President Trump’s newest tariff threat impacting global indexes and forex markets.

Global indices take a sharp leg down after president Trump shifted attention from China to Mexico. The selloff began around 3 am London time when Trump threatened Mexico with a 5% tariff on all its goods, if it does not halt immigrants from illegally entering the United States.

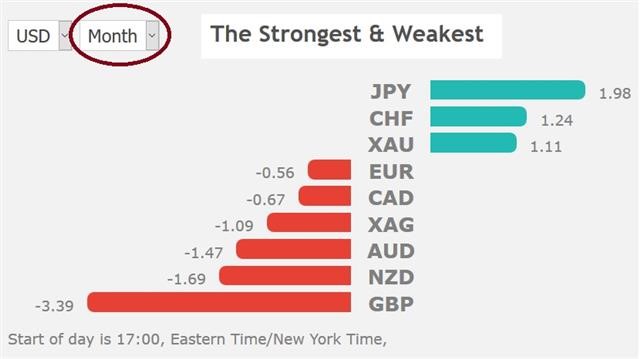

The Mexican peso and crude oil were the biggest decliners, as was the Canadian dollar. The chart below shows how May's ugly market showing has pushed the Japanese yen (JPY), Swiss franc (CHF) and gold to the top of the performers at the expense of British pound (GBP), Aussie (AUD) and New Zealand dollars (NZD).

The Trump team warned that the 5% tariff would rise to 25% by Oct. 1 if illegal immigration was not addressed by Mexico.

Just as China was threatening to restrict its rare earths exports, Trump shifted to Mexico, broadening the risk-off impact of the trade war, which increasingly appears to become the New Cold War of global economics.

Today's upcoming release on US PCE is a key test for the U.S. dollar as the Fed’s Vice Chair Richard Clarida cracked open the door to a rate cut.

On the Bank of Canada

A few words on the notable contrast in speeches between the top deputies at the Bank of Canada and the U.S. Federal Reserve. BoC's Senior Deputy Governor Carolyn Wilkins emphasized upside and downside risks while highlighting that lower bond market rates since the start of the year are stimulating the economy. Clarida warned that downside risks could call for more accommodative policy and that the global economy has been softer than assumed six months ago.

He also emphasized that inflation has been lower than expected. That was a key takeaway from revisions to Q1 GDP as PCE inflation was cut to 1.0% annualized from 1.3%. That drop led to a bid in bonds that pushed yields 5 basis points lower across the curve and back to Wednesday's lows.

Those levels could be taken out if Friday's April PCE report paints a similar picture. The PCE deflator is expected up 1.6% year over year on both core and headline numbers, but after GDP, those risks are certainly on the downside. The details in the data will be especially important because the FOMC has been pushing a narrative that the weakness is temporary and confined to a few skews.