Matthew Kerkhoff, options expert and editor of Dow Theory Letters, continues his 14-part educational series on understanding options and their role in investment portfolios. This series will run each Friday on MoneyShow.com through December, moving from the basics through increasingly more sophisticated strategies.

This is the fifth installment of our new monthly series on options, and it’s the first time we’re going to talk about actual option strategies. Up to this point, we’ve simply been laying a foundation of knowledge with which to begin discussing these strategies.

If you missed any of the prior four prior segments, they can be found below:

We’re going to look at one of the most important roles options can play – protecting your portfolio from major losses by acting as a form of portfolio “insurance.”

Ready to go?

Let’s say, hypothetically, that we’re eight years into a bull market where stock prices have more than tripled. A rather unpredictable president has come into office, causing a massive surge in the stock market that has taken stocks into record territory. Valuations are high, and numerous geopolitical uncertainties exist, any one of which could cause a sharp correction in stock prices.

You, as a savvy investor, are cognizant of the risks that exist, and you want to make sure that your portfolio is protected in the event of a market sell off. What do you do?

The first answer that often comes to mind is to sell your positions. While that would certainly achieve the intended result, it’s not always that easy. Depending on what type of account you’re investing in, there could be significant tax consequences involved.

Then there’s the issue of getting back into the market once you think the correction is over. As we all know, short-term market timing is a difficult thing to do. That’s why we’ve always abided by Richard’s philosophy of investing in sync with the longer-term primary trend of the market.

But nevertheless, corrections will come and stock prices will fall, and if we could protect our portfolios during these periods without having to sell our positions, it would be very beneficial over the long run.

FREE 14-part guide to options: The Basics to In-Depth Portfolio Strategies

This is where purchasing portfolio insurance comes in.

If the idea of portfolio insurance seems novel to you, it really shouldn’t. Insurance has permeated nearly every aspect of our lives as a tool for reducing risk. We purchase auto insurance in the event of an accident, home insurance in the event of a fire, and life insurance in case of death.

While the idea of foregoing auto, home or health insurance probably makes you shudder, many investors go about their everyday lives without giving a thought to buying insurance for their investment portfolio.

Part of the reason for this, at least in my opinion, is that there are no “portfolio insurance” salespeople or companies out there that you can call to purchase your policy. In general, unless you work with a full service broker who can do this on your behalf, you have to purchase it yourself. And it can be a little tricky if you’re unfamiliar with the process.

But don’t worry, buying portfolio insurance is not as complicated as you might expect, and we’re going to walk through it right now.

The acquisition of portfolio insurance is accomplished by buying put options. For this strategy, we’re not going to worry at all about call options, and we’re going to be buyers, not sellers of puts.

If you recall, a put option coveys to the buyer the right, but not the obligation, to sell an asset at an agreed upon price, on or before a particular date.

In order for us to secure our portfolio insurance, we must answer four questions that will determine which put options we purchase, and how many.

Question #1 – What do I want to insure against?

The first thing we need to identify is what we want to purchase insurance against. If we want to buy insurance specifically against Apple stock losing value, we’d look at buying Apple puts. But in this case, since we want to buy insurance against the entire market going down, we’re going to look for a broad based ETF that we can use.

For this, one of the best options we have is SPY, an index fund that tracks the S&P 500. Older subscribers should recognize this ETF as it is frequently recommended here as a low cost way to gain diversified exposure to the U.S. stock market.

By purchasing puts on SPY, we can create an insurance policy that will pay off in the event that the market (and thus SPY) go down in value.

