AST SpaceMobile Inc. (ASTS) has the very ambitious goal of delivering broadband internet service via low-Earth-orbit satellites to…every smartphone in the world. Quite the undertaking! And yet, with backing from some of the biggest names in telecommunications, Wall Street thinks it can get there (or at least close), writes Chris Preston, chief analyst at Cabot Stock of the Week.

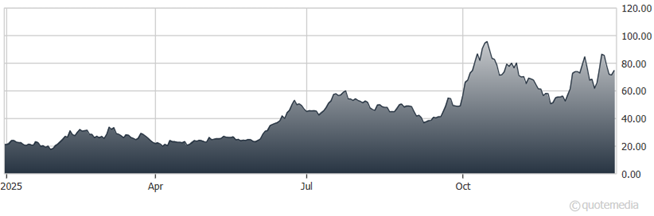

The stock has more than tripled in the last 18 months. But there are reasons to believe its run is just getting started. In September 2024, AST launched the first six of its so-called BlueBird satellites. This past December, it launched a more advanced version in India called the BlueBird 6 – which is 3.5 times larger than the previous BlueBird 1-5 launches and supports 10 times the data capacity.

It would be the largest commercial satellite array in low-Earth orbit at 2,400 square feet. It’s just the beginning of AST’s ambitious upcoming launch phase as AST plans another five orbital launches in the first quarter of 2026, with 40 total set for this year. That bodes well for the stock price over the next 12 months.

AST SpaceMobile Inc. (ASTS)

The accompanying investor buzz that has preceded AST’s previous satellite launches has resulted in huge gaps up in the share price, including a better-than-50% boost in the first half of December, prior to the Dec. 15 BlueBird 6 launch.

Big-name partnerships have expedited AST’s launch schedule. AT&T, Verizon, STC Group, British telecom giant Vodafone, and the US government have all inked deals with AST to help it build out its globe-spanning network – and deliver $1 billion in contracted revenue. All told, the company has agreements with more than 50 mobile operators, with a reach of three billion subscribers around the world.

There are risks here. The stock is notoriously volatile, plummeting from $95 to $50 in just over a month after quarterly results (a $122.9 million net loss) disappointed. And the valuation is sky-high.

But so is the upside. The overall trajectory is decidedly up, despite all the wild gyrations. And the business is just getting started, with more satellite launches planned this year than in its entire previous history. If the bull market marches on in 2026, as I think it will, AST should continue to skyrocket. Pun intended.

Recommended Action: Buy ASTS.