There is an interesting set-up in front of Brexit deal negotiations in the EURGBP, reports John Rawlins.

Looking over the breadth of markets covered by the QuantCycles Oscillator, one thing becomes abundantly clear—the British pound is extremely overbought.

This is a reaction to positive news on a potential Brexit deal. (Also looks at today’s post by Adam Button).

While traders should be cautious putting on positions in the pound while the Brexit wild card is still likely to create two-way volatility, we decided to share the most relevant pound-related pair.

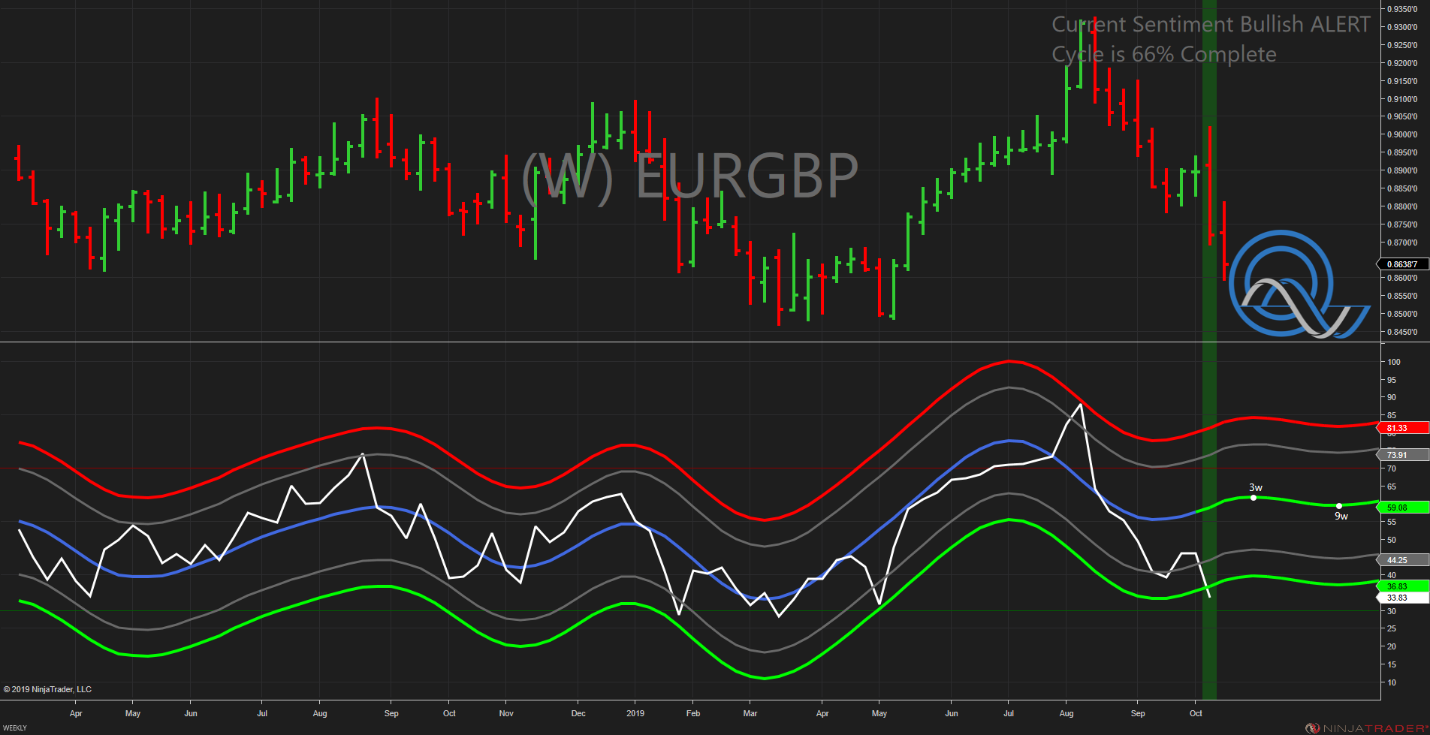

The EURGBP pair is oversold on the long-term oscillator (see chart).

