Jay Soloff breaks down an interesting Wells Fargo trade that can produce solid returns by Halloween.

Despite plenty of volatility in the market, it hasn’t been any easier to generate income for your portfolio. Yields are still ultra-low for most fixed income instruments. Moreover, many high-yield dividend stocks have slashed their dividend payments.

Regarding dividend stocks, buying and holding them is certainly not an unreasonable way to generate yield. The best companies are still paying dividends. And, even the riskier companies will be fine in the long run if they aren’t a bankruptcy risk.

Nevertheless, dividend stocks aren't the best way to generate yield over the short-term. Fixed income products are typically worse. You need to get a little creative in order to find decent yields over a shorter period.

Or, you could simply use covered calls to increase yield.

A covered call is a strategy that combines stock buying with option selling. It's really quite easy to do, and just about every broker should make it easy to execute this strategy. Covered calls are so popular, that several exchange traded funds (ETFs) and funds are entirely based on the strategy.

Let's look at an actual covered call trade from last week to give you an idea of just how useful it can be to increase your portfolio's yield. The trade I'm looking at involves Wells Fargo (WFC). Now, Wells Fargo is interesting because bank stocks have been hit pretty hard due to the pandemic and ultra-low interest rates. The stock is paying an 8% dividend.

As one of the largest banks in the country, Wells Fargo is a relatively safe pick. There is virtually no short-term bankruptcy risk. And the projected dividend should also be safe: 51¢ in August. That means a covered call (which also buys the stock) will also include expected dividend payments.

This particular trade had the covered call trader buying 500,000 shares of Wells Fargo at $25.64 per share. At the same time, the trader sold 5,000 of the October 27.5 calls for $1.98. Selling the calls provides a 7.7% yield on the trade. With the dividend in August, the entire position will yield 9.7% before Halloween (Oct. 31).

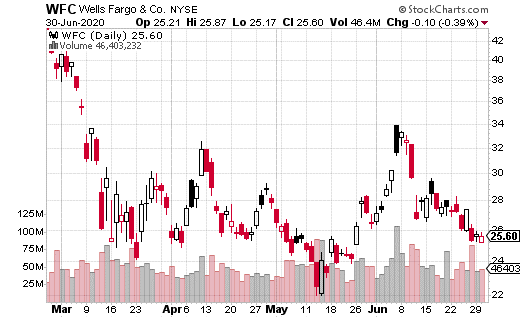

Looking at the chart above, you can see Wells Fargo is already near its bottom for the last several months, including the March crash. So, there doesn’t seem to be a lot of additional downside risk. Plus, the $1.98 yield from the covered call means you can’t lose money on this trade until the stock price drops below $23.66.

What's more, selling the 27.5 calls also means the trade can earn appreciation on the stock price up to $27.50. That's an additional $1.86 in upside potential on the position should the stock price move higher by then. All told, if Wells Fargo is at $27.50 or above at October expiration, this trade can earn 17% profits in under four months and do so without a lot of risk involved.

Jay Soloff is the Options Portfolio Manager at Investors Alley. He is the editor for Options, an investment advisory bringing you professional options trading strategies, with all the bells and whistles of Wall Street, but simplified so all you have to do is enter the trades with your broker. Want to Learn Butterflies and Condors? Join Me for a Live Training Session on Monday. FREE! Beginner’s Options Guide for Investors Who Have Never Traded Options But Want To. Click Here To Download.