The driving force in the market continues to be ebullience and debt. Despite the Fed's plan to raise interest rates, all thoughts are on tax cuts and less regulation, notes Jack Adamo, editor of Insiders Plus.

Get Trading Insights, MoneyShow’s free trading newsletter »

I agree that the interest rate hikes shouldn't be a big deal, and tax cuts and less regs should be good for corporate profits. I'm just not sure how much of that is priced in already. Given the market P/E, I would guess it's a lot.

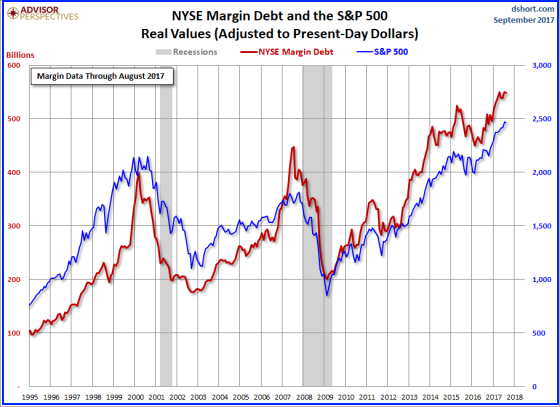

As to how all this affects stock prices, debt and risk, let's revisit two updated charts I like to follow. Margin Debt and Investor Credit.

As you can see from the first chart, current margin debt (the red line) is about 20% higher than the prior peak in 2007, even adjusted for inflation; so it's truly an extraordinary amount.

Advertisement

However, one thing the chart doesn't adjust for is the huge increase in money supply that is encouraging borrowing and speculation.

If one were to adjust for that, my guess is that the gap would not be so large. Still, with the Fed reducing the money supply, margin debt should decrease as well.

The chart also shows that the last two market crashes were preceded by a very sharp rise and a sharp, jagged plunge in margin debt. However, you can also see false alarms where the drop in debt is short-lived, then rises again.

Hence, just because margin debt goes down, it doesn't necessarily mean the market will crash. It's a warning signal, but it's not an infallible timing signal.

In the cases where the signal is real, the chart shows that the sharp drop in margin debt precedes a market drop by six to twelve months. That should give us adequate warning to keep on our toes. With the Fed slimming down its balance sheet, we have all the more reason to be vigilant.

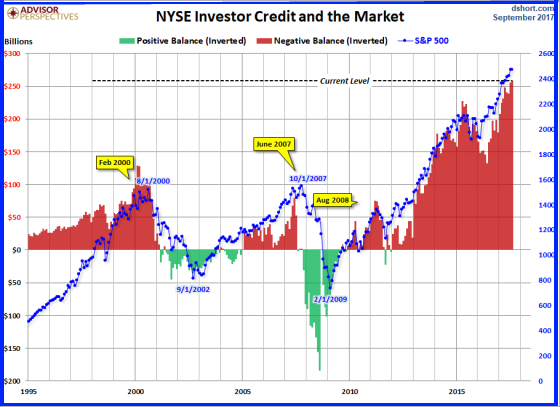

The second chart, shows that the aggregate investor debt (in red) closely follows the rise in stock prices, or vice-versa, depending on how you look at it. Actually, the two feed on each other until they burst.

Again, this is not a timing signal; it just shows that for maximum risk-to-reward potential, you should be investing most when margin debt is low. So, this is something else to watch closely.

However, margin debt is still rising and market technicals look good; so for now, I think we'll see rotation from one sector to another and/or one geographic region to another before stocks pull back hard. After all, in the short-term stocks are driven by emotion, and current market view remains optimistic.