The race to the bottom continues for government bond yields, writes Fawad Razaqzada, Market Analyst, Forex.com.

Another day, another dollar. The race to the bottom continues for government bond yields after the Reserve Bank of New Zealand became the latest major central bank to shift from neutral to dovish overnight. As we had expected, the RBNZ has now joined the likes of the Band of Canada, the European Central Bank, the U.S. Federal Reserve and the Reserve Bank of Australia in insisting that interest rates won’t be going up again in the foreseeable future, with the next policy direction likely to be lower.

Central banks have turned dovish in recent months owing to evidence of a slowing global economy, with Eurozone in particular being a weak spot. Years of zero interest rate policy here has failed to stimulate economic growth and repair the damage caused by the sovereign debt crisis in places such as Greece. Fiscal policy has been as ineffective as monetary policy in the Eurozone. Years of austerity has given rise to far-right political parties across the region, not least Italy, raising fears over the future of Eurozone.

Meanwhile, growth has been further hampered by the recent currency crises in a number of emerging market economies, including Turkey, while the US-China trade dispute has evidently caused a slowdown in economic growth in China, further weighing on Eurozone exports. With China and Eurozone struggling, and places such as Argentina and Venezuela being in crisis, investors fear that U.S. exports might suffer in the months ahead, leading to a slowdown at the world’s largest economy, too.

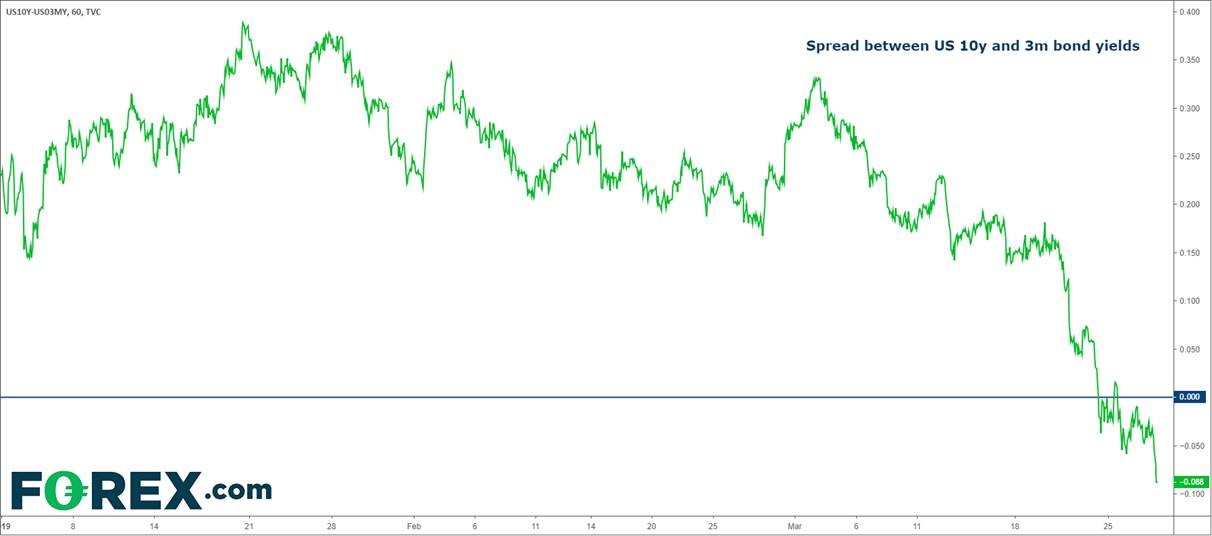

Underscoring these concerns, the yield on longer-term U.S. government bond yields have fallen below that of the shorter-term debt (see chart). In other words, investors expect long term U.S. interest rates to remain around their current levels or fall as the Fed maintains an expansionary monetary policy stance for a lengthy period.

Spread between US-10 year and 3 month Government bond yields

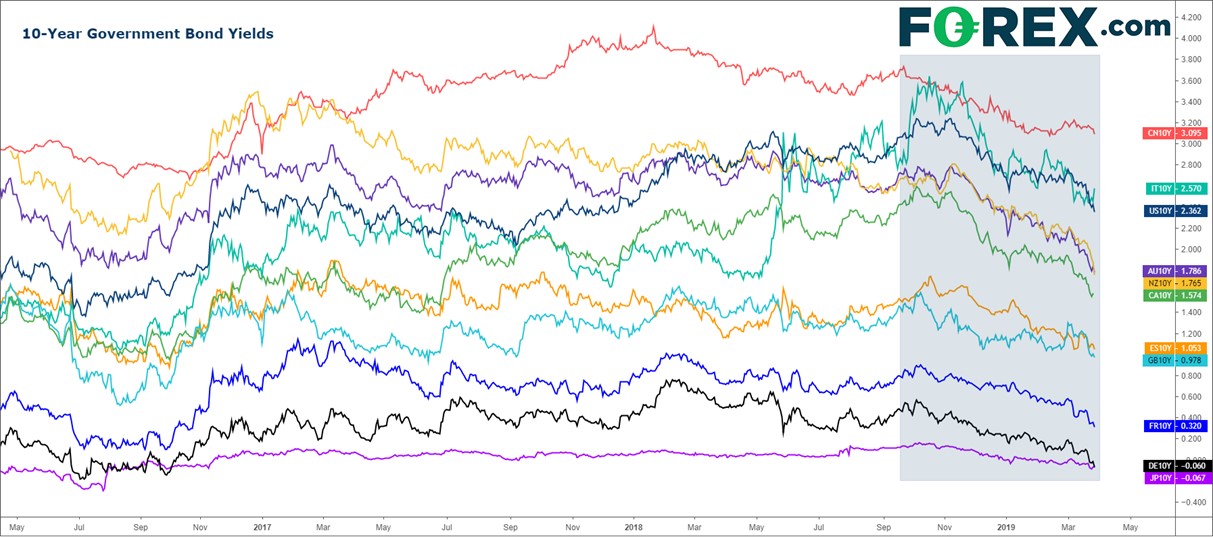

But it is not just in the United States, long-term bond yields have fallen across the major economies, as investors flocked back to the safety of government debt (see chart below). Whether these concerns are justified or not, the markets are flashing major warning signs for the global economy. We think this is good news for lower-yielding assets such as gold and to a lesser degree silver, especially if the US stock markets were to correct themselves now.

10-year Government bond yields of various economies all falling Source: TradingView and FOREX.com. Please note, this product is not available to US clients