The E-mini S&P continues to rally and test resistance on way to new high and or inevitable correction, reports Al Brooks.

The E-mini S&P 500 is rallying in a strong buy climax and it is testing the 2019 close. There is no top yet. Traders will buy the first one- to three-day pullback.

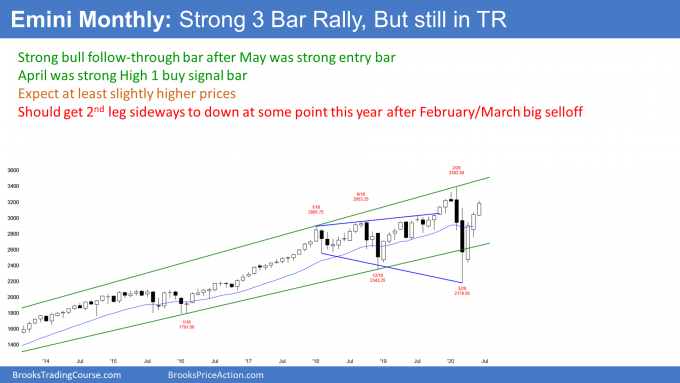

The E-mini S&P 500 futures has been in a bull trend for 11 years. However, it has been in a trading range for 2.5 years. So far, June is a big bull trend bar, but the month just started. The chart could look very different once the month closes (see chart).

In March, the S&P broke below the bottom of the range, then reversed up. April was a strong High 1 bull flag buy signal bar. May close on its high and it therefore was a strong entry bar.

June is the follow-through bar. So far, it is also strong. Traders are wondering if the rally will continue up to a new all-time high. If June closes near its high, the probability will shift in favor of a new high within a few months.

It is still more likely that there will be a second leg sideways to down after the huge Bear Surprise reversal in February and March. However, in 20% of the cases, the second leg down begins after there is a new high.

With this rally as strong as it has been, there is currently a 40% chance that it will continue up to a new high before there is a pullback on the monthly chart.

The E-mini futures chart formed a big bull trend bar last week on its weekly chart (see below). The prior six weeks were not significantly bullish. It looked like they were starting to form a trading range.

This week accelerated up and resumed the V bottom bull trend reversal. Last week was a Bull Surprise breakout. Traders expect at least a small second leg sideways to up after the first pause or pullback.

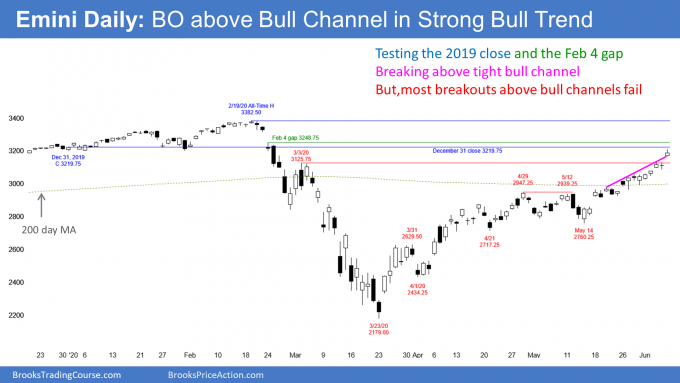

Since the E-mini broke above the March 3 lower high, traders are looking at the next resistance above.

An obvious target is the gap above the Feb. 24 high. That high is 3,248.75. This week’s strong rally makes it likely that the E-mini will test into that gap.

Remember, the E-mini rolls over into the September contract this week. That will change all of the prices.

What about a new all-time high?

Can the rally continue up to a new all-time high? Of course. Also, the closer the E-mini gets to the high and the stronger bull bars it gets, the higher the probability of a new high. Currently, the bulls have a 40% chance of a new high before there is a 15% correction.

That means there is still a 60% chance of a lower high. But if this week is another big bull bar, the odds of a new high would be at least 50%.

The E-mini futures has been in a parabolic wedge buy climax since it gapped up on May 19 on the daily chart (see below). A buy climax can go a long way before the bulls take profits. Also, once they do, the first leg down is usually minor.

Traders expect at least a micro-double top before looking for more than a one- to three-day pullback. The odds favor at least slightly higher prices.

The E-mini is very near the close of 2019. It will probably go above it next week. At that point, the E-mini will be up on the year.

The big gap down on Feb. 4 is just a little higher. That is a magnet as well, and therefore the E-mini might test into it soon.

Most breakouts above bull channels fail. The E-mini is breaking above a three-week tight bull channel. This is happening late in a bull trend. Traders should expect at least a minor reversal down within a couple weeks.

Friday’s gap up was unusually big. That is another sign of a climax. If the E-mini gaps down any day this week, there will be an island top. If there is a gap down and the bears can keep it open for a week or so, traders will begin to look for a swing down.

What is the probability of a new high?

The E-mini has ignored resistance for three months. That is a sign of strong bulls. What we do not know is if the V bottom reversal will make a new high. Is this rally just a strong leg in the 2.5-year trading range?

Until this week, there was a 70% chance that the rally was going to form a lower high. But there were five strong days last week. Also, the E-mini broke strongly above the resistance of the 200-day moving average and the March 3 lower high.

Traders now believe that the bulls have a 40% chance of a new high before there is more than a three-day pullback. If this week continues up strongly, the probability will go up to 50% to 60%.

How big will reversal be?

Since the bull trend began in March, every selloff for three months reversed back up within three days. The bulls have been very eager to buy.

At some point, they will take profits. When they do, the bears will see the profit-taking and they will sell as well. This will create a deeper and longer pullback.

Once there is a correction, one of the first targets is the bottom of the most recent leg up. That is the May 14 low of 2760.25. Since that is near 20% down from the high, the E-mini would probably fall below that level as well. It would then be back in a bear market.

In April, the E-mini broke above the March 31 high of 2629.50, but never tested that breakout point. It therefore also a magnet for the bears.

Traders are deciding if the rally is a bull leg in the 2.5-year trading range or a resumption of the 11-year bull trend. Right now, it is still more likely a leg in the trading range. If it is, traders will expect a reversal down to retrace about half of the rally. That would be about a 15% correction down to around 2700.

However, if the rally continues up to a new high, traders will conclude that bull trend has resumed. But most trading range breakouts fail. Consequently, there will probably be sellers not too far above the February all-time high.

Trading Room

Traders can see the end of the day bar-by-bar price action report by signing up for free at BrooksPriceAction.com. I talk about the detailed E-mini price action real-time throughout the day in the BrooksPriceAction.com trading room. We offer a two-day free trial.