Lack of conviction in this market has ironically contributed to how long it perseveres with rotational moves holding the S&P 500 (SPX) up. Even though there is the risk that it’s only trying for a secondary test of the January highs, writes Gene Inger over the weekend.

Of course, that’s the charts. The Chinese resolve against a trade deal weighs on the markets increasingly. And its resolution won’t be seen on charts.

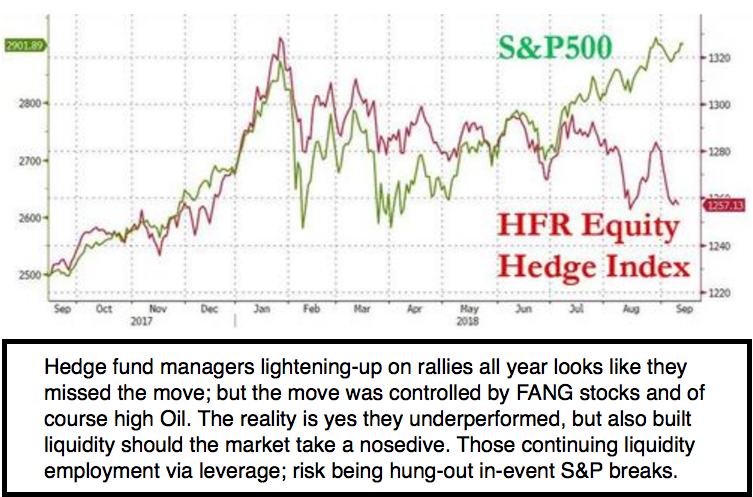

For months we have listened to consistent detrimental assessments of the market by a few technicians and many hedge managers.

Also, ironically, because we concurred about the risk, one notable difference in our views was that we declined temptations to fully liquidate much less short-sell the market, while not being enthused about the rallies either.

MarketWatch: Win streak for S&P 500, Dow poised to end as US-China trade tensions escalate Monday.

The newest iPhones went on sale Friday and initial demand was apparently as strong as possible.

Deliveries slipped from a launch date of September 21 into October almost immediately. That’s either from a shortage of inventory, or more likely (my suspicion) Apple (AAPL) making only small numbers available at start.

That’s because launch deliveries get reported as Q3 revenue, rather than being deferred to Q4.

All the October inventory will be booked as Q4 by Apple. My thinking is they withheld a majority, in-anticipation of shipping after the first of the month.

Regardless, it was well-received and the system for ordering far smoother (at last) than in the past, for those properly prepared who were ordering.

I again note that T-Mobile (TMUS) should benefit uniquely since the new lineup is of course the first that works on Band 71 (actually 600 MHZ) which T-Mobile got a year ago, but not in time for the then-Qualcomm chips to support.

Intel’s (ITC) new cellular chip in all iPhone models (they are all the same now for U.S. delivery) supports all bands, and thus T-Mobile users will see performance a bit better inside steel and concrete buildings than previously.

I warned back in January that it was a parabolic trend completion. but after the projected break in early February. that wed have a series of rotations. not crash.

Partially it’s because we didn’t see the picture quite as glib as so many did. And because the market’s DNA allowed leverage to run-in short-sellers, it was a repetitious pattern of churn without meaningful break.

And there is not only the effect of the Fed increasing rates slowly, but the idea that a trade deal with China may not be as elusive as so many believe.

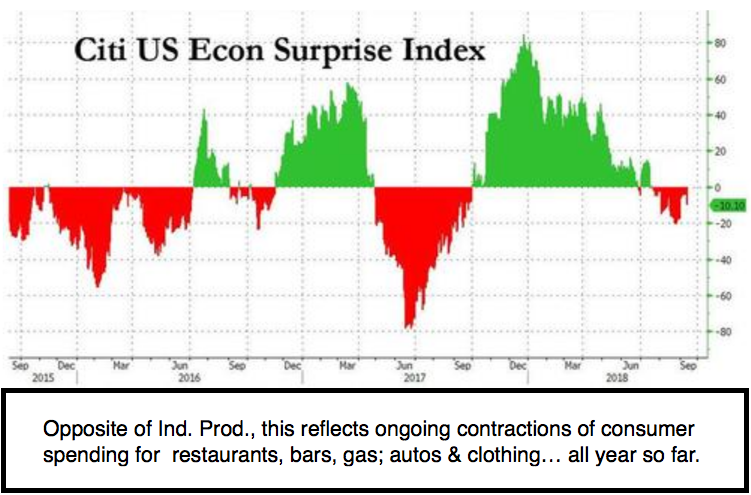

For the moment, the tariffs are having more impact on U.S. manufacturing it seems, than on China, which is part of why they’ve not been motivated to make a deal with us.

The other reason, as a member described, is China’s desire to entirely stand on its own, which they want.

The other side of the coin is that they’re not strong enough to do it. They are not in a mood to cave to the U.S., and pride comes in too.

So, the U.S. comes forth and tries to leverage pressure with new tariffs at the point where it may actually be fully-implemented before a deal occurs which we would still like to see.

Don’t get a deal yields a catalyst to break the S&P at some point. and that’s something I’ve tried to emphasize. Getting a deal won’t do much aside a nominal leg higher for the short-run, though certainly could help deflect a recession out there.

For trading purposes, I’ve described this phenomenon as Rinse & Repeat. While this has not been a dynamic market of-late for Bulls or Bears, it’s also a scenario where liquidity for those who use leverage starts tapering too (rate firming). And that’s part of the near-term risk. I’m suspecting that if we end-up with little changes in trade (when the sides concur somewhat), the market will try to shrug-it off.

And the risk is more deflation ensuing for a time. It’s hard to assess. A profits-driven market might be unable to advance significantly if we go into a doldrums situation, even with rates on the slow side of increase (a policy that the Fed is unlikely to reverse yet).