As pharmaceutical companies worldwide are racing to release vaccines for the coronavirus pandemic, investors are looking for potential trading opportunities, states Suri Duddella of suriNotes.com.

Few of these stocks are currently trading in cup-&-handle chart patterns and signaling potential breakouts.

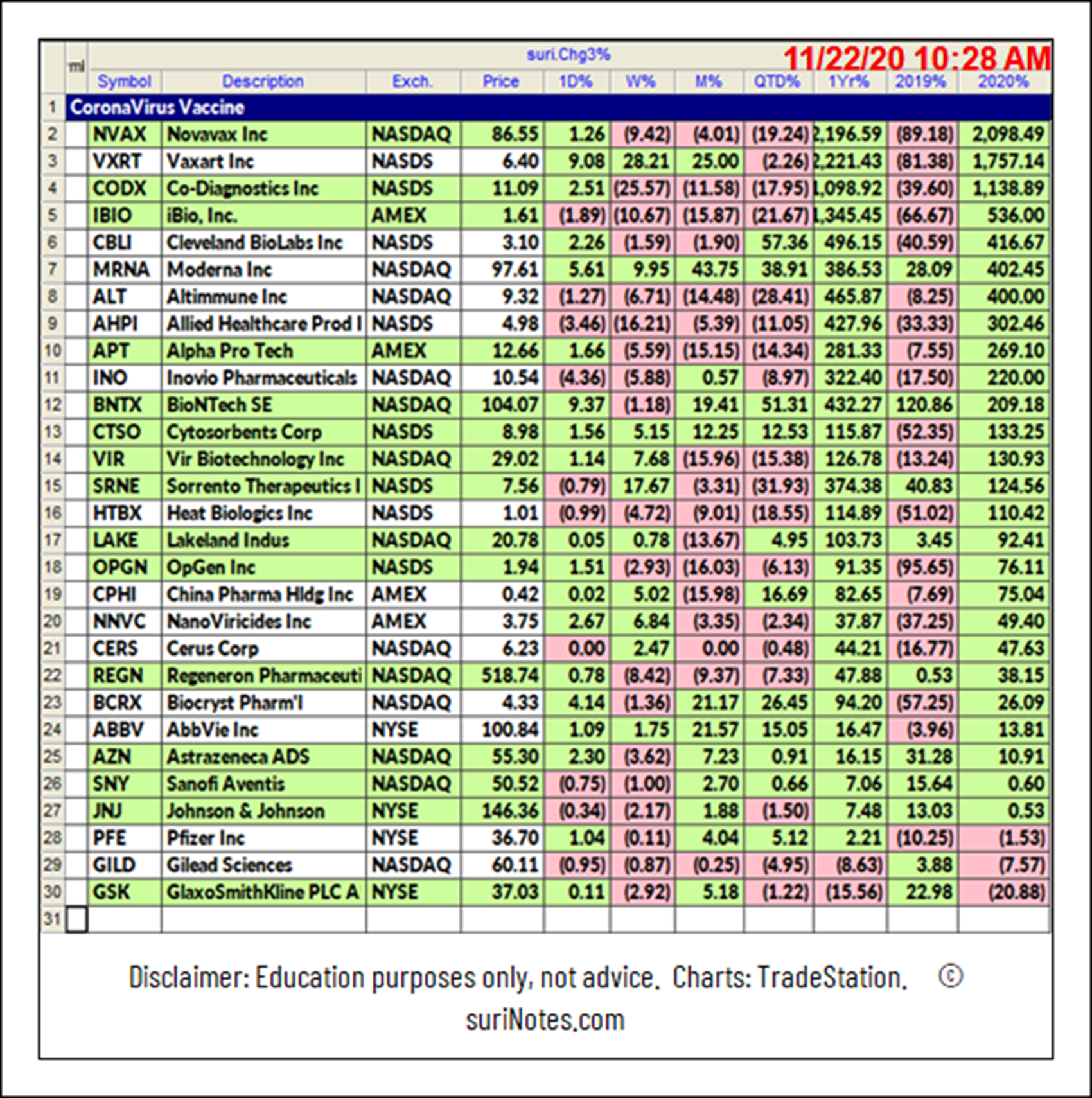

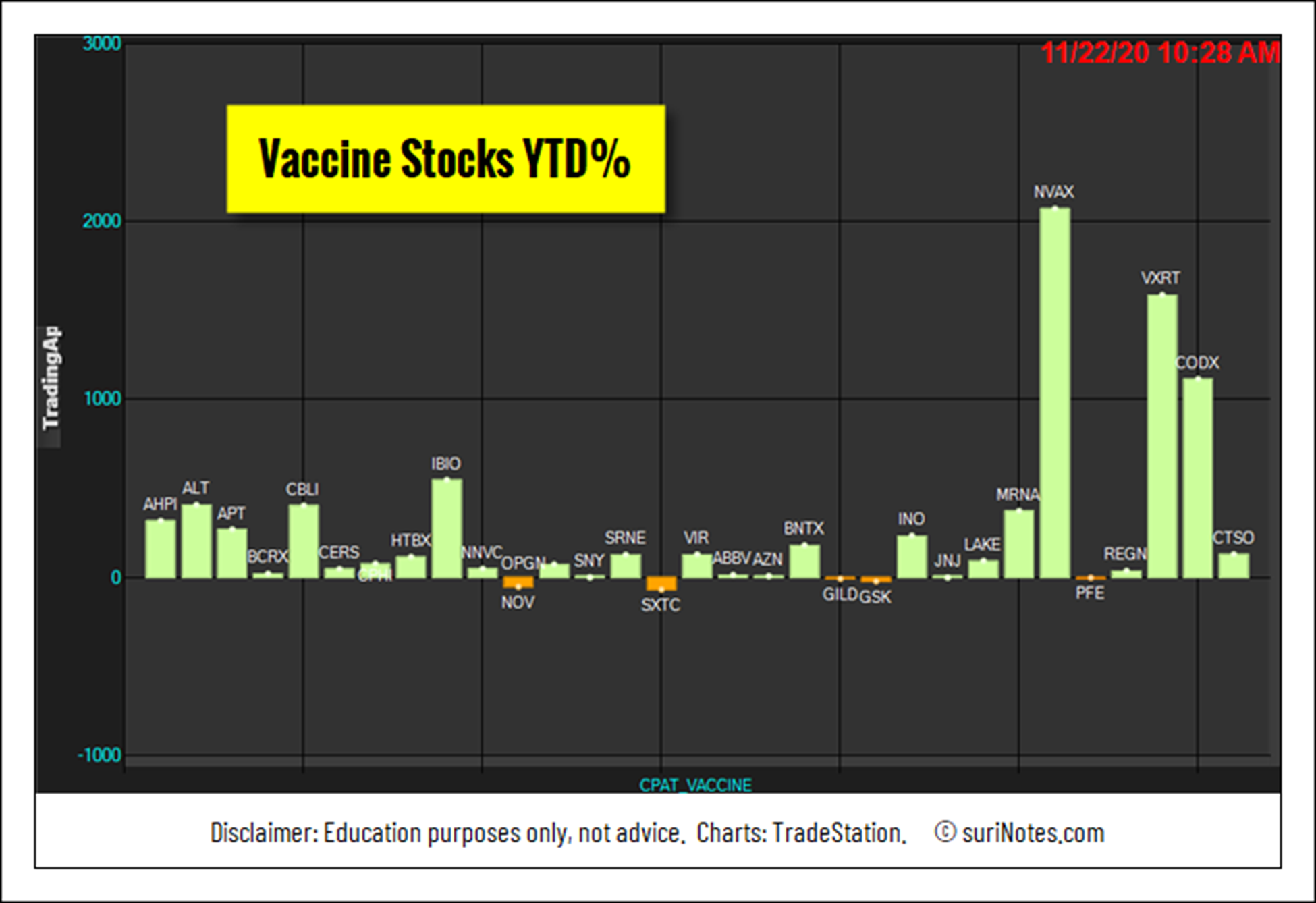

Here are the vaccine-related companies and their performances in the year 2020.

Vaccine-related stocks performance in 2020.

