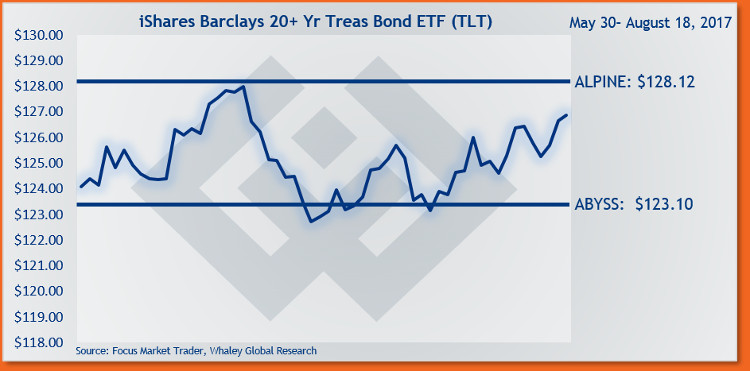

New short trade ideas on TLT can be initiated on a rally to $127.36, or higher. Depending on how much room you want this trade idea to move, use a risk price between $128.15 and $131.06, suggests Landon Whaley of Focus Market Trader.

Get Trading Insights, MoneyShow’s free trading newsletter »

The iShares Barclays 20+ Year Treasury Bond ETF (TLT) gained approximately 40 basis points in the week ending August 18, and is now up 7.9% year-to-date.

Despite last week’s gain, there wasn’t one bullish development for U.S. Treasuries.

The week started with Fed member Dudley giving us a peek behind the curtain by confirming the Fed will announce next month that it’s not reinvesting the entire amount maturing bond proceeds starting in Q4 of this year.

He went on to say that if the economy keeps improving then he would support another rate hike before the end of the year. Neither of those statements are pro-U.S. Treasuries.

On top of Dudley’s comments, the latest U.S. economic reports showed an acceleration in the annual pace of both retail sales and industrial production. Folks, I don’t know what else to say but the Fundamental Gravity for U.S. Treasuries is absolutely bearish.

The Fed remaining on a path towards normalization coupled with U.S. growth accelerating adds up to a huge problem for Treasury bulls.

Trade idea: New short trade ideas can be initiated on a rally to $127.36, or higher. Depending on how much room you want this trade idea to move, use a risk price between $128.15 and $131.06. Once initiated, close all open trade ideas if TLT opens, or closes, above your risk price. If the trade moves in your favor, then you could consider using $123.10 as your initial profit target price.