If sellers don’t act soon, expect an upside breakout, reports Ricky Wen

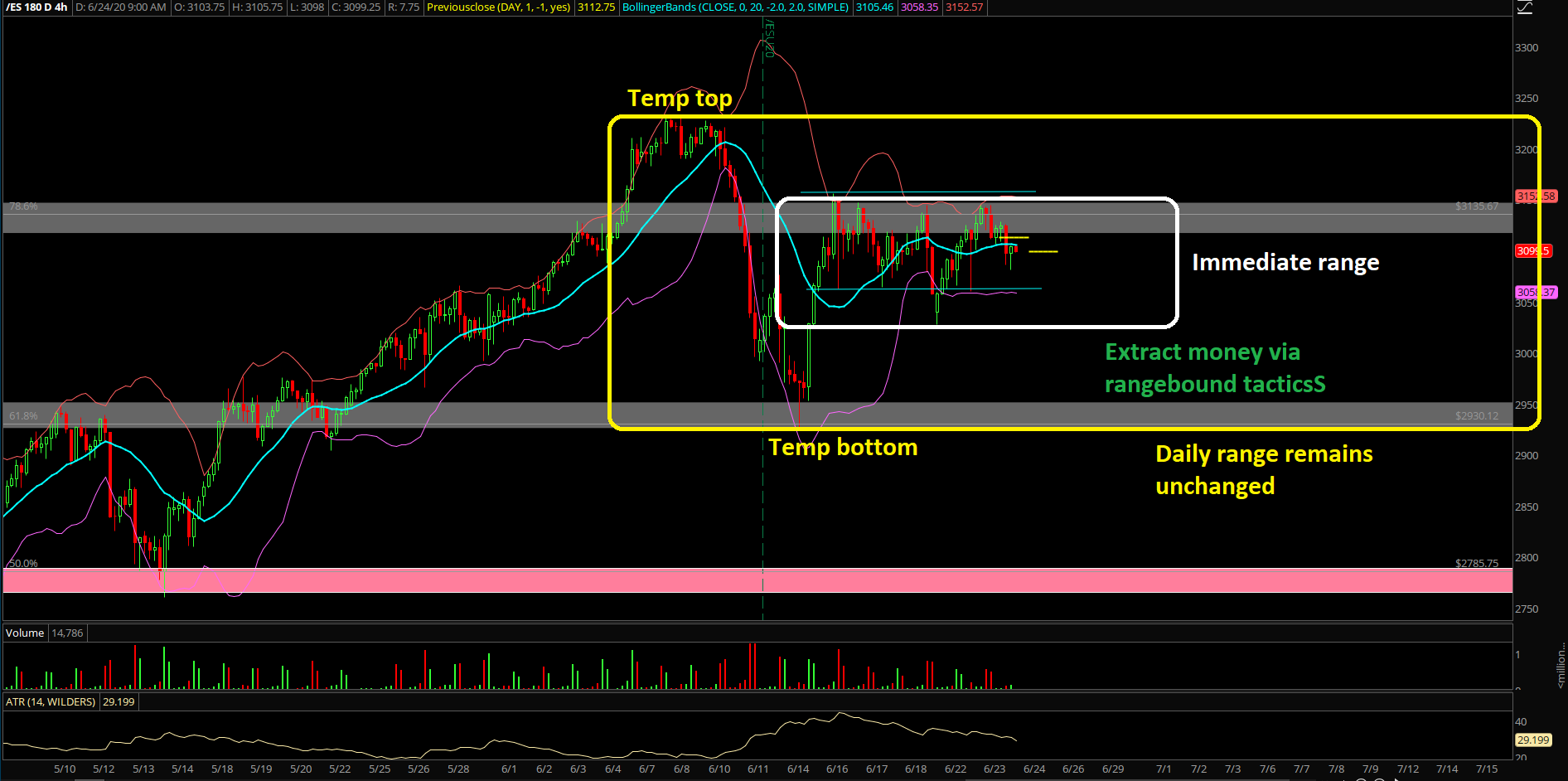

Tuesday’s session was more of the same action as the market remains stuck within our immediate range levels. If you recall, the bulls tried to break above last week’s 3150s range high on the E-mini S&P 500 (ES), but the price did not have the strength to conquer it. Instead, the ES micro-double topped in the mid-3140s and spent the rest of the day grinding back towards the 3110 gap-fill/prior day’s closing print (see chart).