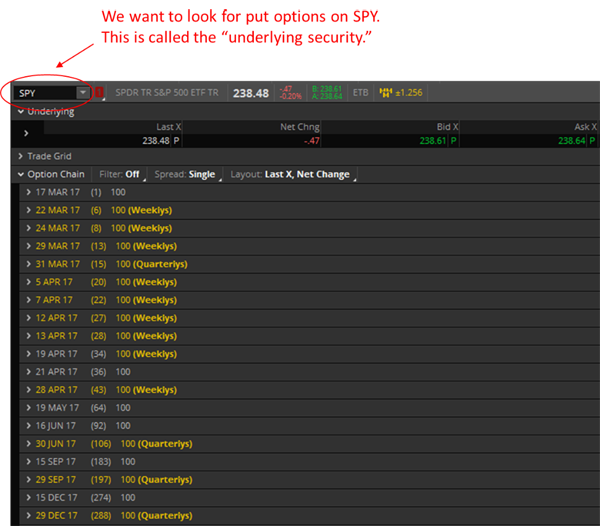

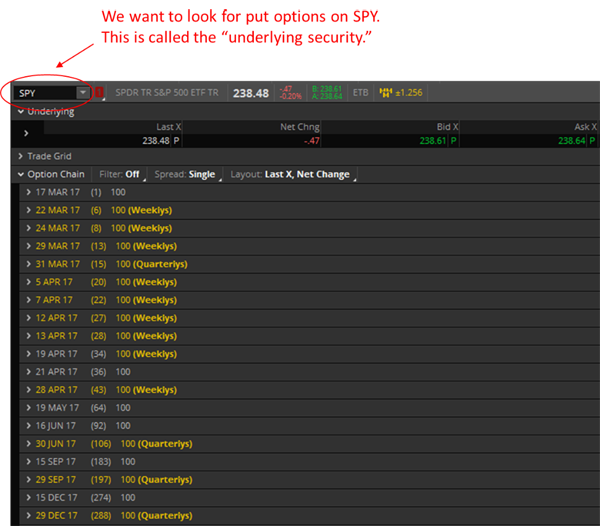

Now that we know that we’re going to be purchasing puts on SPY, we can bring up the available options for that particular ETF. Using my ThinkorSwim trading platform, this is what that looks like.

In each of these scenarios, we’re paying small sums of money to protect our valuable assets from some type of mishap. And typically, we view this simply as a cost of doing business.

