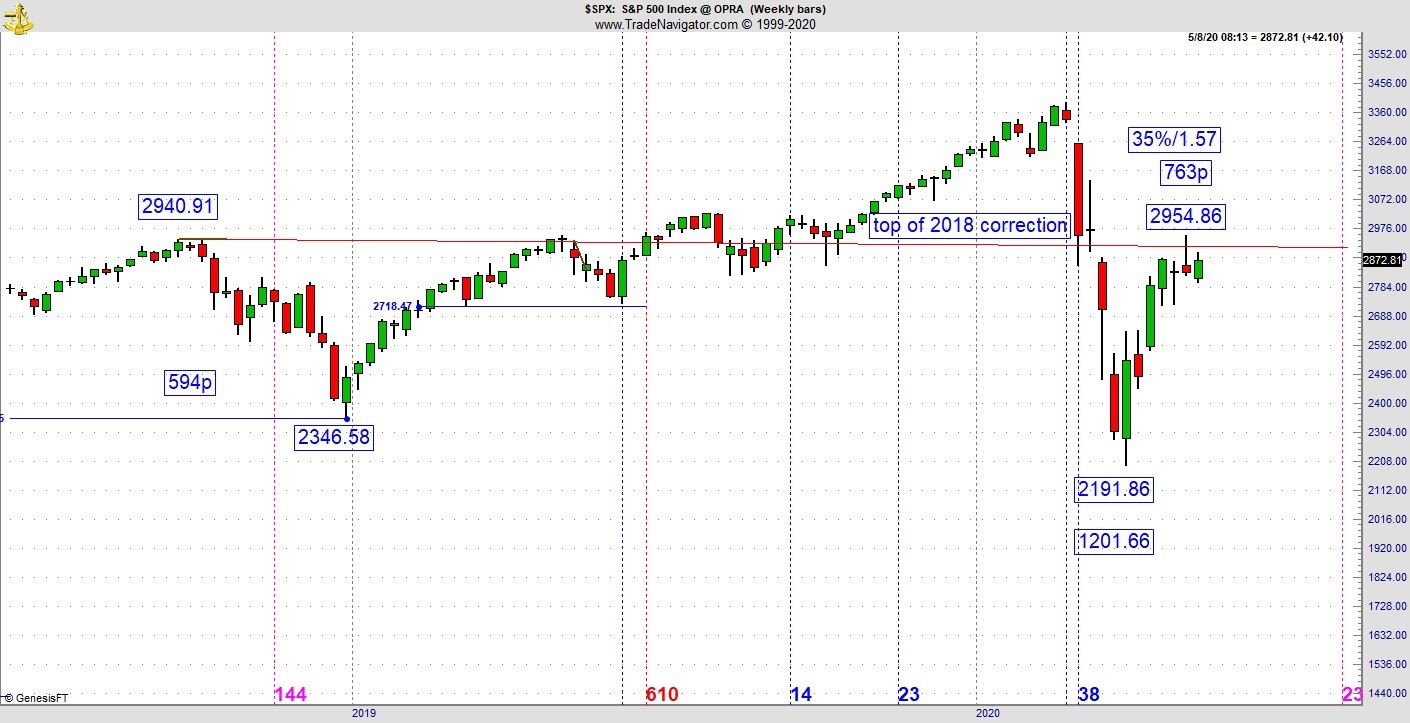

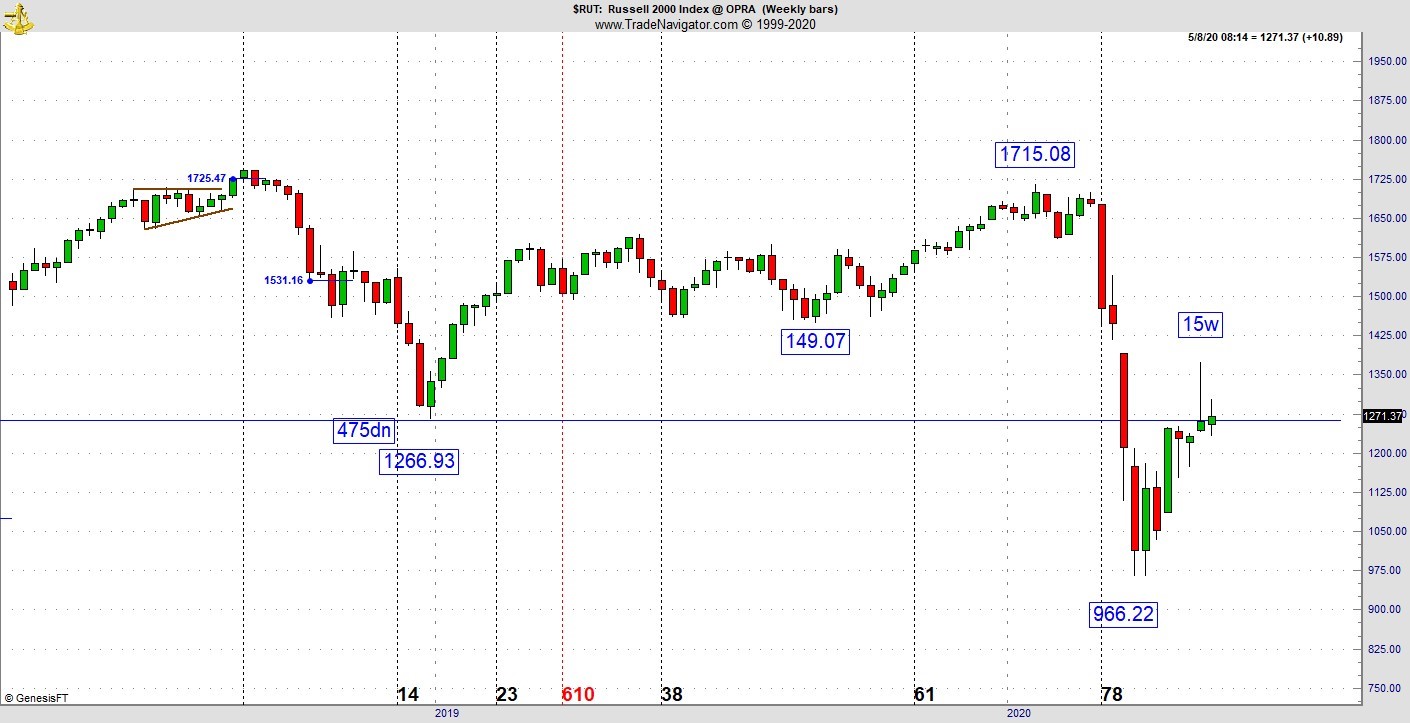

Yet as a trader it is your job to go with the flow, even as it seems totally insane. I have included charts of the SPX and the Russell 2000 (see below). As you can see, the SPX has rallied to the top of the 2018 peak which was the origination point of the last correction. Now it has stalled. The Russell has made it to the bottom of that 2018 correction and left an upper tail on a weekly chart. It has the potential to flip polarity. The technology sector is doing better. But I think these two charts are the more accurate indication of what is going on.

This generation of policymakers have not considered the financial implications to their actions. A great example is Norwegian Cruise Line Holdings (NCLH), which warned earlier in the week they may have to consider quitting as a going concern. If I would’ve told you a year ago a major cruise line might go out of business you would’ve thought I was crazy.

But not to worry. Even as they won’t have revenue for the next 12 months, CNBC just reported they were able to raise more than $2 billion in a mixture of stock and debt to keep them going for the next year. Mom and pop businesses will not have that luxury. Policymakers behave like consumers who run up the credit card at Christmas without any worry about the bill coming due.

Usually, that bill comes within a month or two. This week we will be treated to the worst jobs numbers in our lifetime. That may not be enough to drop the market as the crowd is still inhaling the false hope helium the reopening of the economy will bring things back to normal. It will not return to normal anytime soon and maybe not in our lifetime. All we know right now is nobody can expect a company to turn a profit when they are operating at 25% of capacity after they’ve been effectively shut down for two months.

No V Recovery by there are Trades