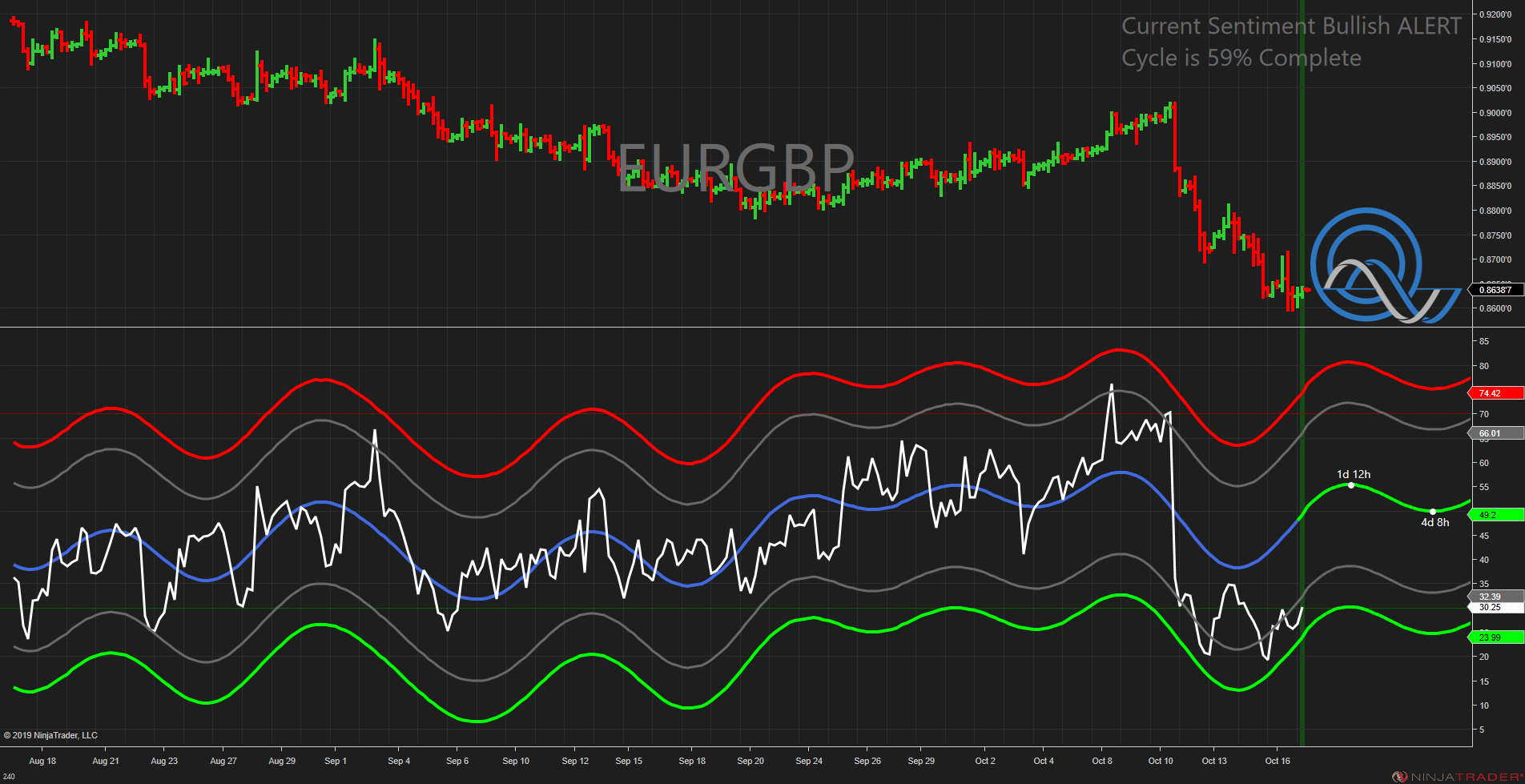

The Brexit-related sell-off in the EURGBP has gone counter to the QuantCycles Oscillator, particularly the daily. This has pushed the daily near oversold territory as well (see chart).

While fundamental news could easily overwhelm our cyclical indicator, the short-term (four-hour) oscillator in the EURGBP is also screaming “Buy.”

As you can see, there is a double bottom followed by an up move. Bearish news on Brexit, or a buy the rumor, sell the fact reaction to a deal could cause a long EURGBP trade profitable.

Tomorrow, we will share some more pound-related crosspair charts.

John Rawlins described the value of the QuantCycles Oscillator recently at The Orlando MoneyShow.

The QuantCycles indicator is a technical tool that employs proprietary statistical techniques and complex algorithms to filter multiple cycles from historical data, combines them to obtain cyclical information from price data and then gives a graphical representation of their predictive behavior (center line forecast). Other proprietary frequency techniques are then employed to obtain the cycles embedded in the prices. The upper and lower bands of the oscillator represent a two-standard deviation move from the predictive price band and are indicative of extreme overbought/oversold conditions.