The markets are full of doubt as many see cutting taxes on corporations as a deflationary measure where their ability to lower margins and fight for market share increases. Others see this as a pro-cyclical boost to growth, writes Bob Savage, CEO of Track Research.

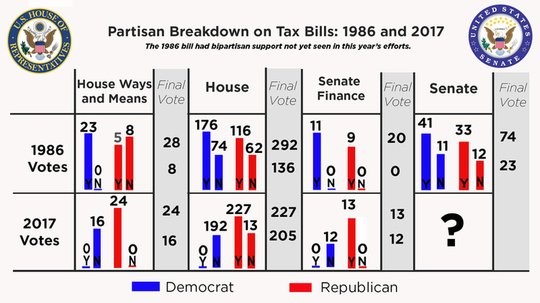

The views on US tax reform have sharply divided the country as Republicans have stuck together to pass versions in both the House and Senate.

The next process is to reconcile those differences and get that passed and onto the desk of President Trump for his signature.

The reconciliation process will be significant and likely full of doubts. However, the partisan split has made the markets not fully embrace the likelihood of change and so the risk for a bigger reaction to the Saturday news should not be discounted.

There is every reason to believe that the Republicans in the Congress see this as a once in a generation opportunity to change the way the U.S. tax system works and to leave their philosophical mark on history as a way to survive the upcoming 2018 elections.

The issue for both the politicians and the FOMC in the weeks ahead will be in determining just how much growth and inflation this package generates for 2018 and beyond.

The markets are full of doubt as many see cutting the taxes on corporations as a deflationary measure where their ability to lower their margins and fight for market share increases.

thers see this as a pro-cyclical boost to growth at a time when the economy is near the last part of an expansion cycle – with the output gap filled from the last recession – any new growth is seen as inflationary.

These growth vs. inflation debates will rage in the next few weeks and dominate much of the market reactions to tax reform passing.

Finally, expect that the key part for the rest of the world – a shift from a multi-lateral, global approach to taxing corporations to a territorial one will mean much more pressure on nations to strike up bi-lateral deals with the U.S.

The role of bringing U.S. money back home will be watched for its push to the US dollar (USD/EUR) along with the effect of making inversions less attractive.

The M&A world in finance and the flows of corporate money around each quarter will be in for a significant shift. All this makes the present tax reform a real game changer for forex, for many in the financial sector and for many foreign companies that have significant U.S. operations but that haven’t yet reflected on their risks for higher taxes into the future.

Market Recap: From the early Saturday morning passage of the Senate’s version of tax reform, to former National Security Advisor Flynn saying he would testify against Trump after a plea deal with the FBI, to the UK upping its divorce deal with the EU to E55bn along with Merkel talking with the SPD for a coalition, the Irish Deputy PM resigning and keeping the government intact, the North Korean launch of a new, higher trajectory missile, Germany evacuating a Christmas market due to a suspicious package and to Israel firing on a Syrian military base (backed by Iran) – that was the geopolitical mess that greeted December.

There was plenty of economic data to mix in with the global PMI reports mostly stronger. Europe saw its PMI return to 2000 highs while China was mixed, Australia higher, Japan lower.

In the US the equity indices all touched new record highs last week. Corporate profits rose to a new record at $1.86trn annual rate.

personal income rose to 0.4% but core PCE was 0.2% leaving the FOMC December hike likely but not 2018 trajectory.

The 3Q GDP revised to 3.3% from 3.0% - filling the U.S. output gap from the great recession. New home sales rose to 685,000 rate – better than the 620,000 expected – showing no pullback post-hurricane spurt. The consumer confidence rose to 129.5 from 125.9 – decade highs.

The weekly jobless claims were 238,000 near the monthly average while October construction spending rose 1.4% - above the 0.5% expected. The US November auto sales were mixed, still up 1% on the month thanks to Black Friday sales.

The weakness in the U.S. was in ISM dropping to 58.2 from 58.7, with the Markit PMI Manufacturing also dropping to 53.9 from 54.6 – all in line but suggesting a moderation in growth.

The Canadian jobs report was a strong surprise with November up 79,5000 – well above 10,000 expected – and unemployment rate now 5.9% from 6.2% expected – back to Feb 2008 lows. Full-time workers were up 29,600. GDP was up 1.7% after 4.3% - also strong and supporting C$.

Equities: The MSCI all-country World Index was up 0.02% on the week squeaking out a gain with Thursday highs. The MSCI EM index fell 3.43% on the week. US and Japan stand out against India and Hong Kong in the big 8 bourse race.

The S&P 500 (SPX) rose 1.53% to 2,642.22 on the week making new record highs Thursday at 2,657.74. The DJIA rose 2.86% to 24,231.59 on the week making new highs Thursday at 24,327.82.

The NASDAQ fell 0.60% to 6,847.59 on the week Tuesday highs at 6,914.19 reversed to Friday lows at 6,737.16. The focus this week was on stock rotations, from technology to banks, and on the effects of US tax reform/US Trump impeachment risks.

The CBOE Volatility Index (VIX) rose to 11.43% up 1.76pp on the week with Friday highs of 14.19% on Flynn story reversing into the close on Senate tax reform.

View TrackResearch.com, the global marketplace for stock, commodity and macro ideas here