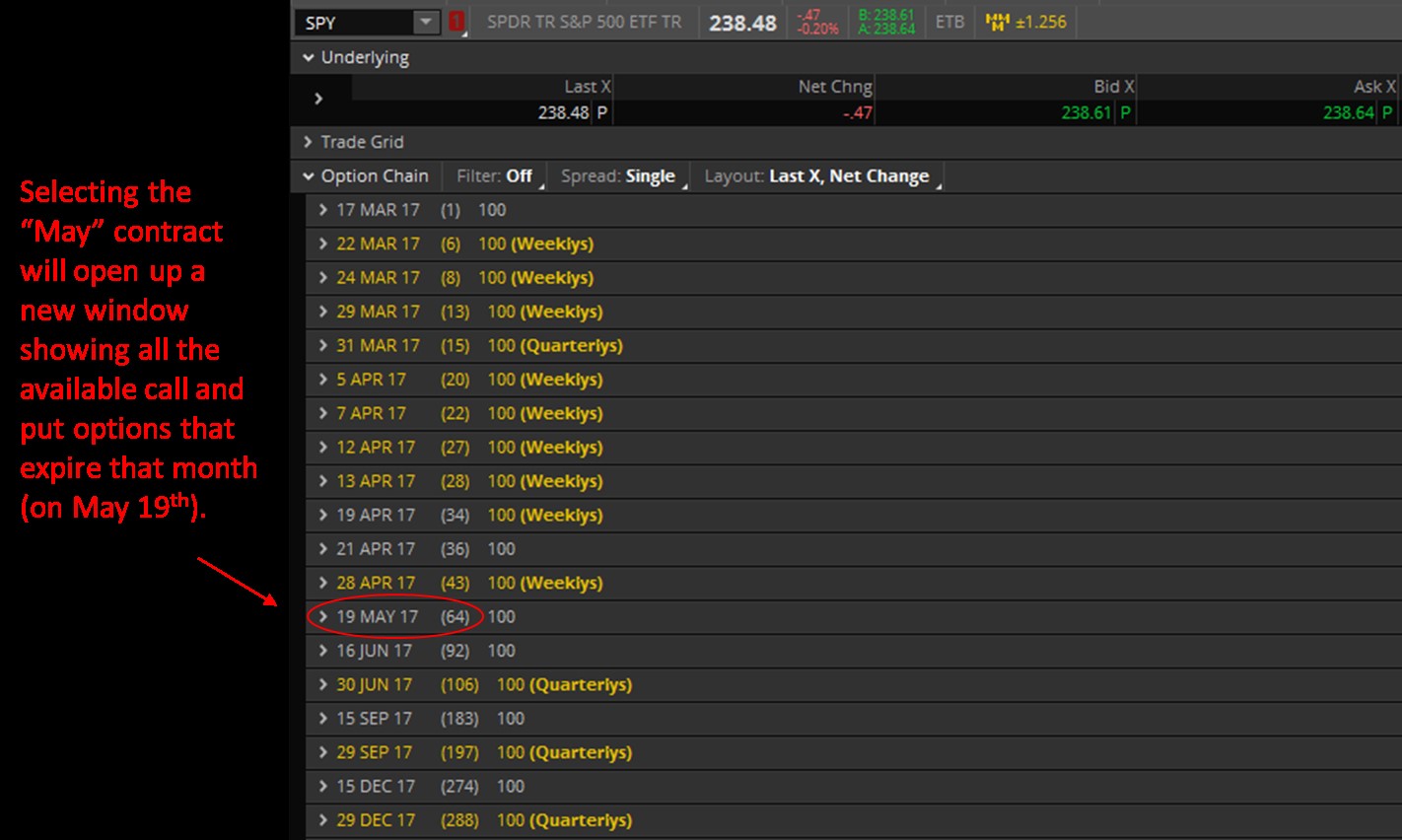

The next step will involve selecting the appropriate expiration date for our SPY put option(s).

Question #2 – How long do I want my portfolio insurance to last?

Unlike other types of insurance that we typically maintain year round, with portfolio insurance we’re more interested in holding it only during periods when we believe the chances of a market selloff are high. This is because portfolio insurance costs money, and over time the premiums that we pay for it can eat into our returns.

Getting back to our example, let’s say the market has just run a long way, and we’d like to protect ourselves for the next two months.

In this case, we’re going to want to look for an SPY put option that expires sometime in May. While weekly and quarterly options exist, for our purposes we’re generally going to focus on monthly options. And there’s one particularly unique aspect of monthly options that you need to know: They all expire on the 3rd Friday of the month.

This means that the “May” put option contract will expire on May 19th. This is important, because it represents the last day that our portfolio insurance is valid.

Looking again at our trading platform, we’re going to select the May contract:

Now we have two of the four pieces of the puzzle figured out. The next step is to select the appropriate strike price.

Question #3 – What do I want my deductible to be?

This decision is going to be the most complicated of the four. At this step, we need to decide whether we want to insure ourselves against a modest correction or a deep selloff.

Said differently, at what level (market price for SPY) do we want our insurance contract to begin paying off?

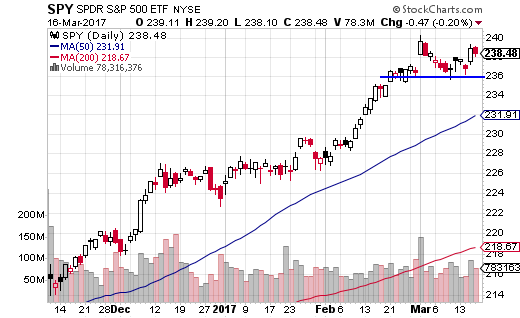

As I write this, SPY is currently trading at $238.48 per share. Do we want to insure, for example, against a drop below $238 per share? Or perhaps $230 per share? Maybe we’re okay taking a modest hit to our portfolio, and only need insurance in the event SPY falls below $220 per share.

These three scenarios are highlighted in red in the chart below. Notice that bid and ask prices (representing what each of these contracts costs) are quite different, depending on what level we choose to insure at.

