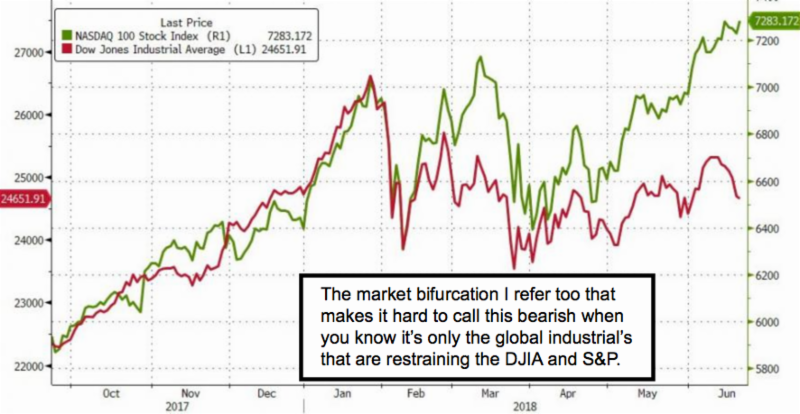

Robust market action actually has been tempered by trade concerns as they put pressure on so many old-line industrials that benefited from what has been a new era (since Trump) of reinvigorating industry.

Plus, sales to countries like China are important to many such larger companies.

Reuters: Wall Street falls Thursday as drops in Amazon, Intel add to trade war jitters.

Hints that resistance to making a trade deal are being chipped-away now, by negotiations with both Germany and China, helped the S&P 500 (SPX) catch-up a bit Wednesday with the broader market, which (led by NASDAQ for once) actually has made higher highs, even a Russell (RUT) record, while the Dow (DJI) stayed dour.

MarketWatch: Blue-chip Dow facing eighth straight loss Thursday, matching a March 2017 streak.

This leaves the market in an interesting position; where superficially it sure remain vulnerable to the volatility we have certainly allowed for near-term. At the same time, it’s not impossible to spike the S&P higher yet, but likely only in event of some actual accomplishments to avoid trade war fears.

Much depends on OPEC and Oil prices on Friday. So, we are in an overbought market and have volatility risk, but not instantaneous in my view.

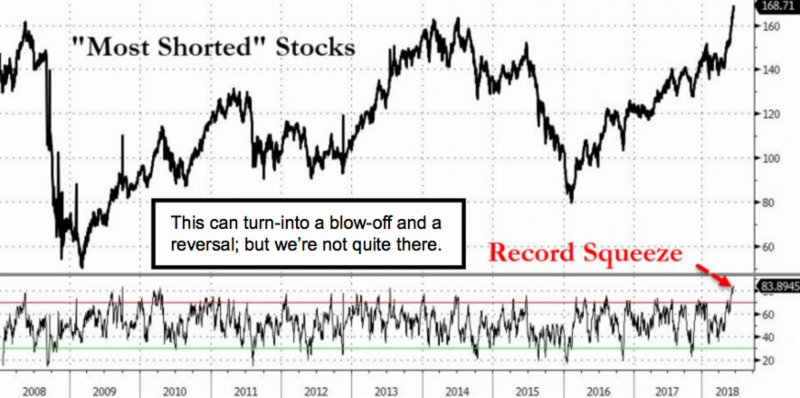

Bottom line: it may be a huge (almost historic) short-squeeze, but it’s not over.

View a short video interview with Gene Inger on his stock pick: LightPath Technologies (LPTH) here

Recorded at MoneyShow Las Vegas: May 15, 2018

Duration: 6:28.