The froth in equities has declined in recent weeks as stocks experienced their sharpest selloff since their March bottom, explains Joon Choi of Signal Alert Asset Management.

The S&P 500 Index (SPX) fell 8.4% and the technology heavy NDX-100 Index (NDX) sold off 11.6%. Stocks seem to have found a short-term support, but it does not seem like we are out of the woods yet as retail investors continue to lever up their bullish bets by purchasing equity call options. I imagine the stock market may not meaningfully staying above the S&P 500 Index’s August 18 closing level (3,389.78) until 2021.

In recent weeks, international equities have fared much better than their domestic counterparts as investors reduced their mega-cap technology stocks exposure. For example, Apple (AAPL) sold off 20.4% (a bear market) from September 1 thru 18. In this article, I will show why international stocks may have a hard time competing with US stocks for the foreseeable future (again).

US dollar reversal looming?

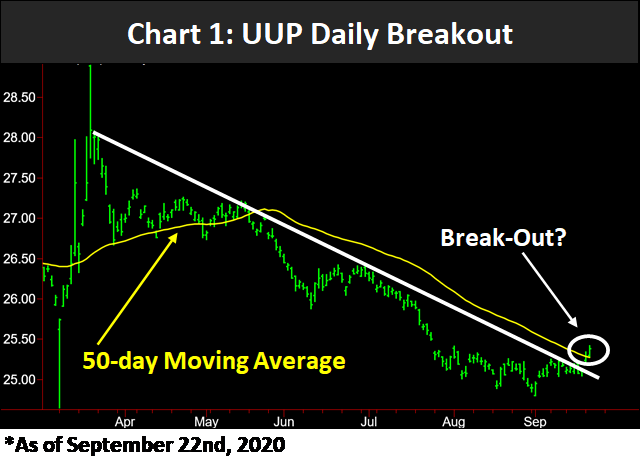

The daily chart of US Dollar Index Bullish Fund (UUP) (Chart 1 below) highlights that the US dollar ETF, recently broke above its downtrend started in March while penetrating its 50-day moving average. This relative strength in the US dollar may attract additional capital and continue to strengthen.

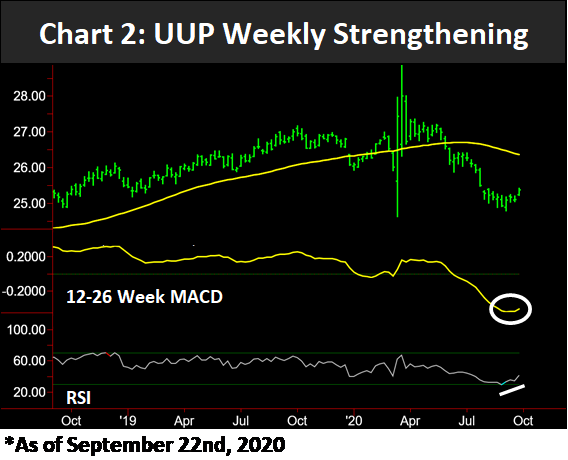

In addition, Chart 2 displays positive signs for UUP as its 12-26-week MACD turned up for the first time since May and it is well below 0; reflecting an oversold condition. Moreover, RSI fell below 30 a few weeks ago and is trending up.

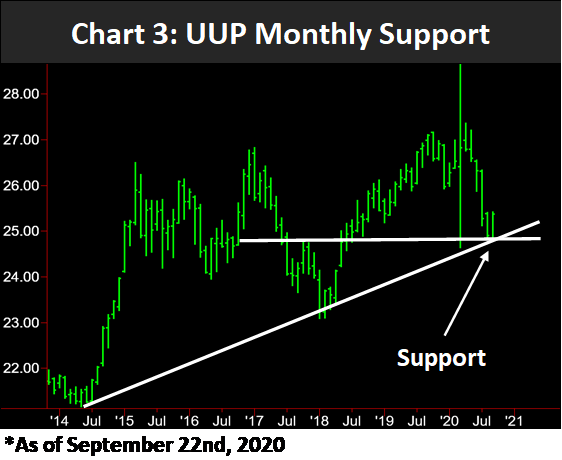

Even the UUP monthly chart shows encouraging signs for the US dollar as it bounced up 1.9% in September after retracing back to the uptrend line dating back to 2014 in August (Chart 3).

Additionally, a strong horizontal support may have also led to this month’s strong rebound.

Strong dollar is not good for international stocks

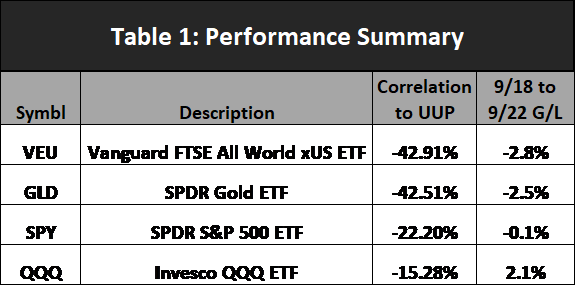

I ran a correlation analysis against UUP since 2010 and discovered that no equity/bond ETFs had a positive correlation; meaning the strong dollar was not beneficial to the ETFs; at least daily (Table 1, next page). However, Vanguard FTSE All World excluding US (VEU) was the most negatively correlated equity ETF (other than some single country ETFs); albeit -42.91% is not a very strong correlation.

This suggests that strong dollar will serve as a headwind for VEU, which make sense since most international ETFs are priced in local currencies. The SPDR Gold bullion ETF (GLD) also was negatively correlated at -42.51% while SPDR S&P500 ETF (SPY) and PowerShares QQQ Trust (QQQ) were less correlated to the dollar; -22.2% and -15.28% respectively.

Coincidentally, as UUP broke the downtrend on September 21 and its 50-day moving average on 22nd, VEU had its worst two-day performance among the four ETFs highlighted in Table 1. QQQ was the ETF with the lowest correlation to UUP with a two-day change of +2.1%.

Conclusion

Since 2011, international equities have been cheaper than their US counterparts for years and switching from domestic to overseas stocks would not have been beneficial. It appears looming the US dollar’s strength will serve as a tailwind for US stocks’ relative performance vs. non-US stocks. Therefore, it is my recommendation to stay close to home as much as possible even when investing for the future.

To learn more about Joon Choi, please visit Signal Alert Asset Management.