On the technical side, the equity markets have hit euphoric levels once again as the longest bull market ever forges ahead. The Nasdaq futures trade near 7600, the S&P 500 future is above 2900 and the Dow (DJI) is above and around 26k, writes Nell Sloane Wednesday.

Something pointed out by my great associate David Wienke of Cabrera Capital is that the emerging markets in comparison to the SPY have reached lows not seen since 2004.

Check out his chart of the iShares MSCI Emerging Markets Index (EEM) vs. SPDR S&P 500 (SPY):

There isn’t a shadow of a doubt this is purely interest rate and U.S. dollar (USD) outperformance related. However, we love analysis like this that shows outright indexes vs. a global counterpart in terms of relative value.

We feel that a few notable names will begin to look at this from a long-term valuation perspective, just sayin’.

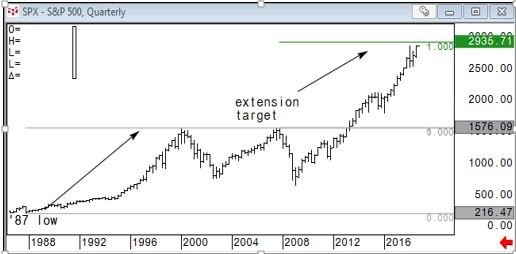

The S&P 500 (SPX) is running into the 1x extension which historically should present at least somewhat of a pause in our opinion:

The S&P 500 future shows the bulls still in control above 2872:

The NASDAQ future continues to press on:

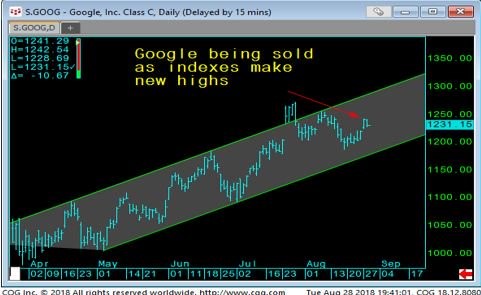

Looking at Amazon (AMZ) and Google (GOOG) we can see that Amazon is up 109% YoY and Google has retreated despite the indexes reaching new highs, which is very curious.

Despite reaffirmation of the Fed to continue their path to normalization while at the Jackson Hole Symposium, we can see the U.S. 10-year yields haven’t budged very much.

We feel that the long end of the U.S. Treasury curve will be continually supported given the fragility of the global economic backdrop.

We all know the Fed can manipulate short rates higher or lower, but the long end is subject to long-term analysis as to where rates will be over a longer time frame.

Thus, we feel pension and insurers, SWF and large liability matchers will continue to be supportive of U.S. rates at current levels:

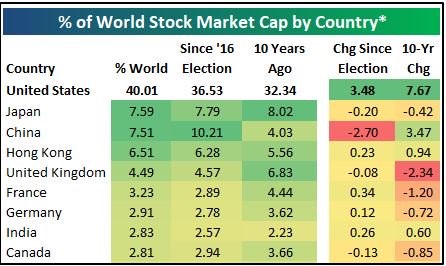

Finally, we would like you to see today’s chart from Bespoke Premium. It highlights the clear fact that global monetary flows have found their way right into the U.S. equities market at the expense of mainly China since the U.S. election of 2016.

So much for all those Sharpe Ratio following, HFT and AI programmatic developers, seems like risk is much more concentrated, not more widely dispersed:

This is why it’s so important to look at investing from a global macro perspective, why we stress monitoring monetary flows and why looking at markets from various sources and interpretations are keys to successfully navigating these turbulent waters.

**

Despite not talking about the crypto currency markets or bitcoin (BTC-USD) in general lately, we still believe in blockchain and will continue to report any significant changes in that space.

As for now the SEC seems hell bent on rejecting any crypto-related ETF, but we expect them to acquiesce in the coming years. If they do, expect Wall Street to push very hard and expect bitcoin and some major Alt coins to be the direct beneficiaries.

As for now, bitcoin is stable around $7000 with a market cap of around $122 billion.

Bitcoin was up 2% last week but still down 53% on the year, but on this date last year, Bitcoin was $4400 so YoY it’s still up some 60%.

**

Thanks for reading and we hope you got something useful out of this. Our Chicago Bears look healthy and ready to go, the Cubs are once again showing they can put out a decent win streak and even our White Sox show some signs of promise.

We are glad to see the Fall season upon us, the year is flying by, we look forward to continuing this exciting journey with you.

Cheers!

Nell

Subscribe to Nell Sloane's free Unique Insights and CryptoCorner newsletters here