The December retail sales report was a disaster, notes Landon Whaley, who recommends shorting the SPDR S&P Retail ETF (XRT).

There is no market whose price action has diverged more from its Fundamental Gravity reality than U.S. retailers. The SPDR S&P Retail ETF (XRT) has bounced 21% off its Christmas Eve lows and is up more than 12.6% in 2019. But as we are seeing across a wide swath of financial markets, there is trouble lurking beneath the surface.

It’s All About the Consumer

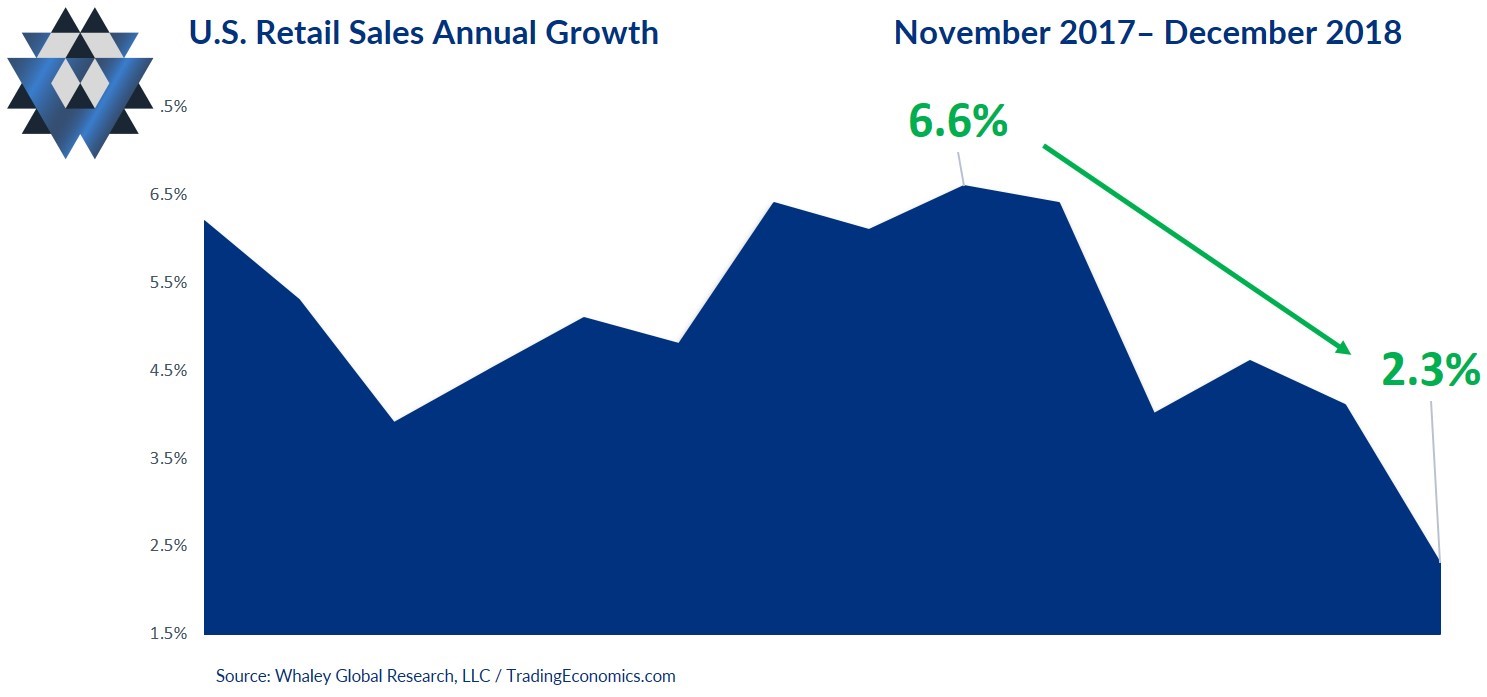

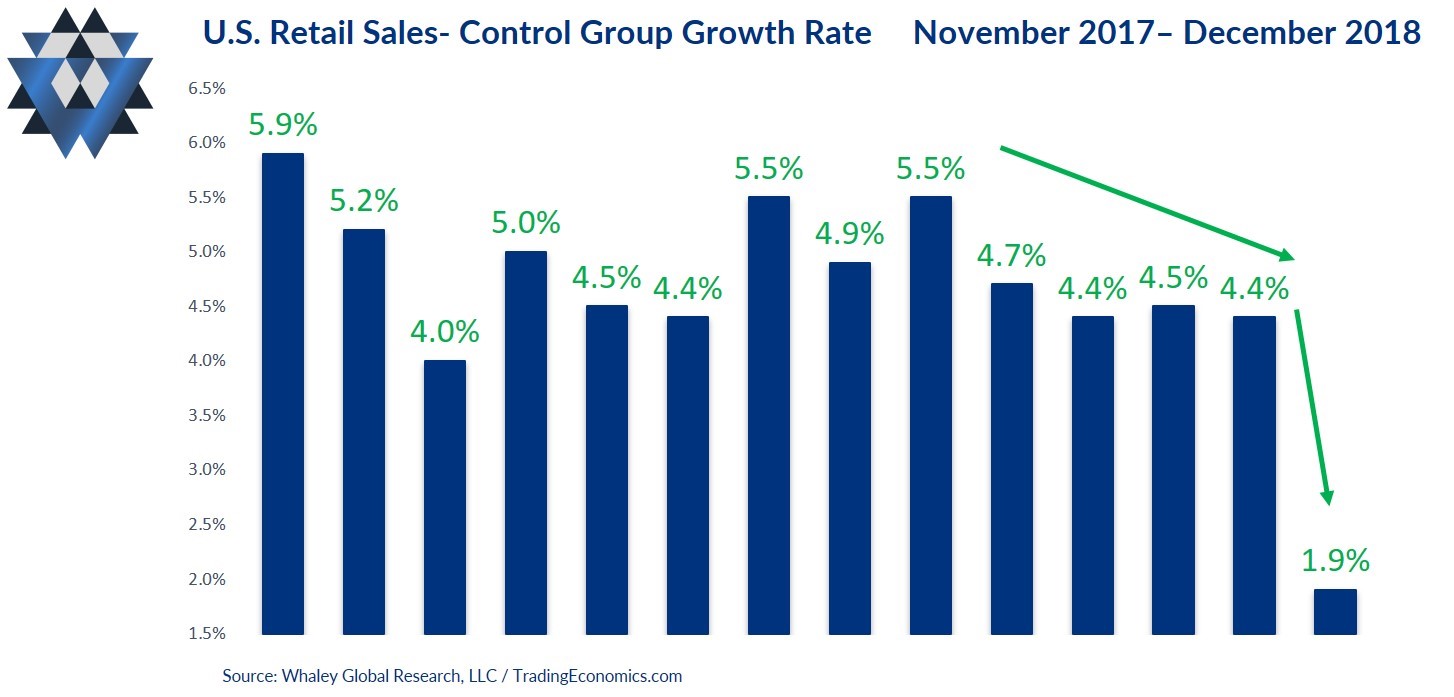

The December retail sales report (which was massively delayed because of the government shutdown) was a disaster. Retail sales growth slowed for the fourth time in the last five months, having now dropped 65% from its July peak of +6.6%. December’s 2.3% annual growth rate was nearly half of the 4.1% growth rate just one month prior. Not only that, but the most important aspect of the retail sales report, the annual growth rate of the “control group,” was cut by more than half, falling to 1.9% from November’s 4.5% growth rate. It’s been years since we’ve seen a “1-handle” on the control group’s growth rate.

Bank of America’s own retail sales gauge, as measured by its internal aggregated credit and debit card data, saw the biggest drop in three years during the month of January. Ten of the 14 sectors that BOA tracks showed contracting growth, with the largest monthly declines seen in gas stations, clothing and food & beverage.

Add to this the consumer sentiment downtrend that’s been underway since last March. As discussed in the U.S. Shift Work update, it had a small bump in February, but that doesn’t change that downtrend.

Retailers Say What?

A couple of weeks ago, toy maker Mattel (MAT) reported earnings. It cut its forward guidance significantly and told investors that it expects year-over-year sales to turn negative in Q1 2019. The company’s stock was rewarded with a 15% intra-day drawdown and a halt in trading. Mattel’s CEO pinned a big chunk of the company’s problems on the closure of Toys R Us.

