Amazon’s momentum might be halted. I don’t think this will cause a correction in the overall market, but if Apple joins Alphabet and Amazon in the doghouse, it could, asserts Don Kaufman.

Get Trading Insights, MoneyShow’s free trading newsletter »

The FANG week on Wall Street ended with a bust as Amazon reported a big earnings disappointment. That means 2 out of the 3 big tech stocks fell after earnings.

I’m not including Facebook (FB) because the stock only fell initially after hours because there was a faulty Bloomberg article saying it missed estimates, when it didn’t.

Amazon stock fell a few percentage points like Alphabet (GOOGL) stock after its report, but the Amazon (AMZN) miss could have real staying power as there isn’t much to like about the quarter.

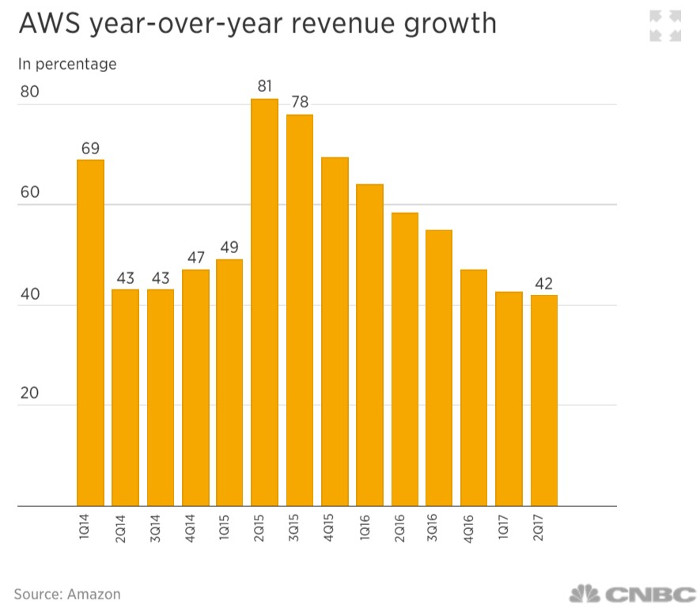

The chart below shows the deceleration of the AWS revenue growth. The 42% growth is less than half Microsoft’s 97% growth rate in its Azure (cloud) business.

It’s even worse on a sequential basis as Amazon Web Services sales only grew 4% which is below the 2-year average of 12%. This business is the profit engine for Amazon, so if the growth is gone, the Amazon story is over.

Getting into the specifics of the report, AWS had a big operating income miss, reporting $916 million which was below the $1.01 billion expected.

The total business earned 40 cents per share which missed estimates for $1.42. The expectation for Q3 earnings was between a $400 million loss and a $300 million profit.

Q2 operating income was $628 million and stock based compensation was $1.16 billion.

This highlights that costs are out of control as the company is running as a startup even though the market cap is about $500 billion. Amazon is disrupting the entire retail business model and in the process, is losing money outside of the AWS division.

That plan won’t work if the AWS business continues to slow. If Amazon stock has a rough quarter until the next report, the Nasdaq and S&P 500 (SPX) will underperform.

The only way the weakness could be salvaged is if the businesses Amazon competes with have their stocks rebound. That’s an unlikely proposition because one bad quarter won’t stop the company from pressing forward with its plans.

Washington update

The GOP has now agreed that the border adjusted tax won’t be in the tax reform plan which is expected by the Republicans to get done this fall, but will probably be delayed until early next year.

This is great news for retailers, but it begs the question as to how the tax cuts will be paid for. Now the options are either cuts to healthcare spending, not cutting taxes by much, or cutting taxes without worrying about deficits. The interesting dynamic is that the faction which is the most in favor of tax cuts, the fiscal conservative group, is also against deficit spending. Given the conservatives’ push back on healthcare, I don’t see how the GOP will pass a tax cut without paying for it.

This means the tax cuts will end up being lower than initially expected. That’s not a huge loss for stocks because some investors don’t think anything will get done and because the repatriation tax holiday, which won’t be affected by this, is the most important aspect that will affect stocks.

The “skinny repeal” made a big step forward today when Sen. Rob Portman said he would vote in favor of it. He’s a key moderate Republican which means the chances are increasing that the skinny plan will be passed.

The problem is that Portman said he wanted a Senate-House conference.

That’s detrimental to the chances of it passing for two reasons. Firstly, the House wants to stop federal funding for Medicaid expansion by 2020, which the Senate doesn’t want. Secondly, after the conference, both chambers must vote on the agreement again.

I don’t see why Portman would want a conference if he’s against Medicaid cuts. It’s possible he isn’t understanding the game theory behind his decision.

Later on Thursday, four more senators added that they would vote for the “skinny plan” only if it goes to conference. Senators Graham, Johnson, McCain, and Cassidy said they would support the plan only if it went to a conference. It was a bizarre statement because they said how much they hated it and would only support it if it didn’t become law.

In the weird world of Washington, lawmakers now vote in favor of things they hate. Paul Ryan said he’s open to a conference. The House decides if it wants a conference or just wants to support the bill as is.

The House might just vote for the bill without a conference if it thinks nothing more fiscally conservative will come out of a conference. The conference might take us to the August break which means Congress will work overtime or push it off into September.

Pushing it off until September delays the debt ceiling increase which is not what the stock market wants.

Hypothetically it’s possible that the House could go against its promise for a conference. The moderate senators could go home to constituents and claim they were duped. That might let them wipe their hands clean of the bill while still getting something done.

Conclusion

The stock market lost one of its leaders in Amazon after the company missed estimates dramatically.

The stock’s momentum might be halted. I don’t think this will cause a correction in the overall market, but if Apple (AAPL) joins Alphabet and Amazon in the doghouse, it could.

On the healthcare reform, we are getting close to vacation. Obviously, Congress doesn’t want to miss valuable vacation plans which means members might gather the momentum to push something to the president’s desk. He will happily sign whatever he can get because the delay has been a few months.

The news leaks out and changes happen fast, so it’s tough to gauge where the market is leaning on this. Some traders probably are waiting to see the exact language of the bill because it’s impossible to know what is in the bill until it passes as changes are made at the last second to push it over the top.