Originally Posted May 21: While the Stock rebound, aided by Fed stimulus, continues to impress, it is good to remember that precious metals have significantly outperformed them in 2020, reports Mike Larson.

Investing is a tough business. If it wasn’t, it would be called winning. The last thing you want to do is make things harder on yourself. And I feel like that’s what too many are doing in stocks these days.

Take this week’s price action. News of a potentially successful vaccine trial that only involved a handful of patients caused equities to soar. The Dow Jones Index surged more than 1,000 points and the S&P 500 rocketed more than 100 points early on, before settling down.

But if you look at a longer-term chart of the S&P, you see it has gone essentially nowhere for 28 months and counting. Ditto for the Dow.

If you owned a tech-heavy, mega-capitalization portfolio that mirrors the Nasdaq 100, you’ve done better. But if you owned a broader, smaller-cap portfolio that mirrors the Russell 2000, you’ve done much worse.

In other words, the stock market is — and has been — a battleground for a while. A long, tough slog to get precisely nowhere ever since early 2018.

That’s when I told you the broad bull run was over. The economic and credit cycles were turning well before the virus struck.

But there is one asset class — and an associated group of stocks — that are on fire! In pure, unadulterated bull market mode. They began to run in late 2018, but they’re only in the fourth inning or so.

I’m talking about gold, silver and precious metals miners.

Short term. Intermediate term. Long term. Gold and gold stocks have been crushing stocks on all time frames, while silver is now playing “catch up” in a big way.

Moreover, precious metals are doing this behind the scenes. They’re not getting the mainstream media or investor attention as, say, FAANG—Facebook (FB), Apple (AAPL), Amazon (AMZN), Netflix (NFLX) and Google (GOOG)— stocks. And that’s a key reason this move is far from over.

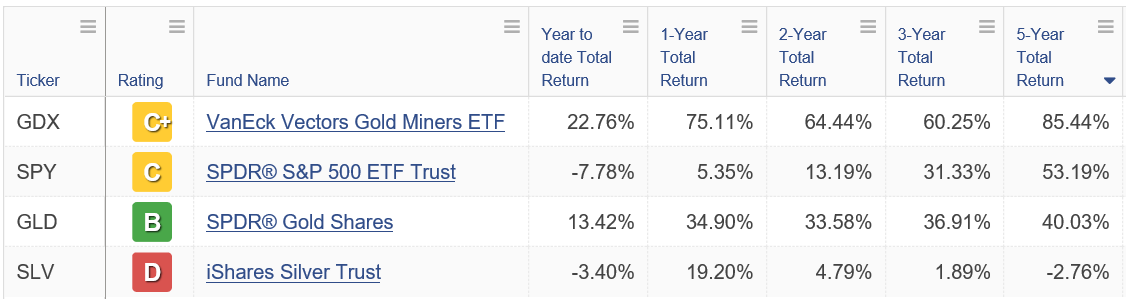

Look at the table below and you’ll see what I’m talking about. It shows how the SPDR S&P 500 ETF Trust (SPY) has performed relative to the SPDR Gold Shares (GLD), the iShares Silver Trust (SLV) and the VanEck Vectors Gold Miners ETF (GDX).

All total return time frames, from year-to-date out to five years, are shown in the columns.

The GDX is up almost 23% year-to-date, while the SPY is still down around 8%, even after its recent rally. In the last 12 months, the performance gap is ridiculous: +75% for GDX versus +5% for SPY.

Look even farther back, and you’ll see the same story. Miners have been coining money throughout, leaving the S&P 500 in the dust.

If you know anything about metals, you know that mining stocks are a form of leveraged investment. That means they tend to rise more than the underlying metals they mine in bull markets and fall more than them in bear markets.

So, let’s take away that advantage. Let’s just compare the GLD to the SPY.

The pattern is mostly the same. Gold has trounced stocks on a year-to-date, one-year, two-year and three-year basis. And even going back a half decade, its returns have been rock-solid.

No doubt silver has been a laggard. That’s one reason why our Weiss Rating for the iShares Silver Trust is lower. But even there, you’ve done better in silver than stocks so far this year and over the last 12 months.

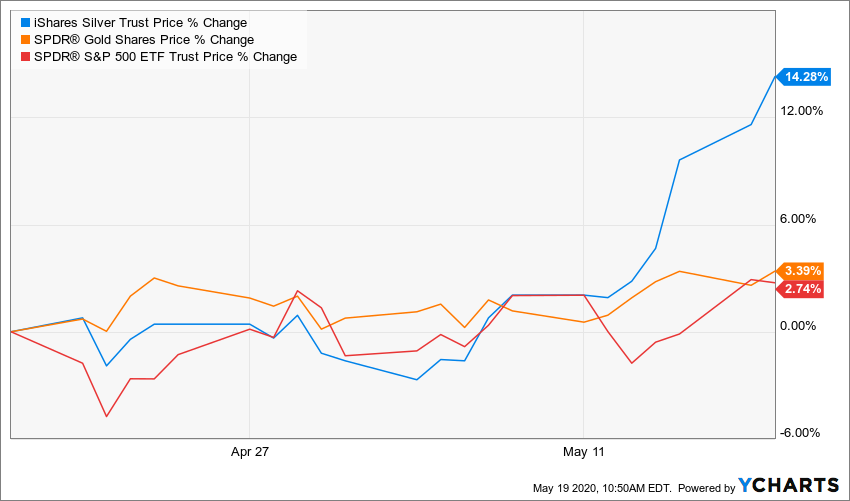

Plus, SLV has rocketed 14% in just the last 30 days. That’s a sign the metal may be ready to close the performance gap with gold and stocks in a big way (see chart below).

I’ve said it before, but it’s worth repeating: I am not a “Gold Bug,” I am an investor.

This means there are times I like precious metals; times I don’t like precious metals and times I don’t really care what metals are doing because there are better investments elsewhere.

But I’ve been vocal since late 2018 that this is a powerful metals bull market. I hope you got on board back then — and are profiting handsomely as a result. Even if you didn’t, I don’t think it’s too late.

After all, this is a world where the Federal Reserve and its foreign counterparts are buying up, bailing out, or backstopping all kinds of markets. They’re printing vast sums of money to do it.

Despite their recent denials, Fed policymakers may also be forced to take interest rates into negative territory here in the United States. Those are all powerfully positive forces for metals, even as short-term corrections and pullbacks are inevitable.

In other words, why just keep hoping the broad stock market is the only place to be? Why not diversify into assets that are in full-on bull market mode?

Seems like an easy choice to me.

Join Mike Larson virtually for his New MoneyShow Virtual Event Presentation: “How to Profit as the Great Gold Rush Gains Steam,” on Thursday June 11.

Subscribe to Weiss ratings' Safe Money Report here…