If we want to protect against any loss at all, we’re going to have to pay up for it. Notice in the table that a put option with a strike price of $238 costs roughly $4.07 (using the halfway point between the bid and ask prices). Since we know that each option contract represents 100 shares, and that the pricing we’re seeing is on per share basis, we know that buying this contract will cost us $407 plus any commission.

So for $407, we can ensure that no matter what happens to SPY over the coming two months, we’ll be able to sell 100 shares of SPY ($23,848 worth at the current price), for $238 per share. This could become a very lucrative proposition if we’re right and the market does sell off.

Next, let’s look at the pricing for the $230 put option. In this case, the price is much cheaper, only about $195 (plus our commission). Why is this insurance policy cheaper? It’s cheaper because the level at which the insurance kicks in is lower.

In this case, our insurance policy would hold no value unless SPY fell below $230 per share. This means that we would have to eat the first $8.48 of losses (based on the current share price).

In a way, you can think of this like purchasing an insurance policy with a higher deductible. If you switch your auto insurance from a $500 deductible to a $1000, deductible, you’ll receive a lower annual rate. This is because in the event of an accident, you’re going to bear more of the cost.

The same applies with purchasing portfolio insurance … if you want to get a cheaper price, you’re going to have to bear some of the potential losses.

Taking this one step further, we could go all the way to the $220 strike price, in which case two months of portfolio insurance would only cost us $87 plus commission.

If we’re concerned about a low probability but high potential for decline event, this type of policy may make sense. In this case, the policy would have no value unless SPY fell below $220 per share, but on the flip side, the insurance doesn’t cost us much to purchase.

Finally, notice that you can buy put options at every strike price in $1 increments. This provides lots of flexibility in case you want to use specific levels (such as key support and resistance levels) to determine where your insurance policy should kick in.

Question #4 – What total value of insurance do I need?

At this point in the process we know that we are going to purchase put options on SPY that expire on May 19th of 2017. Let’s say, for the sake of moving forward, that we decide to go with the $236 strike price because, as you can see in the chart below, that’s our most recent level of support.

Referring back to the previous table, we can see that this will cost us roughly $335 per contract. In addition, we must remember that one option contract only represents insurance on 100 shares of SPY (or roughly $23,858 of market value at the current price).

Now … what happens if we need to insure a $100,000 portfolio? Or a million dollar portfolio? In that case, we’re going to need to purchase more than one put option.

The math is pretty easy here. For a $100,000 portfolio, we’re going to need about 4 put option contracts. This will protect $94,400 in market value ($236 per share x 100 shares x 4 contracts). If we need to protect a million dollar portfolio, we’d scale that up by a factor of 10 and purchase 40 contracts.

Once we know how many put option contracts we need to purchase, we can execute the trade. And once that’s completed, we can sit back and relax, knowing that if the market continues to rise, our portfolio will still participate in all the upside. On the other hand, if a correction comes along, as we anticipated, the most our portfolio can fall is about 1% (($238.48 - $236)/$238.48).

You might be quick to point out that paying $335 to insure a $23,848 portfolio against anything more than a 1% loss seems expensive. After all, it represents 1.4% of the portfolio’s value. To this, I have a few comments.

First, realize that option prices are always fluctuating based on factors such as supply and demand, and particularly, volatility. This means that the premium you pay for portfolio insurance is always changing based on market conditions. If you buy insurance when everyone else is scared, it’s going to cost a lot. On the other hand, when the market is optimistic and volatility is low, portfolio insurance will be much cheaper.

Next, recognize that you can customize all the parameters of your portfolio insurance policy to make it work for you. If you don’t want to pay that much for insurance, choose a lower strike price, don’t insure for quite as long (choose an earlier expiration), or only insure a portion of your portfolio (don’t buy as many contracts). In this way, you can find whatever balance works for you.

Buying portfolio insurance is one of the simplest and most effective option strategies to implement, and that’s why we’ve used it as a starting point. That being said, there’s a good chance that many of you have questions about this strategy and some of the details we’ve discussed.

In the next installment on this series, my aim is to answer any questions you may have about this strategy, and then walk you through how you would want to go about exiting these positions under various market scenarios.