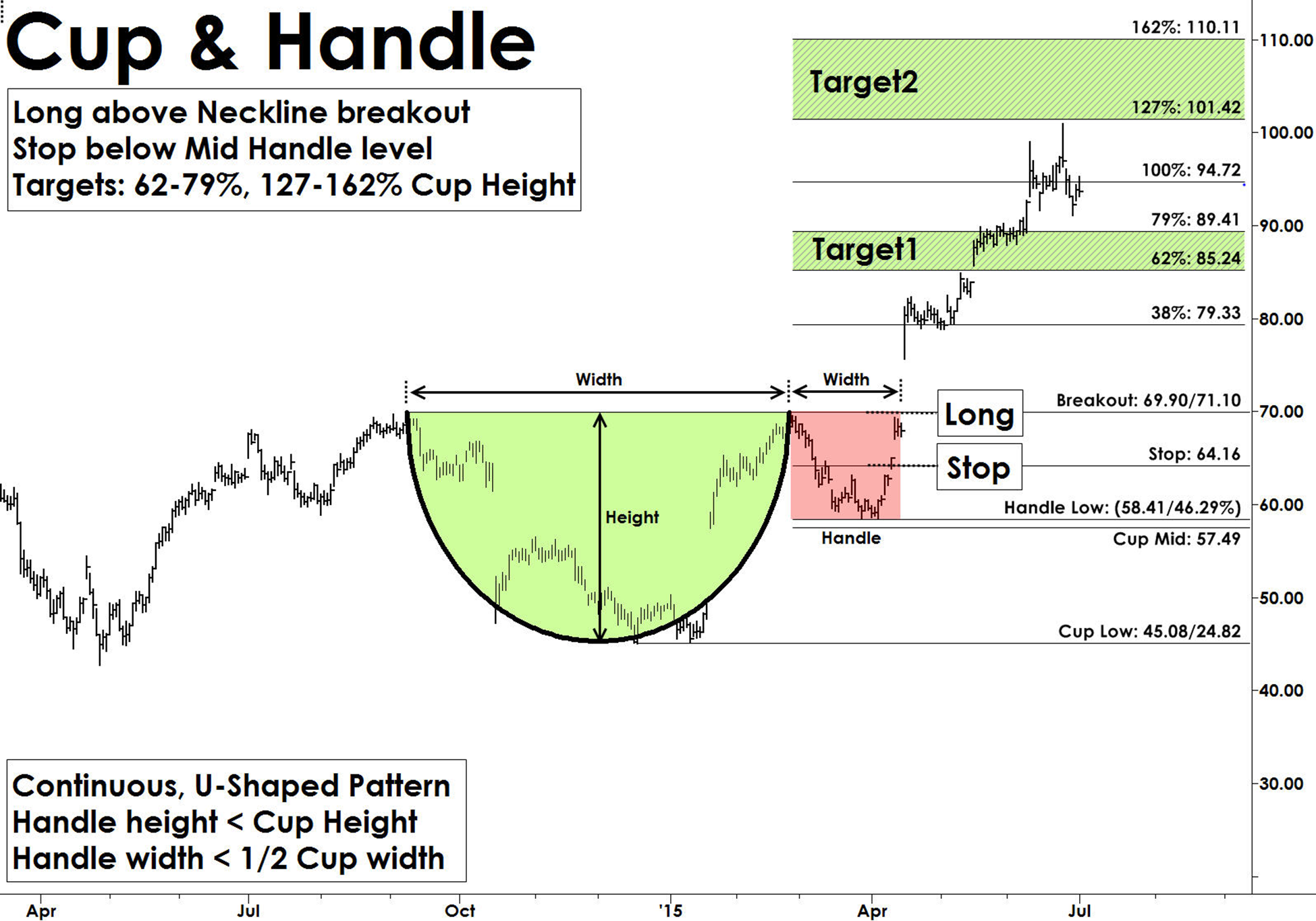

Cup-&-Handle Patterns

The cup-&-handle chart pattern was developed and popularized by William J. O’Neil in the 1980s through his CANSLIM methodology, Investor’s Business Daily articles, and his book How to Make Money in Stocks.

The cup-&-handle pattern resembles a cup with a handle and are continuation patterns that usually form in bullish trends. Most cup-&-handle patterns are reliable and offer great trading opportunities. They also form in all markets and in all timeframes. The “cup” formation is developed as consolidation phase during price rallies from the round bottom formation over multiple weeks to months. The “handle” part forms due to a price correction after “cup” formation and before a clear breakout to the upside.

Cup-&-handle pattern structures show the momentum pause after reaching a new high in a U-Shape form, followed by another attempt to breakout. When this breakout from the rim of the cup fails, it starts to fall back to build the "handle" structure. Usually, the handle structures are small, and the handle depth should not exceed more than 50% of cup depth. The handle part of the pattern generates interest in buyers as they expect the pattern to breakout from these levels. The pattern is valid only if price convincingly breaks out with increased volume above the rim of the cup levels (see chart below).

BioNTech SE (BNTX) forms a cup-&-handle pattern on its daily chart and trades near the breakout level of $105.09. C&H patterns are valid only when the price closes above the breakout level. A long trade is entered above the breakout level with a stop placed below the lowest low of the mid cup $79.55, and the handle low $86.60. Targets are placed at $124.33, $136.4, to $145.0.

