Now that a preponderance of evidence suggests markets are turning bearish, the tough work begins, reports Jeff Greenblatt.

If this were a courtroom and I were prosecuting the case against the bull, evidence is mounting against it. Let’s just talk about the events of the past week. Last week I talked about crosscurrents in the market. On the one hand, the NYSE Arca Oil Index (XOI) put in the type of square out vibration that would’ve taken off in a bull market. By Friday morning, it had failed, which speaks to a bigger failure. What did work is the continuation of the inverted yield curve, which continues to spook investors and traders alike.

Then we have the ongoing saga of interest rates. Jackson Hole, with the backdrop of the Grand Tetons, is the one time of the year I can look at my television and relax. The atmosphere was anything but relaxing given all the linguists were trying to gain any edge they could out of Fed Chair Jay Powell’s speech. Excuse me for asking, but didn’t we just have a Fed meeting a few weeks ago? Has the world changed so much in three weeks? We’ve noted here that all the QE in the world this time isn’t going to save this market. Proof came just as Powell wrapped up; he was ceremoniously preempted by President Trump’s temper tantrum with China.

Within the hour, Powell’s speech was an afterthought. Nobody was talking about interest rates anymore. The President pitted Powell against Chairman Xi to allow the public to vote which was public enemy number one. An astounding event for any U.S. President. Just as astounding was his demand U.S. companies get out of China. The Dow finished down more than 600 points with the rest of the crowd left to deal with the aftermath.

After the close the President announced an increase in tariffs in retaliation for what China had done. This announcement came roughly 10 days after he suspended certain tariffs. The problem isn’t so much the tariff but the on again, off again nature of these negotiations. The see-saw effect is becoming tiring to many, and if the market loathes anything, its uncertainty. President Trump announced those tariffs, in a couple of weeks he could change his mind. The other issue is more problematic. Many don’t realize the office of the President has very broad emergency powers as far as issues of national security are concerned. He was asked about it at the G7 and said it was his right, but he elects not to do so at this time. Consider what would happen to world markets if he really did order Google (GOOG) and Apple (AAPL) to leave China. The fact we are even having this discussion shows how close we might be to the ledge.

The market has been very questionable for the light volume late August period. There is still one more time window coming up the week after Labor Day so we are hardly out of the woods. Markets are in trouble; some traders are feeling it in ways that likely are not in their best interests. Now let’s talk about identifying crash legs.

Crash Legs

Since the financial crash of 2008 I’ve been asked numerous times about how to recognize the next crash leg. The first time came in the very early stages of the new bull in early 2010. One man wanted to know how to recognize the next crash. Unfortunately for him I had just revealed the signal for the long-term bottom where the square root of the bottom of the SPX lined up with the top of the 1987 crash leg in terms of months. If you recall, certain hedge fund operators got short as early as 2006 because they knew something was wrong with the housing market. They had to wait two years for it to pay off. Now some people are attempting to catch the next “big one.”

I have experience with bear markets. In the Spring of 2001, I participated every day in a NASDAQ drop of nearly 2000 points in eight weeks. At that point, all one had to do was go short early in the day and wait out the consolidation until the last hour. In at least three of five days a week, the market got crushed in the last hour. Here’s the problem: That was a methodical drop, a once in a lifetime condition. It has never happened again. The 2008 crash was a lightning quick, violent drop. By the time one figured out to take a position, the move was already light years from where a reasonable person would put their stop loss. How many could absorb a 50- to 75-point stop loss in the Dow Jones Futures (YM) on a regular basis? Consequently, I didn’t participate much in that bear.

Now that I’m getting bearish, people are telling me they want to be short because if it’s going to happen, they want to ride the wave. I get the fascination, but why is it so many get enchanted by the fantasy of capturing the top of a potential crash leg? True trading isn’t about fantasies of fast money. If you have a good methodology, you should be able to take money out of any market. In fact, the crash leg is the most difficult to master and easiest to lose money, even if you are right. Why? Look at the situation right now. Unless you’ve captured the top, you’ll have little staying power when a short squeeze comes against you. The top was July 26, since then we’ve alternated between big up and down legs. Do you have the financial and mental staying power to hang on when President Trump suspends tariffs? Wouldn’t it be better to take a position based on a really good setup and then be happy with what the market gives you?

