Trade idea: With crude now trading solidly with a $50 handle, you have all you need for a rally to $55 before it meets resistance. As long as OIL trades above $5.14, then you can initiate new long positions, suggests Landon Whaley of Focus Market Trader.

Get Trading Insights, MoneyShow’s free trading newsletter »

The iPath S&P GSCI Crude Oil Total Return Index ETN (OIL) gained 1.9% in the week ending September 29, but remains underwater 14.9% for the year.

OIL’s gain was underpinned by bullish headline risk and U.S. supply data that is beginning to normalize, post-hurricanes.

Advertisement

Crude was helped by positive comments from Russia and OPEC over the reduction of the global supply glut but it’s the potential supply disruption from the Kurdish independence vote that juiced oil’s return last week.

As Bloomberg reports, Kurdish oil supplies may be in jeopardy as Turkey, Iran and the Iraqi central government are seeking to isolate the Kurds.

From everything I’m reading, it’s pretty clear the Kurds are going to vote for independence, which means things in the Middle East are just getting interesting.

Couple this development with crude now trading solidly with a $50 handle and you have all you need for a rally to $55 before it meets resistance.

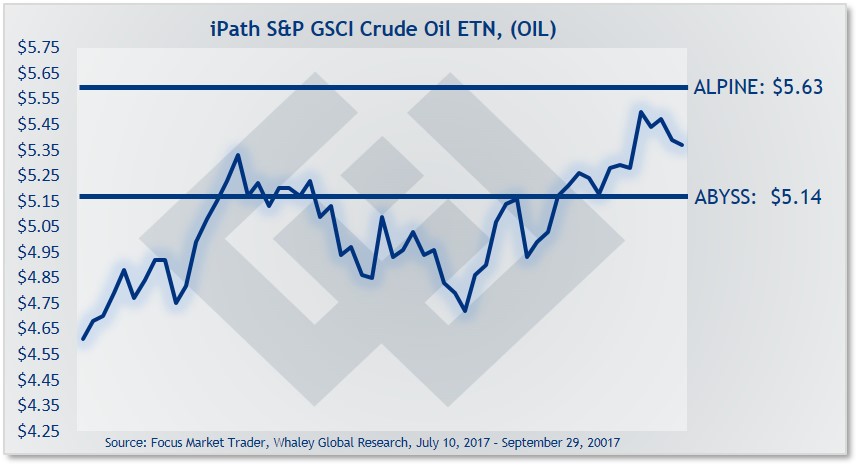

Trade idea: As long as OIL trades above $5.14, then you can initiate new long positions.

Depending on your entry price and how much room you want this trade idea to move, use a risk price between $5.30 and $5.14

Once initiated, close all open trade ideas if OIL opens, or closes, below your risk price. That said, your risk price “line in the sand” is that $5.14 level. If OIL trades below that price, even for a second, then promptly close all open trades.

If this long trade moves in your favor, then you could consider using the area between $5.63 and $5.73 as your spot to take profits on some or all your position.