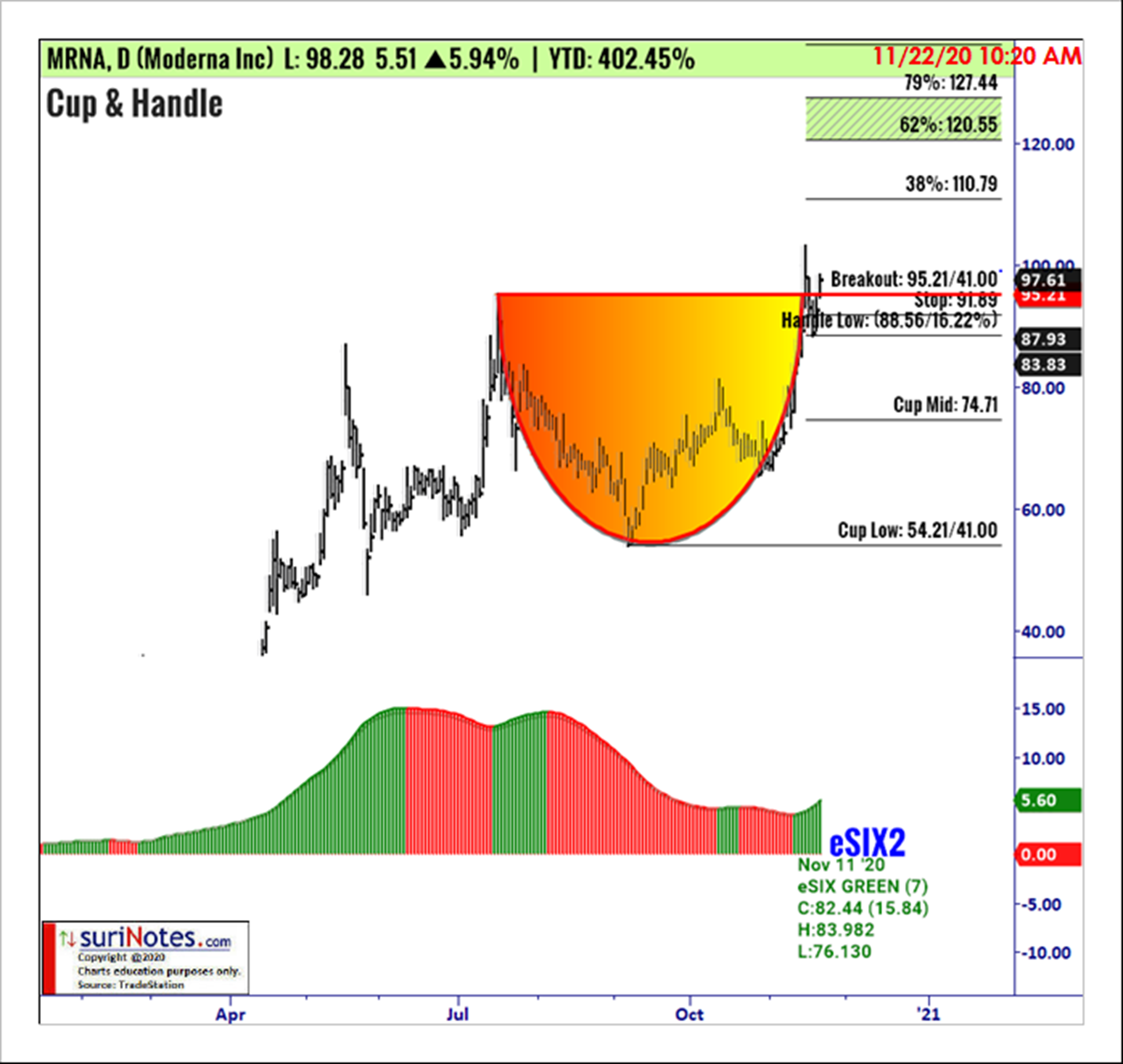

Moderna Inc (MRNA) forms a cup-&-handle pattern on its daily chart and trades near the breakout level of $95.31. C&H patterns are valid only when the price closes above the breakout level. A long trade is entered above the breakout level with a stop placed below the lowest low of the mid cup $74.71, and the handle low $88.56. Targets are placed at $110.79, $120.5 to $127.4.

To learn more about Suri Duddella, please visit SuriNotes.com.