The Coronavirus has highlighted the value of the biotech sector working on creating vaccines for various threats, writes Joe Duarte.

Last week we highlighted how biotech firm Gilead Sciences (GILD) could be a stock that could explode higher based on its work for a treatment for the Coronavirus. However, GILD is not the only biotech sector stock to be watching, and Coronavirus is not the only viral health threat that needs to be addressed.

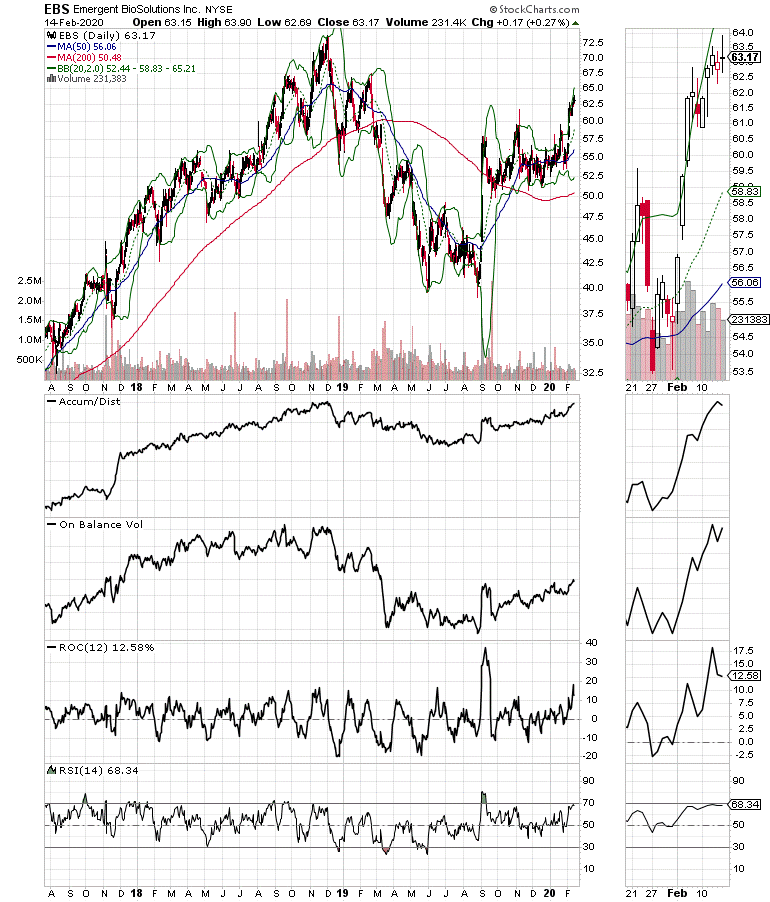

Shares of Emergent BioSolutions (EBS) have recently been moving steadily higher (see chart below). That’s because this mid-size biotech is well positioned in vaccines for germ warfare, bioterrorism, and a key antidote for opioid overdoses.

Unfortunately, the stock can be frustrating to trade as given its generally low profile, it often moves with thin volume making for choppy action. Still, if you’re looking for a company which is well positioned in case of a biological catastrophe, EBS is near the top of the list, and here is why.

It has the exclusive contract for the U.S. government for filling the stockpile for anthrax vaccine, and has just signed a multiyear, multibillion contract with the defense department for the next generation of anthrax vaccine, which is already in production and in the early delivery phase, a fact that should be noticeable on the bottom line over the next few quarters.

It’s also in late stages of a vaccine for a mosquito transmitted virus (chikungunya), which can be similar in symptoms to the Zika virus and dengue fever, potential plagues over the summer months.

oreover, EBS is likely to receive exclusive European approval for an oral cholera vaccine in the next few months. The likely scenario is that a majority of the millions of European travelers, who often frequent endemic cholera regions of the world, will be receiving the vaccine, which has been available in the U.S. since 2016.

EBS will report earnings on Feb. 20 and is likely to move in response. It beat expectations in its November 2019 report after missing the previous three times. However, the company did give positive guidance for 2020 after the November report and the stock has been moving steadily higher since early February. This trading pattern suggests a positive buzz. Nevertheless, the company can disappoint so small positions may be warranted for those who decide to take a bite.

Joe Duarte is author of Trading Options for Dummies, and The Everything Guide to Investing in your 20s & 30s at Amazon. To receive Joe’s exclusive stock, option, and ETF recommendations, in your mailbox every week visit here. I’ll have more for subscribers in this week’s Portfolio Summary. For a 30-day Free trial subscription go here.

By the way if you couldn’t make it to Orlando for my Money Show presentation, you can see it here.