As the Fed continues to posture future rate increases to battle inflation, recent economic data shows Consumers are in a state of shock as price factors continue to skyrocket, states Chris Vermeulen of The Technical Traders.

Food, gas, materials, etc have shot up in price over the past 24 months—with no end in sight.

Consumers Are Recoiling Away From Traditional Spending Habits

The natural reactions of consumers fall into two categories: grow or survive.

This is similar to how plants and trees operate. In healthy environments, plants and trees enter a growth phase—flowering and prospering.

In an unhealthy environment, plants and trees enter a survival phase—directing resources toward anything essential for survival.

Global inflation is putting pressure on central banks to thwart excesses in the markets after over eight years of easy money policies and nearly two-plus years of Covid stimulus. Consumers thus seemed to have switched into Survival mode very quickly over the last six or more months. This reaction could have very telling outcomes for global GDP and regional economies over the next 24+ months.

In August 2021, we published an article highlighting the shift in consumer activity. It brings attention to how important Consumers are to the overall health of the global economy.

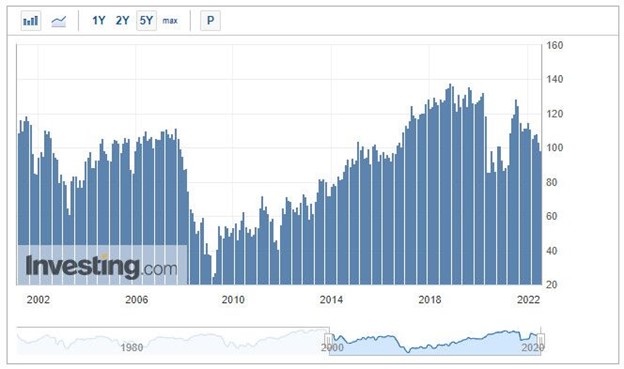

Consumer Confidence Dips Below 100

After the 2008-09 GFC, Consumer Confidence took more than five years to rally back above the 100 level (in 2015). The 2015-16 range was a US Presidential election cycle, which usually disrupts US economic activities a bit.

In early 2017, Consumer Confidence started to rally higher—eventually reaching a peak in October 2018 near 137.90. Historically, the only other time Consumer Confidence reached higher levels was in 1998-99 (Dot Com Peak).

(Source: Investing.com)

IYC May Start a Wave-Five Downtrend—Targeting $45-47 as a Base

Traders should consider the broader scope of the market trends while attempting to understand the opportunities that will come by waiting out the risks of trying to buy into a falling market. The Fed has clearly stated they intend to continue raising rates to break the inflationary cycle. Consumers will reflect these new risks by moving further away from traditional spending habits (Survival Mode) while attempting to wait out the risks to the environment.

It appears the Consumer Discretionary ETF (IYC) has formed a moderate Wave-Four peak, which is below the Wave-One bottom. From a technical perspective, it appears IYC will attempt to move below the $47 level over the next few weeks—attempting to establish a new base/bottom.

US Real Estate Showing Signs of a Top

No matter how you slice the data, more homes are flooding the US markets right now. Sellers are trying to “cash-out” at sky-high prices. Yet, buyers are staying very cautious because of rising interest rates and borrowing costs. Price Reductions on listed homes have risen to the highest levels over the past eight-plus years. Sellers with homes on the market longer are aiming to tempt buyers with a discount. The race to the bottom has started. The Fed will add more fuel to the declines with another rate increase.

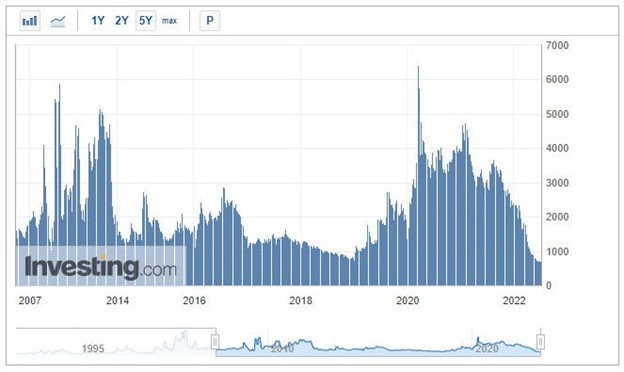

Recent Mortgage Refinance Index data shows the current 726.1 print is the lowest level since July 2000. This means the purchase and refinance are the most unfavorable for buyers over the past 22+ years (not since the peak of the Dot Com bubble).

(Source: Investing.com)

A reversion of home prices is almost a certainty at this point. I suspect a surge of new foreclosures and slowing sales will compound with layoffs and other economic contraction trends to present a “perfect storm” type of reversion event.

IYR Targeting $70 to $75 as Assets Unwind

iShares Real Estate ETF (IYR) is likely to continue trending lower, targeting $70 to $75, before finding any real support. The reversion of asset valuation levels is still very early in the process of the Fed attempting to battle inflation. Depending on how the global markets react to the overall economic environmental change, we could see an extended contraction in assets lasting well into 2023—possibly into 2024.

Traders should stay cautious of trying to chase the falling market trends. The real opportunity for profits exits when the reversion event is complete and when opportunities for less volatile extended trends resume.

Protective Patience May Be the Best Trader/Investor Attitude Right Now

The US markets are already down by more than -25% overall. Any extended decline from current levels could push many traders/investors into a crisis. When the bottom sets up and is confirmed, we’ll begin to allocate capital back into sector trends. In the meantime, we avoid this massive drawdown event by waiting on the sidelines and being ready to deploy capital.

My strategies pulled capital out of the markets very early in 2022. Since then we have been sitting in cash as a protective market stance while the global markets continued to decline. Protecting capital is the first rule for any trader/investor. Learning when to trade and when to be patient should be rule number two.

As Consumer Confidence continues to decline, Consumers have moved into a protective/patient (survival) mode. Traders and Investors should consider the longer-term risks of not adopting a similar stance right now.

What Strategies Can Help You Navigate the Current Market Trends?

Learn how we use specific tools to help us understand price cycles, set-ups, and price target levels in various sectors. Also, learn how we identify strategic entry and exit points for trades. Over the next 12 to 24+ months, we expect very large price swings in the US stock market. The markets have begun to transition away from the continued central bank support rally phase. A revaluation phase has started as global traders attempt to identify the next big trends. Precious Metals may start to act as a proper hedge as caution and concern begin to drive traders/investors into safe havens.

Historically, bonds have served as one of these safe havens. This is not proving to be the case this time around. So if bonds are off the table, what bond alternatives are there? How can they be deployed in a bond replacement strategy?