Friday’s rally had the feel of a big tradeable bottom having formed after a multi-week spell of capitulation selling, says Joe Duarte of In the Money Options.

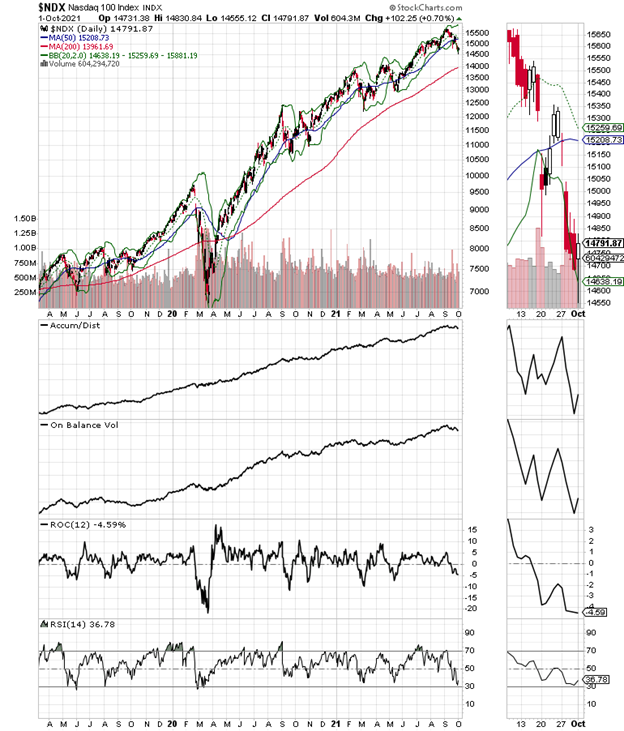

Specifically, both the Nasdaq 100 (NDX) and the S&P 500 (SPX) bounced off of oversold readings. But, at this point all we can do is wait.

Sure enough, the bottom was falling out of the stock market until the news hit, at week’s end, that Merck’s (MRK) new antiviral, Molnupiravir, aimed at COVID works well enough to likely reduce hospitalizations and deaths significantly when taken early enough in the disease process. Thus, if the initial assessment of the drug, and the critical trial results are verifiable, there is a new flu pill in town. And if you want more good news, it looks as if Pfizer (PFE) and Roche (RHHBY) are close to delivering their own COVID pills, which means that there could be a potential cocktail to deal with new mutant strains.

So, while the news is potentially a major positive development for real life, we’ll have to see whether what could be great news for patients and the global population can hold the stock market up as the Fed winds up its QE taper.

Bonds and Options Liked the COVID Pill News

When stock traders talk about bonds it’s often a sign of trouble in the markets. And last week’s bond selloff and recovery is a perfect example. But when the usual sourpuss bunch, which makes up the bond universe, whose poster child is Ebenezer Scrooge seemed to like the news that there may be a potential non-vaccine treatment for COVID, we’ve got to take notice.

Last week, I noted that mutual fund cash levels and fund manager behavior—the search for higher bonuses—could drive stock prices higher. Unfortunately, unlike earlier in 2021 when rising bond yields fueled a significant stock rally, this time around the bond market had other ideas. And the difference may be the ongoing talk of QE tapering from the Fed combined with what could be long-standing inflationary pressures and an increasingly dysfunctional US government.

Indeed the US Ten-Year Note yield (TNX) has risen dramatically lately, topping out near 1.55% before retreating to end the week of 10/1/21 below its 50-day moving average. And not by accident so have key economic statistics retreated. For example, mortgage applications have slowed, PMI data is rolling over, and consumer confidence has steadily eroded. In other words, lower bond yields make sense when the economy is showing signs of slowing.

So, under normal circumstances what the bond rally adds up to is the fact that the MELA system composed of the Markets (M), the Economy (E), people’s life and financial decisions (L), and the Algos (A), are as expected, reacting rapidly to the changing dynamic created by the Fed’s QE tapering announcement. And that means that bonds could now be betting on a significant slowing.

Certainly, things could change on a dime. After all there are algos involved, which means that any hint of good news will reverse what could be an emerging long-term downtrend for MELA. And if the new COVID pill does pan out, things could get very interesting.

Moreover, as I describe below, the action in the options market shows a significant shift from bearish put option dominated activity toward a more positive mix of call option transactions.

Trading the Chart: Continental Resources Breaks Out

I recently recommended purchasing shares of Oklahoma shale giant Continental Resources (CLR) on its improving technicals and show of relative strength. But as time passes and winter approaches the stock could continue to improve on a situational basis.

Ryder – The Silent Supply Chain Partner with Huge Long-Term Potential

Ryder Systems (R) is one of those companies that often flies under the radar in the stock market. But that’s not a big deal, as their trucks and their footprint is everywhere in the real world of logistics. Indeed, its presence in trucking, supply chain management, and fleet management puts the company in a golden spot for the current business climate in which there may be some hope for a true respite in the COVID pandemic, but supply chain issues are still likely to remain in place for the foreseeable future.

Ryder makes money by supplying trucks, logistics, and trucking services to its customers. But aside from retail rentals—its most visible business segment—the company’s true cash cow is how it helps its big clients manage their trucking and supply chain issues via multiple divisions. Specifically, Ryder, via its outsourcing programs, provides truck leases, repair services, and shipment and delivery management services, which combined let their customers manage their supply chains and deliver products to their own clients. Moreover, Ryder is also a big player in used truck sales, a side of the business, which also helps its cash flow.

Thus, in a time when supply chains are tight and labor is difficult to manage, Ryder takes the pressure off companies by providing a convenient outsourcing solution to the entire supply chain and shipping spectrum. But perhaps the best aspect of the company’s current stance is that they have pricing power, a fact that helped the company survive the COVID slowdown and put it in a good place to grow as the economy bounced back. Moreover, as demand for trucking services has increased, especially in the face of tight supplies, port logjams, and truck shortages, Ryder is in an excellent position to increase its profits via rising volume in leases and the ability to resell lease returned trucks.

Technically, the stock is on the verge of what could be a long-term breakout with the $87 area being a key price resistance point. And with earnings due on 10/27/21, and the company’s positive guidance on its last quarter’s earnings call, a short-term move in expectations of an earnings beat would not be extraordinary. There is good support above the $80 price area and dips that hold at $80 can be used to add to the position.

I own shares in R as of this writing.

SPY Options Turn Bullish

Prior to Friday’s COVID bombshell from MRK, as I described above, the SPY options were hugely bearish. Thus, when the good news hit, the bears had to cover their shorts and turn bullish. As a result, put buyers that were just below the active strike price for SPY options reversed course and the result was that call-buying increased, leading to dealer hedging in the form of buying stocks and stock index futures

Now, we’ll have to see if this new bullish climate lasts.

Market Breadth: Yet Another Near Miss for NYAD. Indices Oversold.

It could have been worse for sure. But the New York Stock Exchange Advance-Decline line (NYAD), the most accurate indicator of the stock market’s trend since 2016 was all over the place last week. But by the time it was all said and done it again failed to close decisively above its 50-day moving average while the RSI indicator for NYAD remained below 50. Thus, technically speaking, we are in sell-signal territory

Still, it was good to see the market’s breadth improve. Moreover, now we will see if it can last.

In addition, the S&P 500 also closed the week below its 20- and 50-day moving averages while also bouncing off an oversold level on RSI.

Meanwhile the S&P Small-Cap 600 index (SML) remained in a trading range showing some relative strength.

To learn more about Joe Duarte, please visit JoeDuarteintheMoneyOptions.com.