In sideways trending markets, Kerry Given, PhD suggests you choose stocks with a sideways price pattern and reasonably high levels of implied volatility to yield good premiums: BA, CELG, and ISRG.

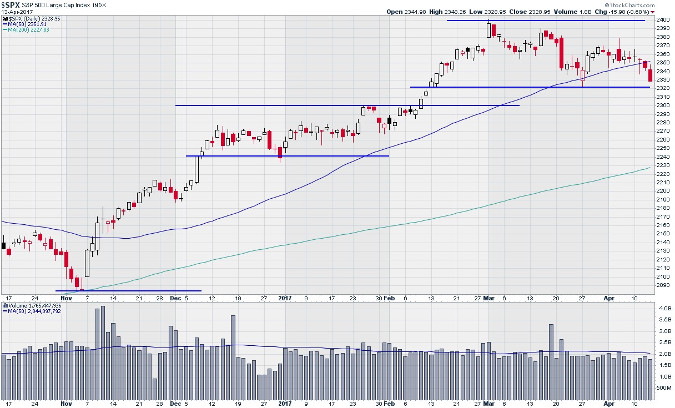

What should investors do now? The Standard and Poor's Index (SPX) closed on Thursday (April 13) of this holiday-shortened week at $2329, down $16. This close remains above the low at $2322 SPX hit on March 27. There are two ways to analyze the S&P 500 price chart:

- SPX remains in a sideways trading channel, but we may need to move our lower trend line down a bit, or

- SPX has been trending lower since it hit its high on March 1, setting up an imminent correction.

Standard and Poor's 500 Index (SPX)

Chart courtesy of StockCharts.com

I am inclined toward the former viewpoint of the broad markets remaining in a sideways trading range. Consider recent news events: the poison gas attack in Syria, and the US response, and North Korea's continued saber rattling rhetoric. And virtually every newscast is filled with stories designed to demoralize Americans, if not scare them about thermonuclear war.

How has the market reacted? The reaction has been minimal or nonexistent. Trading volumes on both the S&P 500 Index and the NASDAQ Composite have been consistently running below the 50-day moving average (DMA). The bulls remain in control and they haven't panicked-at least not yet.

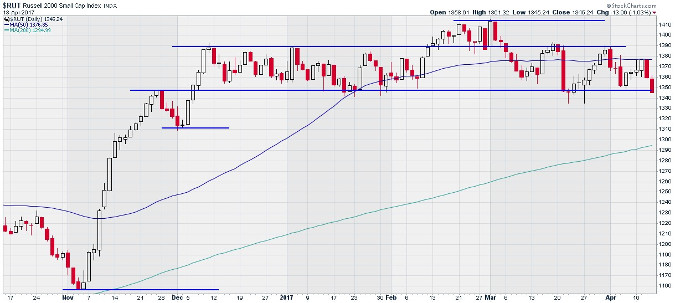

Russell 2000 Index (RUT)

Chart courtesy of StockCharts.com

The Russell 2000 Index (RUT) is composed of small to medium capitalization stocks and these stocks have historically led the market either up or down. But RUT has been trading sideways within a narrow range since early December. Thursday's (April 13) close at $1345 remains solidly within that trading range, albeit at the lower edge of the range.

In contrast to the Russell 2000 Index, the NASDAQ Composite has been the most bullish of the major market indices since the election last year. But that upward charge seemed to end in late February, and NASDAQ has traded between $5800 and $5920 since then. Its close Thursday was just above the lower edge of the range at $5805. NASDAQ has transformed from the market leader to joining the other indices in trading sideways.

The S&P 500 Volatility Index (VIX) moved quite a bit this week, opening the week at 13% and closing yesterday at 16%. This move is beginning to get my attention. Volatilities greater than 15% begin to be a concern, although some would argue that one shouldn't worry about VIX until it reaches the low to mid-twenties as it did last November.

Let's summarize the evidence:

Trading volumes on the Standard and Poor's Index and the NASDAQ Composite both remain below average. This supports the sideways trading range conclusion.

SPX, RUT, and the NASDAQ Composite are all solidly in a sideways trading range.

The other side of the coin is better supported by the rise in VIX this week. That is a concern and may be setting the stage for a pull back or correction.

The preponderance of the evidence supports our placing our trades on the presumption of a sideways trending market.

So, I return to the question I posed earlier: what should investors do now?

I believe this is an optimal market for the classic non-directional options trades: ATM butterflies, ATM calendars, and iron condors. I am focusing on two types of trades for my clients:

- Iron condors on the broad market indices: SPX, RUT, and NDX. I position the spreads at about 1.25 standard deviations OTM with about 45 days to expiration. Use the 200% rule to close the side under pressure.

- Iron condors on stocks: choose stocks with a sideways price pattern and reasonably high levels of implied volatility to yield good premiums, e.g., BA, CELG, and ISRG. I position the spreads with the short options at deltas of 18-20 and 30 days to expiration. Draw support and resistance lines on the chart and use those as your stops.