These foolish decisions won’t be felt until the next quarter. I do not believe there will be a V or U-shaped recovery. More likely is a relentless stairstep drop like the 1930-32 market. Remember, the four-year cycle hard bottoms in 2022. For those of you who’ve read Socionomics, that would be the most favorable outcome considering these kinds of bear markets usually lead to major wars.

That being said, let me show you what is working in the E-mini from a trade this morning. There are tendencies which can be learned over time which repeat in the market on a regular basis. This is not financial advice because if you are going to be in this market you must be well prepared and at the top of your game as past performance does not equal future returns.

What you are seeing is a trend on a one-minute E-micro Dow Jones futures chart (see below). Here is the setup. The market rallied 150 points off the low to create a 52% retracement against the prior drop. Keep in mind the low is 23653 (653). Then it hit a 52 point drop to 23751 (751) where it put in a bullish engulfing formation.

At that point I connected the dots to get the lower trend line, which did not exist while the Kairos was setting up, after I simply drew a parallel upper line and rode the pattern until it hit that upper line. You can see the entry on the bullish engulfing formation. Nothing spectacular, but it was roughly 40 Dow E-mini points in four minutes. In this elevated risk environment, many traders are opting to participate in the E-Micro and the mechanics of this setup is the same whether it’s the E-mini or E-Micro.

Overall, it’s going to be hard to get this market to drop considering all the unnatural interference from the Fed. On the other hand, it’s hard to imagine a stock market getting to new highs on an economy that is only beginning to get the spring thaw. Unless and until there is a new black swan event, the stock market is likely to have its ups and downs which could result in a massive trading range.

If you want more information, go to: Lucaswaveinternational.com and sign up for the free newsletter.