Here the latest on the best trending sector from Phillip Streible.

Markets across the board have been shaken up about news of the Coronavirus and specifically the impact on the global economy due to the weight of China. Commodities such as copper, crude oil along with the softs and agriculture sectors have been hit the most. Safety plays like gold, Treasury bonds, Japanese yen and the U.S. dollar have had limited response indicating that the market may only over another 24-48 hours of dramatic moves.

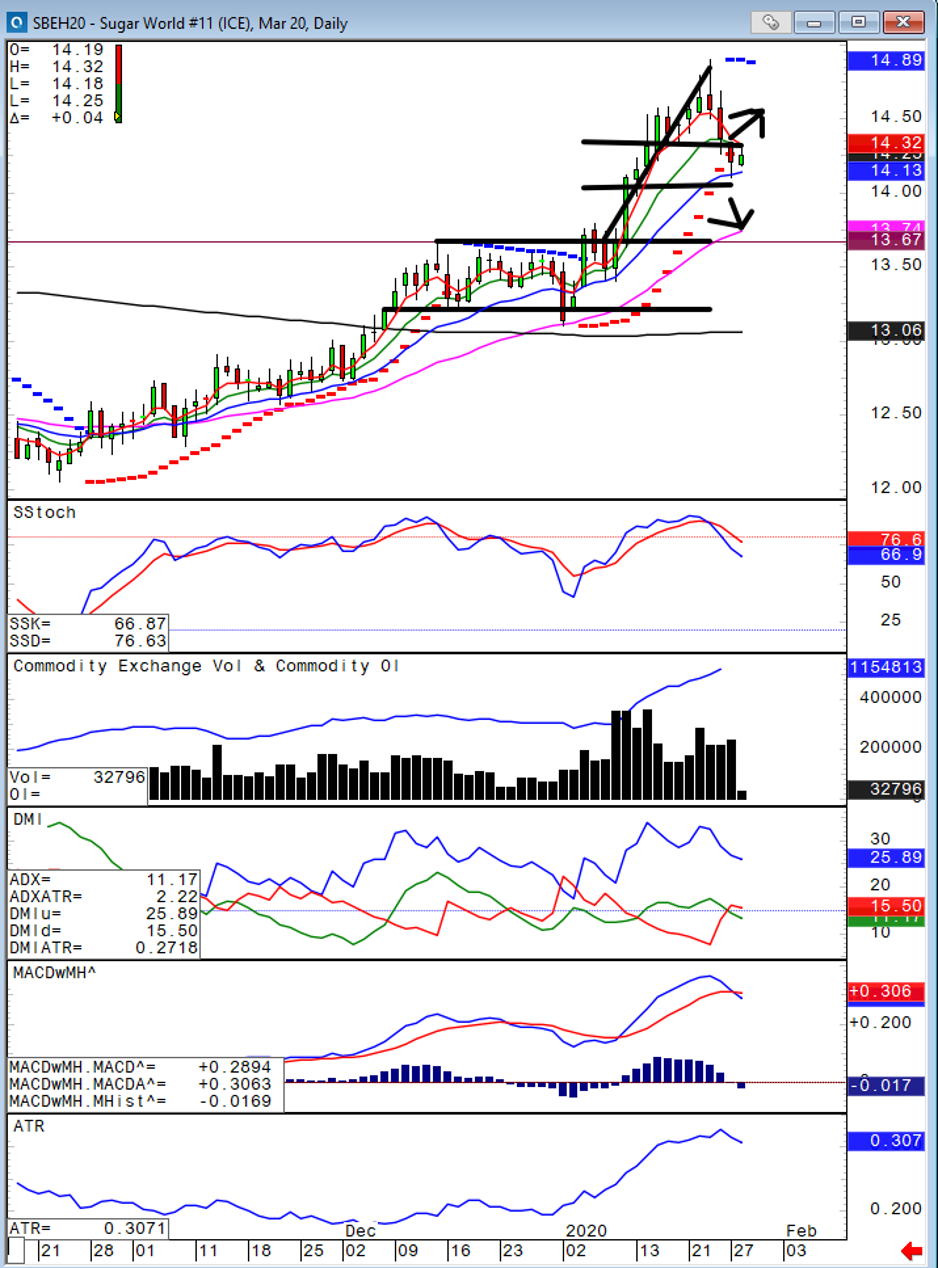

Sugar: Up 5.96% year-to-date

With energy prices starting to rebound off their lows we should see a small boost in ethanol demand therefore supporting prices. If you picked up put options on sugar looking for a washout, this might be the time to step back to the sidelines.

The impact of the volatility in the markets should have shaken out some of the longs and with the record open interest, this gives traders a reason to get back long. Sugar has a bit more technical work to do in order to put the bull trend back together. We need to see a strong close back over 14.40 and the next session needs to get off to a positive start. If we can get this kind of recovery, the market should challenge the contract highs at 14.89 (see chart below).

Resistance 2 - 14.90

Resistance 1 - 14.34

Support 1 - 14.10

Support 2 - 13.79

Target - Neutral

Reversal point = 14.34

Cocoa: Up 8.35% year-to-date

Yesterday, to my surprise, cocoa was higher for a portion of the day and then went into negative territory before settling higher. Managed money continues to add to the long side as hot and dry weather continue to hit key growing regions in West Africa. From a trading standpoint the market needs to close above 2792 or punch through 2800 to resume the bull trend. Support is down at 2697 while a break below this level would result in a washout down to 2616 the 50% retracement.

R2 - 2859

R1 - 2800

S1 - 2700

S2 - 2625

Upside target = 2856

Reversal point = 2800

Coffee: Down 18.16% year-to-date

Coffee continues to lack support and looks to target $1.05. Keep an eye on the Brazilian real for any signs of a bottom as the Coronavirus has shut down Starbucks (SBUX) and Luckin Coffee Inc. (LK) stores in parts of China. Your trend reversal point is back with a close over $1.1250 where a short covering rally should be sparked.

R2 - 112.50

R1 - 110.00

S1 - 106.15

S2 - 105.00

Downside Target – 105

Orange Juice: Down 4.41% year-to-date

Orange juice continues to fail to make headlines as prices have been in a well contained area of consolidation for the past couple weeks. From a technical perspective it appears this market could make a move in either direction. If we see a break above 97¢ per lb. we could see a short covering rally back up to $1.04 while a break below recent support of 94.25¢ could result in a washout back to 90. My bias is neutral on this market for the time being and there are better opportunities now.

Bill Baruch provides technical levels on all markets throughout the week at BlueLineFutures.com. Please sign up at Blue Line Futures to have 1 or all 6 of our research reports emailed directly to you.

Please sign up at Blue Line Futures to have our research emailed to you each morning.