The operative word in the financial markets for the first week of 2021 was up as stocks, bond yields, and the US dollar, moved higher in tandem, states Joe Duarte of In the Money Options.

Even more remarkable was the fact that the multiple rallies took place during a rather volatile political environment and amid rising uncertainty regarding the status of the COVID-19 pandemic as new strains emerge and the vaccine rollout continues.

But that’s the way the ball bounces these days, as we should only expect the unexpected. Moreover, since the news batters the markets so frequently, it makes sense to focus on the markets first and on the news cycle second. Indeed, as time passes the simple fact is that until proven otherwise the Federal Reserve’s zero interest rate policies and aggressive QE are more likely than not to push stocks higher, albeit with rising volatility, as we experienced during the first trading session of the year when stocks got clobbered only to recover impressively the rest of the week.

Bonds, Bonds, Bonds

That said, it is imperative to keep an eye on the bond market as the US Ten-Year Note (TNX) has now crossed well above the 1% yield area and seems poised to test the 1.10-1.25% area at some point, perhaps in the not-too-distant future. At the same time, TNX is well outside its upper Bollinger Band (green bands above and below yields), which means that some sort of slowing in the uptrend is in the offing.

Bollinger Bands act as restraining envelopes to prices, as well as signaling when big moves are likely. In this case, the interaction between the bands and TNX suggest that the selling has been too aggressive and that a move back inside the bands, perhaps to the 20-day moving average is possible before any change in the trend becomes more tangible. No matter what, though, TNX has now crossed above its 200-day moving average, along with the fact that the 50-day moving average has crossed above the 200-day line (a golden cross). All of which means that regardless of what happens in the short term, the trend in yields is now to the upside.

Perhaps the biggest surprise in the early going for the new year is the action in the US Dollar Index, which ended last week above the 90 area. This price area has been a crucial pivot area for decades, meaning that if the index can remain above it, the odds of it rising further increase as each day goes by.

Certainly, the dollar’s downtrend is nowhere near a convincing reversal. Yet, it has some room to rise with a rebound to the 92-94 area not being an unreasonable expectation with uncertain consequences in the short term. Thus, what it all boils down to is that we are in uncharted waters as no one really knows what to make of a situation in which market relationships are all lined up along the same path.

So, while we scratch our heads, the only choice is to follow our sound trading rules:

- Don’t fight the Fed

- Trade in small lots

- Use well-placed sell stops (5-8%)

- Stick with strong stocks in strong sectors

- Consider option strategies

- Look for emerging potential winners in overlooked areas of the market

MoneyShow’s Top 100 Stocks for 2021

The top performing newsletter advisors and analyst are back, and they just released their best stock ideas for 2021. Subscribe to our free daily newsletter, Top Pros' Top Picks, and be among the first wave of investors to see our best stock ideas for the new year.

Brinker Remains Steady Eddy Worth Owning

Shares of casual restaurant operator Brinker International are beating to their own drum lately as the stock continues to move steadily higher, a sign that institutional investors are still adding to their holdings of the stock.

The stock broke out of a nearly textbook cup-and-handle formation in November of 2020 and continues to find buyers near its 20-day moving average on every dip to the area. This is a bullish trading pattern for sure and it looks as if barring a major market event, the stock should continue to move steadily higher.

Brinker (EAT) was in deep trouble just 10 months ago as the COVID-19 pandemic threatened to put restaurants out of business. But the company managed to hold itself together by pivoting to drive-through service and improving its offerings while remaining competitive in its pricing. Moreover, by forming a delivery-only wings restaurant (It’s Only Wings) and partnering with DoorDash, it added to its offerings in a rapidly growing segment of the restaurant sector.

Perhaps the biggest sign of relative strength is the fact that the company stopped giving forward guidance for the fiscal year due to COVID-19, but the stock has continued to move higher. At the moment both Accumulation Distribution (ADI) and On-Balance Volume (OBV) are positive confirming the uptrend.

I own shares in EAT as of this writing.

Market Breadth Starts Year with a Roar

The New York Stock Exchange Advance Decline line (NYAD) broke out to impressive new highs to start the year, although the upward trajectory of the line is not likely sustainable for too long, a least in the short term.

The Nasdaq 100 is within striking distance of a new high as well with the internal action of the index looking better than the index itself. It is often bullish to see breadth outperform the index. Nevertheless, it’s important to point out the following:

- RSI for NYAD is struggling to get above 70. In this case, this suggests a loss of momentum

- ROC is also quite muted during the current advance, again suggesting upward momentum is weak, and

- NYAD itself has rocketed above the upper Bollinger Band, which usually precedes a rolling over, or a consolidation is near

- None of this necessarily means that a market crash is near. It merely points out that the market’s advance may slow in the short term, although a crash is certainly plausible

Indeed, as I noted last week, we should also remember that when RSI falls below 50 and NYAD breaks below its 50-day moving average it is a Duarte 50-50 sell signal. Not all of these signals lead to major declines, but the major declines of the past four years have all started with Duarte 50-50 sell signals.

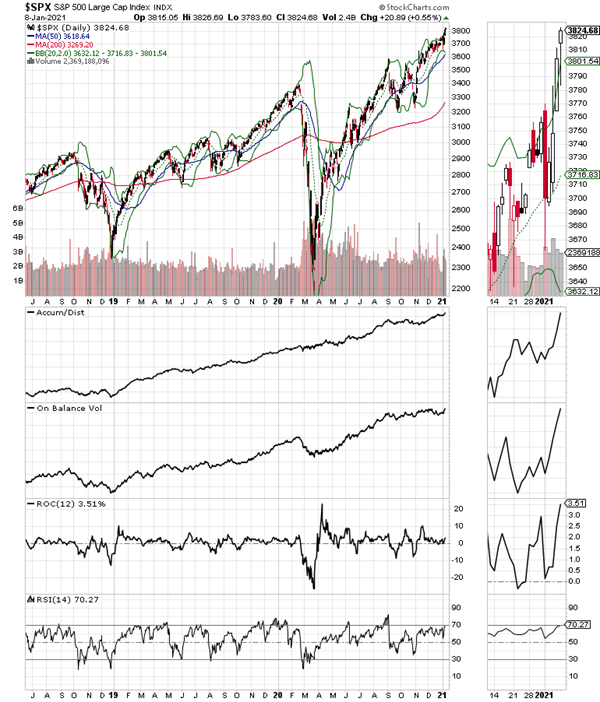

The S&P 500 (SPX) also delivered a new high confirming the high in NYAD on the back of strong On-Balance Volume (OBV) and Accumulation Distribution (ADI) indicators. The flip side is that just as we saw on NYAD, SPX is now trading above its upper Bollinger Band, suggesting that the short-term uptrend is likely to slow.

The Nasdaq 100 (NDX) also confirmed the new on NYAD. Interestingly, compared to NYAD, NDX had very good momentum as there were major moves registered in the blue-chip tech stocks.

It’s Likely to be Another Spectacular Year

With stocks, bond yields, and the US Dollar all rising simultaneously, 2021 is off to what is already a spectacular start. Of course, things could change in a millisecond, but all we have so far is what we’ve seen.

So focusing on what we know that is fairly certain: as long as the Fed remains accommodative, the odds favor higher stock prices albeit most likely in fits and starts and with the potential for some scary pullbacks along the way.

Still, it will pay to stay in tune with the action in the bond market as a major rise in yields could create a great deal of uncertainty.

To learn more about Joe Duarte, please visit JoeDuarteintheMoneyOptions.com.