Oil prices are on pace for a fifth straight weekly loss. However, two energy stocks could be ready to rally, if history is any indicator: W&T Offshore, Inc. (WTI) and WPX Energy Inc. (WPX), suggests technical expert Andrea Kramer, analyst with Schaeffer's Investment Research.

Both W&T Offshore and WPX Energy recently pulled back to key levels on the charts, suggesting it may be time to buy the dip.

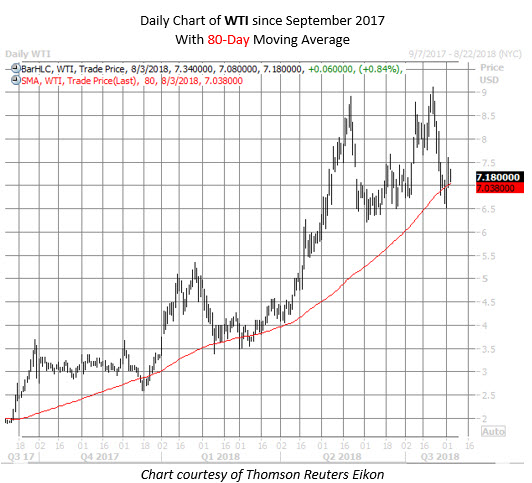

W&T stock has nearly quadrupled in value over the past year, rallying more than 278% since trading in the low single digits. The equity tapped a three-year high of $9.12 on July 23, but subsequently took a breather. WTI shares recently traded at $7.18, as traders continue to applaud the company's stronger-than-expected quarterly earnings, which were recently released.

In light of the pullback from new highs, WTI is now within one standard deviation of its 80-day moving average, after a lengthy stretch above this trendline. There have been six similar pullbacks for WTI in the past, after which the stock went on to average a one-month gain of 15.5%, per data from Schaeffer's Senior Quantitative Analyst Rocky White.

Despite the equity's impressive rally in the past year, analysts remain wary of the penny stock. Just one out of four brokerage firms deems WTI worthy of a "buy" or better rating. Should the shares once again bounce off their 80-day, a round of positive analyst initiations or upgrades could lure more buyers to the table.

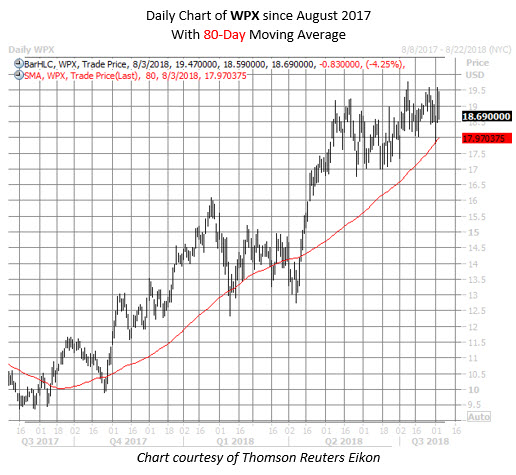

WPX Energy stock has enjoyed a slow burn higher over the past year, advancing more than 90%. The security notched its highest close since 2014 yesterday thanks to a well-received earnings report, but has given back 4.3% to trade at $18.69 today.

WPX is also back within one standard deviation of its 80-day moving average, after a notable stint north of the trendline.

There have been eight similar dips for the energy stock in the past, and WPX went on to rally 5.48%, on average, in the subsequent week, and was higher 88% of the time. Looking a month out, the shares also boast a win rate of 88%, with an average gain of nearly 8.5%.

Should the equity once again rally off this trendline, a short squeeze could add fuel to WPX's fire. Short interest accounts for more than 26 million shares, representing nearly a week's worth of pent-up buying demand, at the stock's average pace of trading.