Equities are near their all-time highs but appears toppy and are at risk of a correction, cautions Joe Duarte.

Active traders are now balancing on a high wire as the rally off of the March bottom is starting to show consistent signs of wear and tear while still offering some opportunities on the long side. It is during times like these that fortunes can be made or lost in a hurry and where staying focused and following strict trading rules can make the difference between a great trade or a painful day.

Accordingly, as the U.S. Presidential election nears expect the unexpected. In fact, as I write, the news is breaking that President Trump is scheduled to make an announcement regarding a potential therapeutic breakthrough regarding Covid-19. The news is likely to have an influence on the stock index futures since the press conference is scheduled for 5:00 PM Central time, precisely when the overnight futures market opens.

Of course, no one knows what Trump will say or how his opposition or just as importantly, the Federal Reserve will respond. All anyone can say is that starting now we should all be prepared for things we have never seen or heard before, and that can create market volatility.

A World in Transition and a Federal Reserve on the Bubble

As Covid-19 and its consequences are cemented into daily life, the complex adaptive system comprised of the markets, the economy, and people’s lives (MEL) has emerged into a new reality and we are witnessing an evolutionary transition whose repercussions will be felt for years. Moreover, for investors who can identify the dominant trends both on the ground and in the stock market as the situation evolves, the potential for profits seems to be just getting started.

Still, as I’ve noted over the last couple of weeks, the market’s breadth and a general lack of energy suggest that pullback, consolidation, or even a correction may be underway. What that means is that we will have to work harder to find winners and to be more patient and disciplined as we wait for the stocks to blossom or to require selling.

In addition, even though we are now in a higher risk environment than where we were a few weeks ago I am not fully bearish yet. That’s because no matter what the Federal Reserve says, especially at its upcoming Jackson Hole, Wyoming shindig, they are still going to have to pump money into the banking system or the highly indebted economy will collapse. And that one factor favors at least some stocks rising.

In addition, whereas Covid-19 was the major influence on government and central bank policy in the past six months, the next quarter and beyond will likely be about these three major themes:

- Covid-19 fading as the lead headline story and becoming the major underlying influence in the public’s behavior, thus affecting MEL

- Lingering Consequences: Exodus from major cities and a positive effect on housing, a disruptive effect on the workplace and the supply and demand equation for everything

- The Election – where seasonal tendencies lead toward higher stock prices in the fourth quarter

It should be noted, that even though the Fed’s hands are tied, the central bank’s most recent minutes suggested that the FOMC will be aggressive in its addition of liquidity only if the economy remains weak. So, it’s important to know the most recent PMI data, released last week, shows that the economy is on the mend to some degree. My own view, however, is that the recovery, such as it may be, is a regional situation influenced by the movement of people from high crime, high tax areas that have been ravaged by Covid-19 to areas where there has been less economic damage and the perception of safety.

But the numbers are what they are, so it’s hard to know what the Fed, given its national focus may or may not do. From a market standpoint, the best guess is that unless the current correction in the stock market turns into something very aggressive, even as the election season heats up and the negative sentiment rises, the odds will still favor stock picking. Nevertheless, it’s important to keep the following principles in mind and to put them into practice:

- Take at least partial profits on positions which have gained 20% or more

- Expand your research focus beyond your comfort zone

- Stick with strong sectors and stocks

- Trade in small lots and don’t be in a big hurry to buy stocks in the short term

- Look closely at lagging sectors for potential turnaround candidates

- Adjust sell stops to prevent losses beyond 5%

Underlying those principles is finding the specific sectors and stocks that have performed and are likely to continue to outperform during this unique period. This may require you to expand your research. Tomorrow, we will highlight specific stocks we recommend and have recommended to perform in this environment.

