We continue to be mired in perhaps the riskiest environment in stock market history. Our comfort zone remains gold stocks, especially our favorites, Newmont Mining (NEM) and IAMGOLD Corp. (IAG), writes Alan M. Newman, editor of www.cross-currents.net.

Get Trading Insights, MoneyShow’s free trading newsletter »

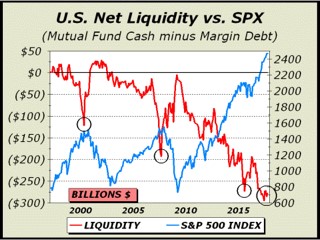

Our chart here may not look like anything has changed but that is precisely the point. Not much has changed. We continue to be mired in perhaps the riskiest environment in stock market history.

Given the extent of manic activity in calendar 2017, the changes appear modest.

While our net liquidity measure remains a tad below its April high, total margin debt (NYSE + NASD) advanced nominally to $596.7 billion in August, another new record. That we can remain in this mode of overindulgence to such a fantastic degree and for so many months bears witness to the extent of this stock mania.

Advertisement

The differential between bulls and bears for the Investor’s Intelligence tally of investment advisors, surged to its highest since August 14 (54.3% bulls - 17.1% bears) after which prices dipped nominally and went sideways for five weeks.

That appears to be the best case for stocks at this point. Of course, despite this reasonable view, it seems every time we write it, the market proves us wrong. But that’s the way a mania works.

On February 28, 2000, we forecasted a 35% crash for Nasdaq by April and it happened, but not before Nasdaq astonishingly rose another 500 points into the March 9 high. We never dreamed yet another 500 points could be in store! Tech stocks were already trading at 225 times earnings.

This little piece of history offers proof that anything goes.

So, what to do? Our lone area of comfort remains gold stocks, especially our favorites, Newmont Mining (NEM) and IAMGOLD Corp. (IAG).

Fair warning, IAG is highly speculative whereas NEM is one of the largest players. The chart for NEM is positive despite the recent pullback. IAG is testing support at the October 2 low of $5.93.

Important support for the Dow is at the 21,197 level. Our correction target is a decline to Dow 19,677. If our correction target goes not hold, a bear market is likely in effect and the next major support level would be Dow 17,883.

Subscribe to Cross-Currents here