While the closures of both Sears and Toys R Us last year got the most press, they were just two names in a long list of retailers bum-rushing bankruptcy. In fact, since 2016 there have been 35 retailers that have filed for Chapter 11. Already this year at least half a dozen companies have followed suit: Shopko (SKO), FullBeauty Brands, Charlotte Russe, Things Remembered and Gymboree (GYMB).

J.C. Penney (JCP) just announced that it will be closing another 24 stores. Victoria’s Secret is closing 53, and on Thursday, Gap (GPS) announced that it will be closing 230 stores over the next two years.

Payless (PSS) is also a Retail-iation victim, announcing on Feb. 15 that it is filing its second bankruptcy in the last two years and closing 2,100 stores.

Folks, every single one of these retail failures occurred during the second-longest expansion in U.S. history, during which retail sales growth hit a seven-year high and unemployment was at record lows. If retailers can’t sell enough stuff to stay in business against that backdrop, what’s going to happen to America’s retail industry when the next recession finally comes crashing in?

The Bottom Line

The big unknown is when the Fundamental Gravity reality of U.S. retailers will finally be reflected in the price of publicly traded retailers. That my friends, is anyone’s guess, which is why timing shorts in this space is extremely critical. That said, the playbook for March remains the same: be out of, or opportunistically short, U.S. retailers via the SPDR S&P Retail ETF (XRT).

Please click here and sign up if you’d like to receive March 4 edition of Gravitational Edge, which contains an update for all five macro themes as well as full breakdown for all 14 markets we believe are providing the best opportunities right now, bullish and bearish. By signing up, you will also receive the latest edition our research reports as well as to participate in a four-week free trial of our research offering, which consists of three weekly reports: Gravitational Edge, The 358 and The Weekender.