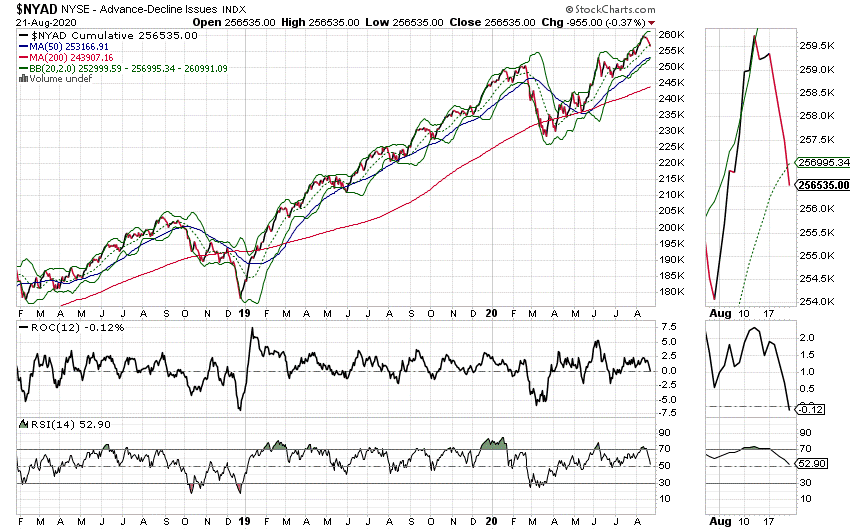

NYAD Develops a Slight Divergence

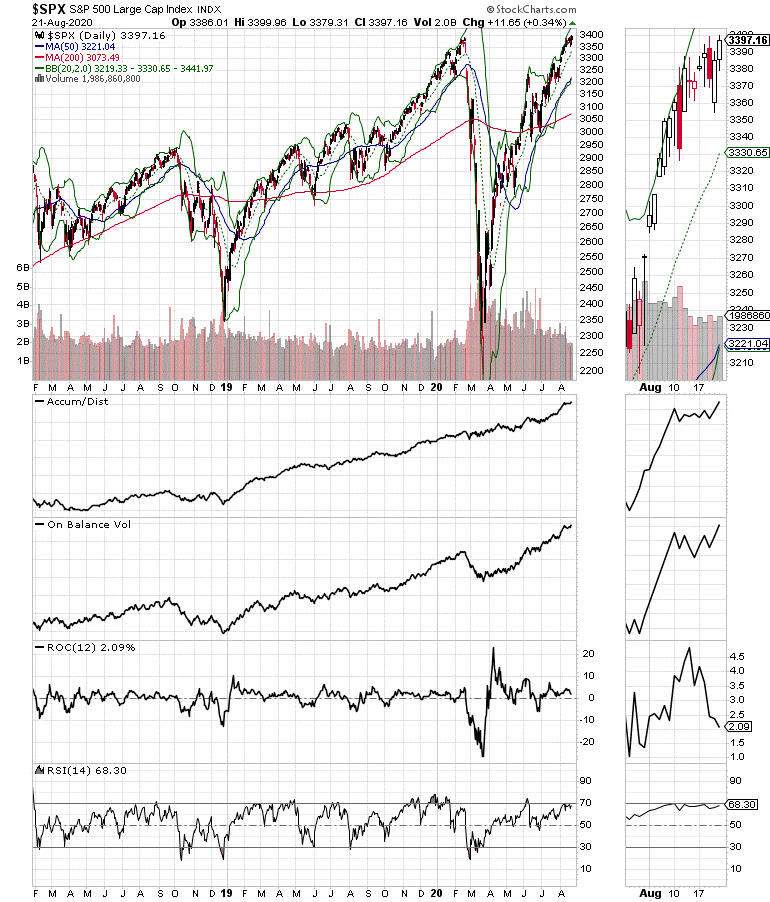

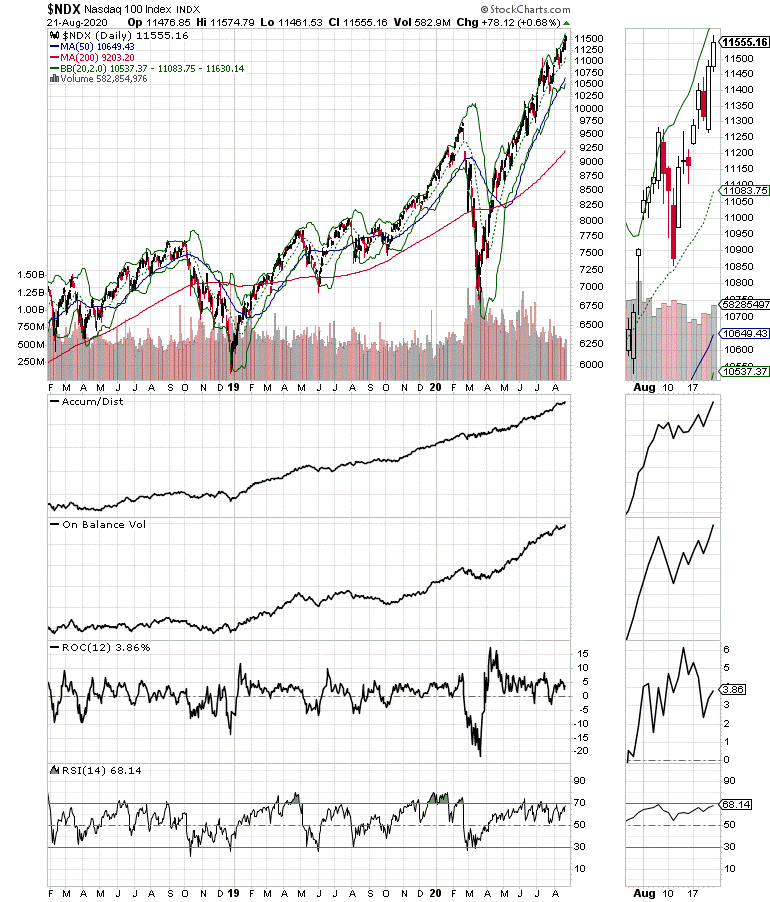

I am watching the NYSE Advance Decline line (NYAD) closely now as the indicator may be flashing a cautionary sign. Specifically, on Friday Aug. 21, the NYAD was down as the S&P 500 (SPX) moved higher. This is not a good scenario unless it is reversed (see chart).

Things would be outright negative if NYAD breaks below its 50 day moving average and the corresponding relative strength index (RSI) indicator closes below 50 as that would trigger a Duarte 50-50 Sell Signal.

In fact, SPX didn’t just move higher, it along with the Nasdaq 100 index (NDX) made new highs. That means that we now have unconfirmed new highs in the indexes that if not corrected soon would signal a potential full blown correction lies ahead in the market.

As a result, while we continue to look for new stocks to own, it also makes sense to be very cautious in this market unless this situation is rapidly corrected.

Caution Makes Sense in Late August

There are still plenty of stocks with bullish chart patterns, but the potential for a major technical divergence between the NYSE Advance Decline line and the major indexes, which has just appeared, suggests that there is no hurry to buy aggressively in this market until this situation is corrected.

As a result, the best tactic at the moment is to protect profits and to be very aware of how things develop over the next few days, even as you make your shopping list and put some money to work in those stocks which are exhibiting extraordinary chart patterns which are supported by strong fundamentals and outstanding management.

Joe Duarte is a former money manager, an active trader and a widely recognized independent stock market analyst since 1987. He is author of eight investment books, including the best-selling Trading Options for Dummies. For a FREE trial to Joe Duarte in the Money Options.com, click here.