Keep an eye on these Big Pharma names, likely to outperform, says Joe Duarte.

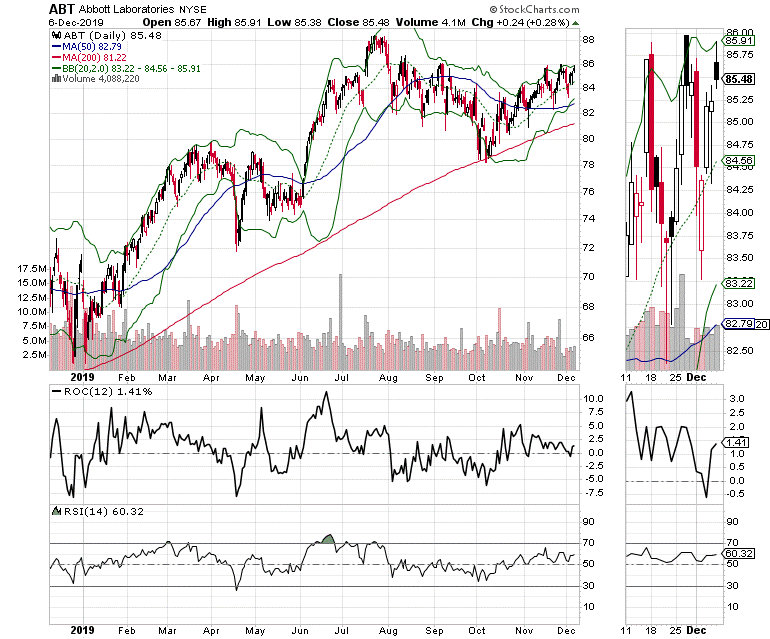

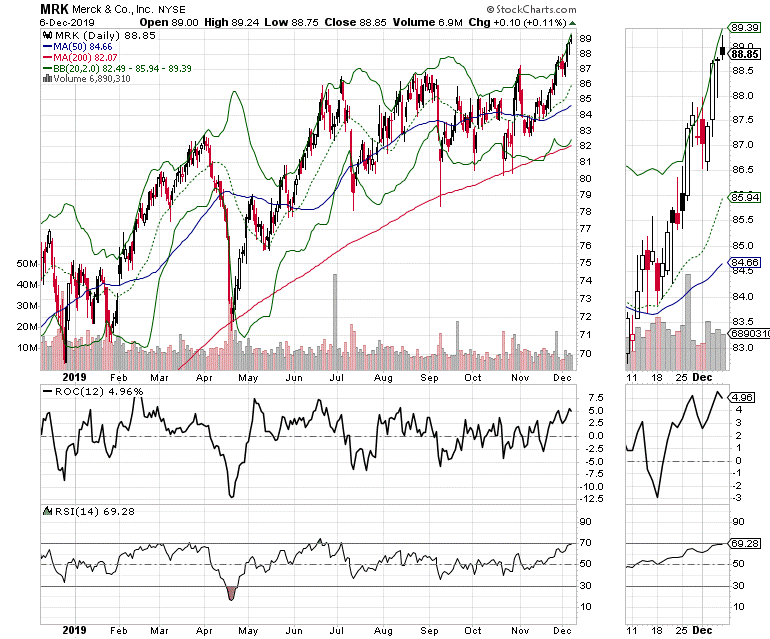

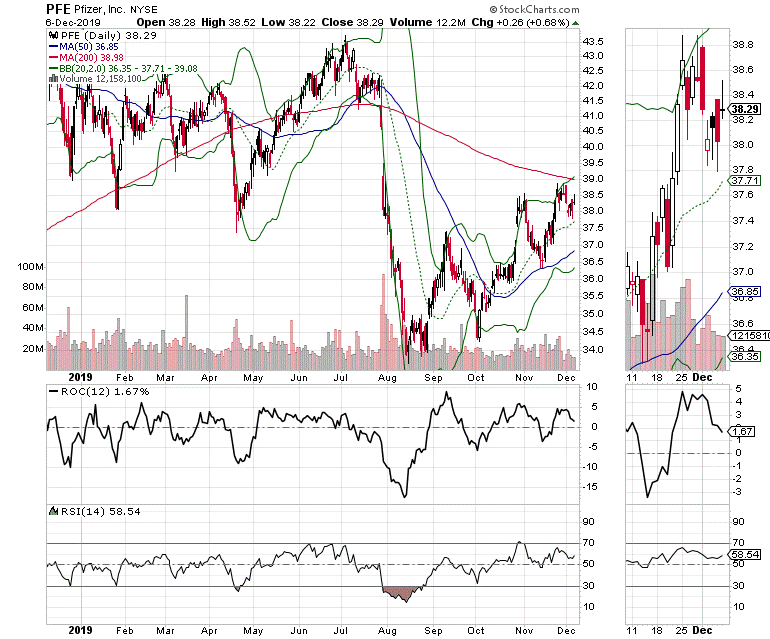

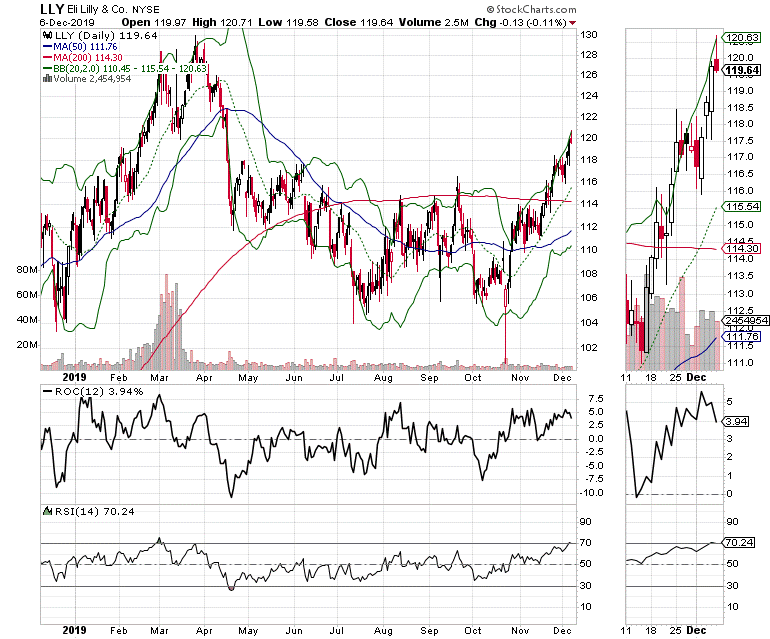

One of those high potential areas of the market is Big Pharma, where companies such as Abbott Labs (ABT), Merck (MRK), Eli Lilly (LLY) and the slow and steady turnaround which is Pfizer (PFE) are finally adapting to the health insurance marketplace and are sitting on potential blockbuster drugs and equally healthy pipelines with big things in late stage clinical trials.

These four Big Pharma stocks are increasing their market share and rising as they expand sales of products which have been truly disruptive in healthcare. Abbot, for one is moving on the success of its cardiac products aimed at treating heart valve disorders as well as its continuous blood sugar monitoring systems, while Merck’s Keytruda is becoming the world’s leading cancer drug as the company continues to broaden the types of cancers that are responding favorably to treatment with the medication.

Pfizer, on its own account, may be the turnaround story for 2020 as it slowly recovers from losing its patent protection for its blockbuster drug Lyrica and a host of management decision mishaps while slowly building a new stable of potential blockbusters including the enigmatic Vyndagel to treat what may not be as rare as it is believed to be type of congestive heart failure.

Not far behind Pfizer in the turnaround category is Eli Lilly, which reeled when it lost its patent protection for erectile dysfunction drug Cialis. Lilly, however, is making inroads in the treatment of migraines with the recent approval of its Lasmiditan 5HT-1 blocker for the treatment of acute migraines to go along with its migraine prevention injectable drug Emgality. The combo gives it a potential one-two punch in the sector which could lead to a sizeable increase in its market share for the condition.

