Buy the rumor/sell the news may start to become evident on solid earnings reports. And Wall Street just wishes the Syrian crisis would go away so investors could be drawn into stocks at these high levels before risk returns, writes Gene Inger Thursday in IngerLetter.com.

The Coney Island market rollercoaster persists. And yes, even Thursday, we got a dramatic late fade from an otherwise robust rally. In essence, it was the suspected pattern of moving above the declining-tops just a bit and then reversing, which it did in stages during the session.

Bloomberg: US stocks turn lower Friday as banks lead the way down.

Perhaps the most favorable fundamental story at mid-afternoon was the president’s remark that he’d be interested in rejoining the Trans Pacific Partnership, if the TPP is renegotiated.

Like I’ve believed, that’s the case with many of the trade concerns out there. Talk tough and make a deal.

The global trading map looks really confusing right now, reports Bloomberg.

If you review almost all the hardliner positions and the outcomes where there has been a resolution, the deals were more favorable to the U.S. That’s a tactic that has been more successful, if less stable in process than we’ve seen in many years if not decades.

In that respect he shook things up to the benefit of American workers, companies and forward profit outlooks.

Now the hardliner approach in the Middle East is another story.

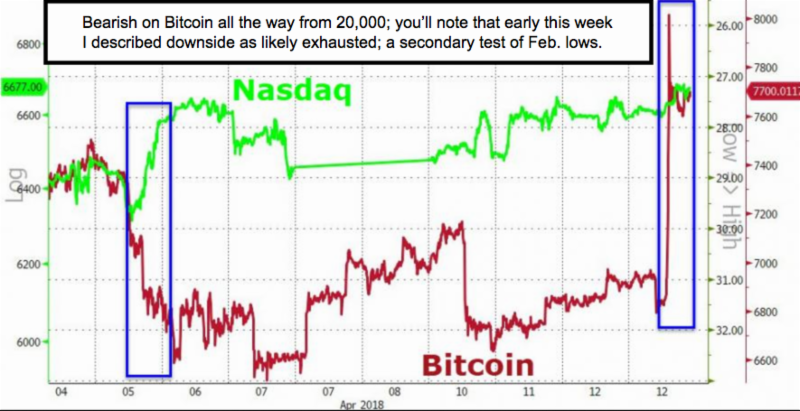

I’ll let charts and videos on my site tell most of the market action Thursday. It is still the outlined pattern and I’m not buying the argument of it as being a three-week base to launch a huge advance. It’s rather a three-week defense of the 200-day moving average, to deflect what I suspect is an inevitable breakdown below that level, regardless if it takes time to be implemented. S&P 500 (SPX).

Bottom line: The market remains in rollercoaster mode.

Risk is here and has been present throughout the year, as we’ve identified since just gandering at that parabolic January run-up, and calling for a February break.