Based upon the NYSE ARCA Natural Gas Index (XNG) there is a seasonal tendency for natural gas companies to enjoy gains from the end of February through the beginning of June, explains seasonal trading expert Jeffrey Hirsch, editor of Stock Trader's Almanac.

This trade has returned 14.5%, 16.6%, and 14.9% on average over the past 15, 10, and 5 years respectively. One of the factors for this seasonal price gain is consumption driven by demand for heating homes and businesses in the cold weather northern areas in the United States.

In particular, when December and January are colder than normal, we see drawdowns in inventories through late March and occasionally into early April. This has a tendency to cause price spikes lasting through mid-April and beyond.

This winter got off to a slow start in the Northeast with relatively mild temperatures lasting until around Christmas, but that quickly changed. The Times Square New Year’s Eve celebrations were a perfect example as temperatures plunged into the single digits.

As a result of widespread, below average temperatures, natural gas inventories are near the lowest they have been in five years for this time of the year and are 13% below levels from one-year ago.

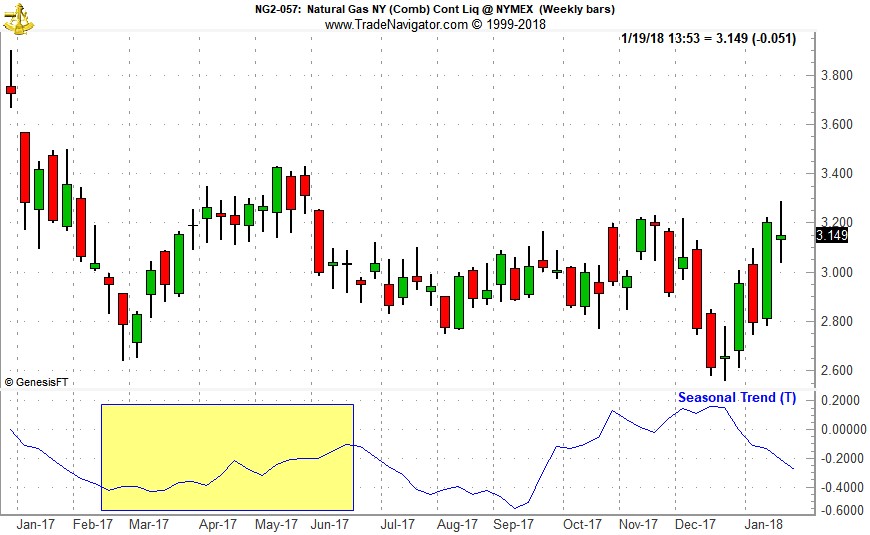

Natural gas prices have rebounded from their early-December lows in response to surging demand and currently trade around $3.20/mmBtu. The situation appears to be setting up well for continued strength in natural gas and the stocks of companies that supply it.

First Trust Natural Gas (FCG) is an excellent choice to gain exposure to the company side of the natural gas sector. FCG could be bought on dips below $23.95. The net expense ratio is reasonable at 0.6% and the fund has approximately $190 million in assets.

United States Natural Gas (UNG) could be considered to trade the commodity’s seasonality as its assets consist of natural gas futures contracts and is highly liquid with assets of over $400 million and trades millions of shares per day. Its total expense ratio is 1.27%. UNG could be bought on dips below $24.50. If purchased, set an initial stop loss at $22.00.