Interestingly, Pfizer and Eli Lilly also have a potential billion dollar drug in their nerve growth factor inhibitor (tanezumab) which is aimed at treating chronic low back pain. The allure of this drug is that it is not an opioid, which means that the likelihood of it being accepted quickly in the marketplace upon Federal Drug Administration approval would be significant, especially as insurance companies would be pressured to pay what is likely to be a fairly steep price for a drug, which could reduce opioid usage and thus the potential for drug overdoses and which could positively impact the healthcare and societal costs of opioid addiction.

Tanezumab may also work for osteoarthritis, and for cancer related pain, which, if true, would expand its potential market share dramatically on a global basis, especially as the global population ages.

More importantly, Pfizer and Lilly have no competition in nerve growth factor inhibitors as several other companies have shelved their own candidates due to severe side effects which were not widely present in the most recent trial for tanezumab.

I own ABT, LLY, MRK and PFE as of this writing.

Joe Duarte is author of Trading Options for Dummies, and The Everything Guide to Investing in your 20s & 30s at Amazon. To receive Joe’s exclusive stock, option, and ETF recommendations, in your mailbox every week visit here.

Join Joe at the MoneyShow Orlando Feb. 6-8 where he will be discussing the ins and outs of the Markets-Economy-Life ecosystem (MEL) and how he uses it to pick winning stocks.