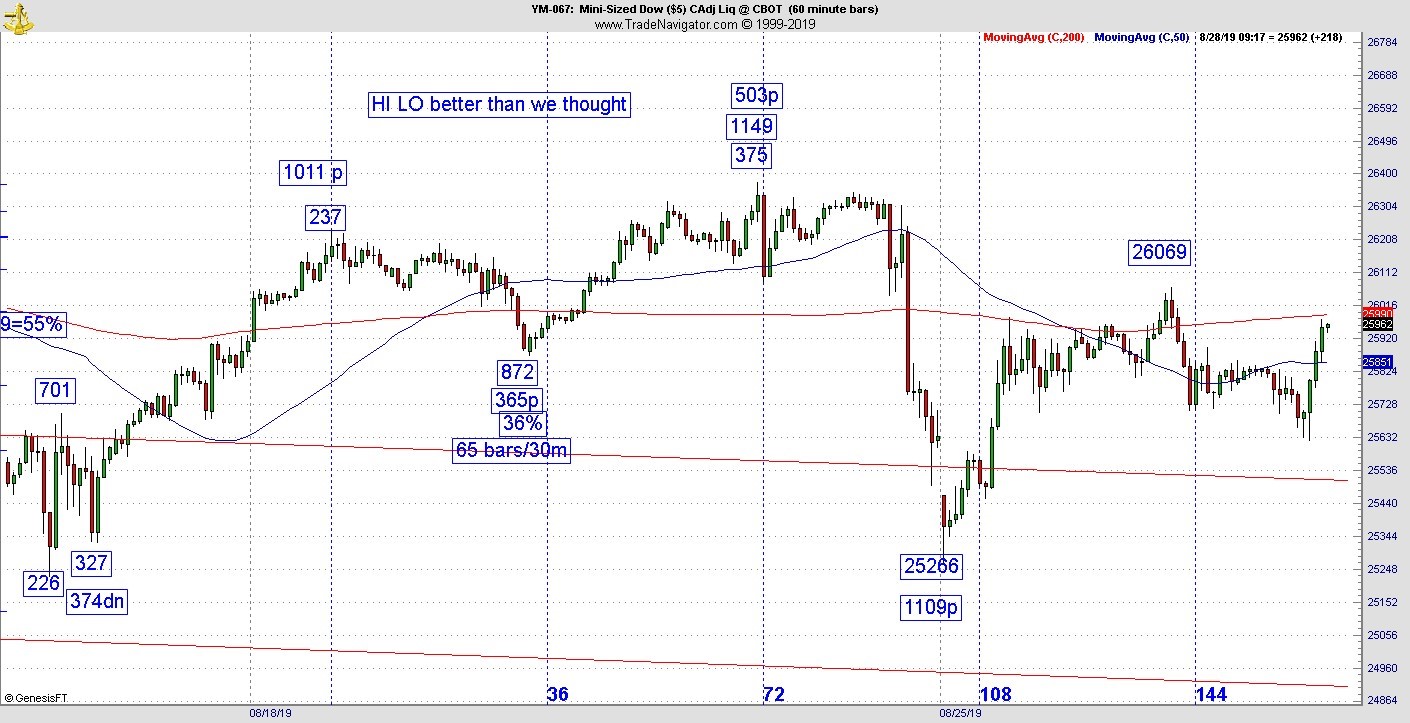

Case in point is last week’s Trump crash leg. We had an excellent set up and I’m showing you the square out vibration portion of it (see chart below). Kairos suggests we look at three points to get a square out. In this case the high to high was 71 hours with a 25872 low. This set up led to an 1109-point drop in 31 trading hours. By the way Kairos doesn’t give you these kinds of incredible drops on a regular basis but sometimes when you are good you get lucky. This was a gift horse. Three days later the market took back 72% of those gains. Yet there are traders out there who are short and absorbing this kind of push back. It’s not fun to take this kind of pressure. I get it that some of you want to hit a home run, but some inexperienced traders will go broke trying. At this point nobody knows if the market will retest the high or go sideways and collapse after Labor Day. Another point to consider is while the market topped in 2007, it took a whole year before the financial crisis kicked in. Very few traders have the capability of hanging onto a position for an entire year.

The trader who gets in early has more staying power. You must be a cycle expert to be able to pull that off. Most people don’t have that skill. Isn’t it better to find good setups and take what the market gives you? One of the cardinal rules of trading is never allow a winner turn into a loser.

So, while you are reading this at the beach or some barbeque, enjoy the holiday. At the same time realize that nobody knows exactly what will happen—even with September statistically the most bearish month of the year. Use good trading discipline especially at a time when risk is high. September can be good for traders, but the other 11 months are just as important.

If you want more information, go to: Lucaswaveinternational.com and sign up for the free newsletter.