One of our key covered call writing exit strategies is rolling an option when the strike is in-the-money at expiration and we want to retain our shares, explains Alan Ellman of The Blue Collar Investor.

We can roll out to the same strike at a later date or out-and-up to a higher strike at a later date. For both, there will be an intrinsic-value cost-to-close. When we roll out-and-up, we will benefit from share value being worth more than prior to closing the original short call. In our BCI methodology, this gain is referred to as bought-up value. This article will detail all the explanatory calculations.

Hypothetical trade

- 5/24/2021: Buy 100 x BCI at $48.00.

- 5/24/2021: STO (sell-to-open) 6/18/2021 $50.00 call at $1.50.

- 6/18/2021: BCI is trading at $52.00 as expiration approaches.

- 6/18/2021: BTC (buy-to-close) the 6/18/2021 $50.00 call at $2.10 ($2.00 intrinsic-value + $0.10 time-value).

- 6/18/2021: STO the 7/16/2021 $55.00 call at $1.00 (rolling-out-and-up).

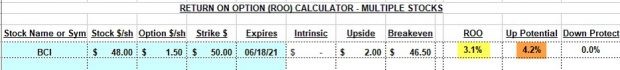

Initial trade structuring (multiple tab of the Ellman Calculator)

BCI: Initial Calculations

The initial time-value return is 3.1% (yellow cell) with the possibility of an additional 4.2% of upside potential (brown cell) if BCI moves up to or above the $50.00 strike by expiration. As long as the contract obligation to sell at $50.00 is in place, our shares cannot be worth more than $50.00. This is how the trade is structured.

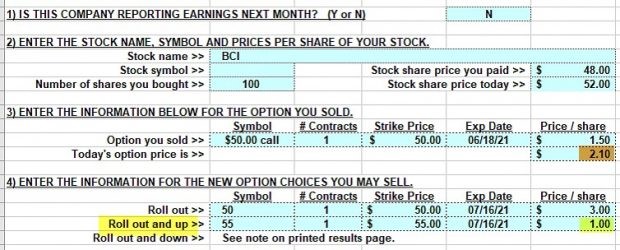

Rolling-out-and-up: information into the “What Now” tab of the BCI Calculators

Rolling-Out-And-Up Data Entries

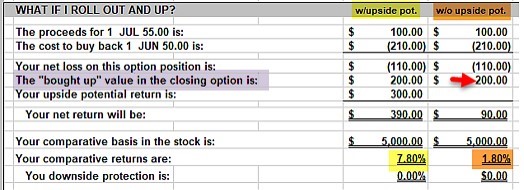

Rolling-out-and-up: final calculations from the “What Now” tab of the Ellman Calculators

BCI: Rolling-Out-And-Up Final Calculations

The bought-up value is $2.00 per share or $200.00 per-contract. This is because shares can only be worth $50.00 with the original short call in place, but once the short call is closed, shares are worth market value of $52.00. This bought-up value must be incorporated into our calculations since we paid for it in the form of intrinsic-value cost-to-close.

The final calculations show an initial time value + bought-up value combined return of 1.8% (brown cell). If share price moves up to the new out-of-the-money $55.00 strike by expiration (an additional $3.00 per-share), the total one-month return will be 7.80% (Yellow cell).

Discussion

When rolling an ITM strike out-and-up, there will be an intrinsic-value cost-to-close. There will also be an unrealized increase in share value by that intrinsic value amount. In the BCI methodology, this is known as bought-up value and must be incorporated into our rolling calculations.

Learn more about Alan Ellman on the Blue Collar Investor Website.