The QuantCycles Oscillator is showing a potential major reversal in the Euro currency, reports John Rawlins.

The U.S. Dollar Index is off to a strong start to 2020. The dollar has been gaining strength against the euro in a slow-moving two-year trend.

The euro has been looking to end this long-term trend for months and now appears to be ready to make its move.

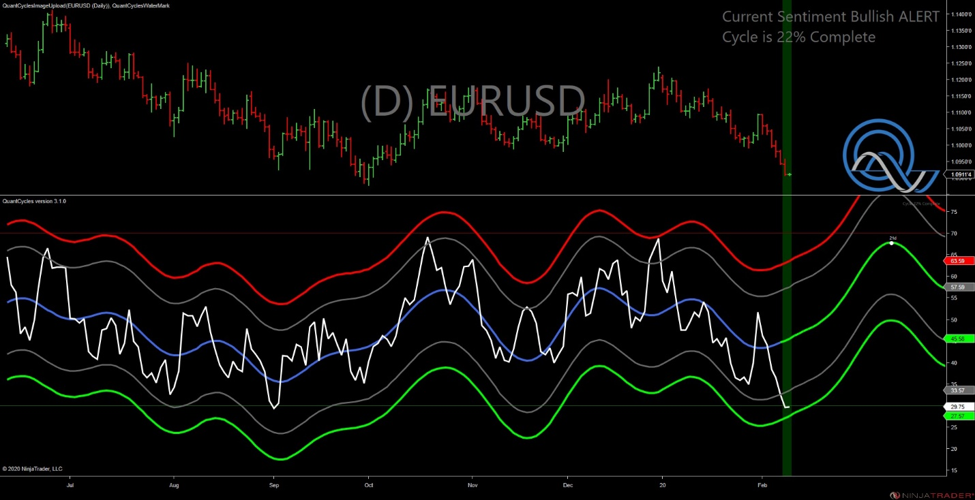

The long-term QuantCycles Oscillator for the EURUSD is turning up in a big way (see chart below). The recent weakness has placed the EURUSD in oversold territory in the midst of a bullish trend.

The euro daily oscillator turned bullish at the beginning of February, just as the euro reversed lower. This has pushed the daily oscillator close to extreme oversold territory (see chart). This create a strong opportunity for euro bulls.

The short-term (four-hour) oscillator provides more detailed and timely information. It turned on Monday, with the euro somewhat oversold. This confirms the other two signals and suggest the euro

John Rawlins described the value of the QuantCycles Oscillator recently at The Orlando MoneyShow.

The QuantCycles indicator is a technical tool that employs proprietary statistical techniques and complex algorithms to filter multiple cycles from historical data, combines them to obtain cyclical information from price data and then gives a graphical representation of their predictive behavior (center line forecast). Other proprietary frequency techniques are then employed to obtain the cycles embedded in the prices. The upper and lower bands of the oscillator represent a two-standard deviation move from the predictive price band and are indicative of extreme overbought/oversold conditions.