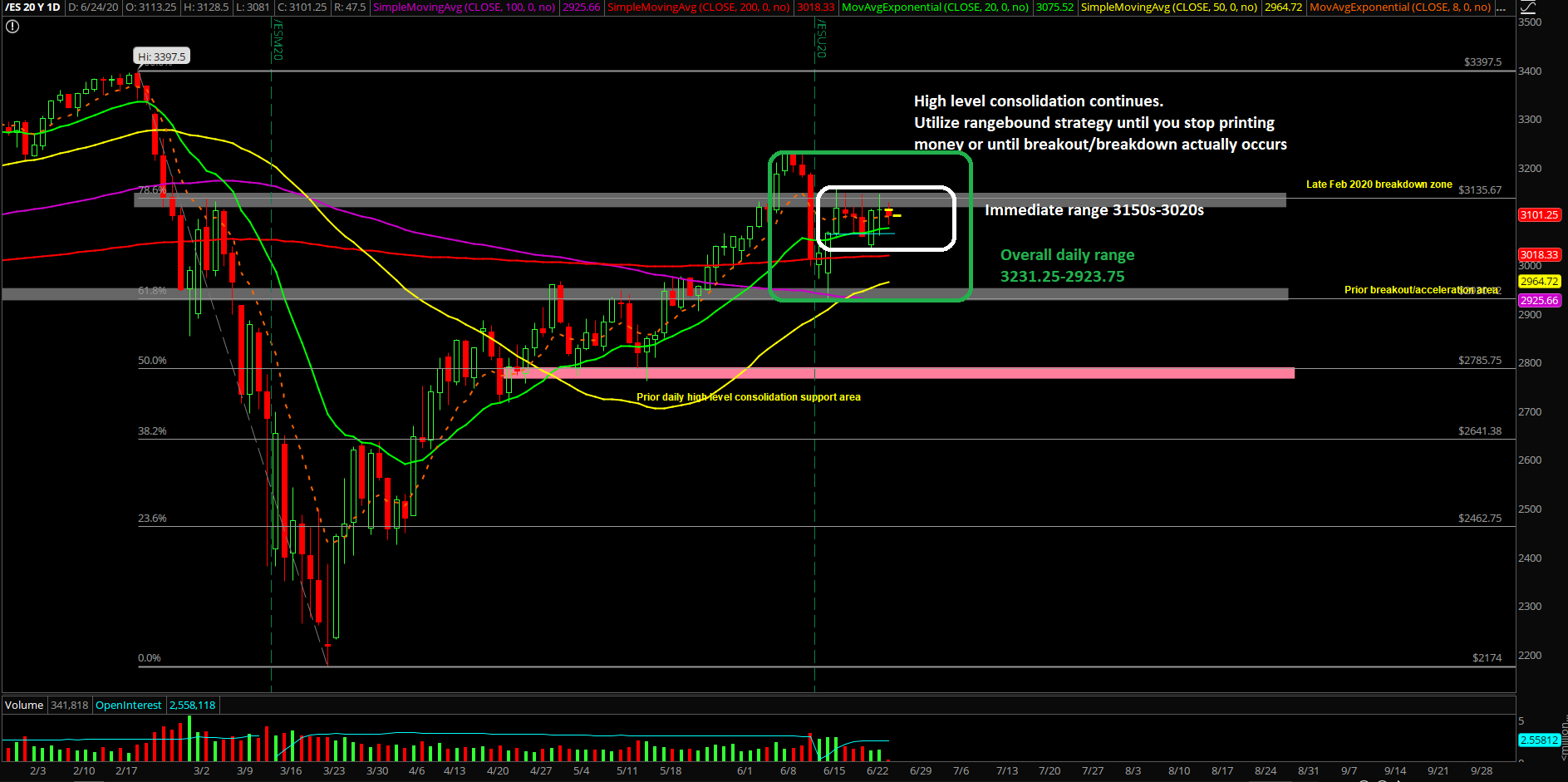

The main takeaway remains the same as the price action remains stuck in an overall daily range of 3231.25 to 2923.75 where a temporary top and temporary bottom were confirmed a few sessions ago (see chart below). The ongoing battle remains tough for both sides because the longer this thing consolidates in a high-level consolidation, the better the outcome for the bulls. That is why it’s critical for gummy bears to act now and entice the real, big, bad bears to rotate back into town.

What’s next?

Tuesday the ES closed at 3112.75 on a doji candlestick, meaning that the price action remains indecisive within this high-level consolidation/bull flag environment. My game plan:

- I am neutral to immediate bullish at the moment going into this week given the ongoing battle in regard to the immediate range vs overall daily range (3156.25-3027.25 within 3231.25-2923.75).

- Zooming in, the immediate range has widened a little bit to 3027.25-3156.25 given last Friday and Sunday night’s price action movement.

- Price action has consolidated in a decent manner as a bull flag/continuation pattern for the past few sessions; it’s been the same old story almost every single week or two since the March 23 lows. The bears are running out of time against the consolidation patterns, and the bulls are doing the same old trick at trying to end Fridays/monthly closing at/near the dead highs. Not rocket science when above support.

- In addition, if you’ve noticed, June 15 to June 19 was a retracement week that covered up 38.2% to 50% of the losses of the June 8-12 week. This indicates that the immediate bears are not as strong as projected as we confirmed the 2923.75 temporary low from a few days ago.

Ricky Wen is an analyst at ElliottWaveTrader.net, where he hosts the ES Trade Alerts premium subscription service.