Over the years, the most frequently used ETF in my portfolios has been Invesco QQQ Trust (QQQ), says Alan Ellman of The Blue Collar Investor.

Premium members have noticed that, lately, a relatively new eligible security in our Premium Members ETF Reports has been QQQM (Invesco Nasdaq 100 ETF). Both are based on the Nasdaq 100 Index (NDX). This article will highlight the similarities and differences between these two securities and offer guidance as to which is best suited for our option-selling portfolios.

What is QQQ?

QQQ is an exchange-traded fund based on the Nasdaq-100 Index. The Fund will, under most circumstances, consist of all of the stocks in the Index. The Index includes 100 of the largest domestic and international nonfinancial companies listed on the Nasdaq Stock Market based on market capitalization. The Fund and the Index are rebalanced quarterly and reconstituted annually.

What is QQQM?

The Invesco NASDAQ 100 ETF (QQQM) is an ETF based on the NASDAQ-100 Index. The Fund will invest at least 90% of its total assets in the securities that comprise the Index. The Index includes securities of 100 of the largest domestic and international nonfinancial companies listed on Nasdaq. The Fund and Index are rebalanced quarterly and reconstituted annually.

What Are the Corresponding Expense Ratios (Fees Inherent in the Securities)?

- QQQ: 0.20%

- QQQM: 0.15%

Option Expirations

- QQQ: Has Weeklys and LEAPS

- QQQM: No Weeklys or LEAPS

Similarities

Same underlying

- Same price performance

- Same implied volatility

- Risk

- Returns

QQQ Advantages

- More liquid

- Tighter spreads

- More expiration choices (three per week)

QQQM Advantages

- Lower expense ratio

- Less than half the price

Type of Investor

Trader: Favor QQQ:

- Large asset base

- Highly liquid

- Narrow spreads

Long-term, buy-and-hold: Favor QQQM

Save 0.05% in administrative costs

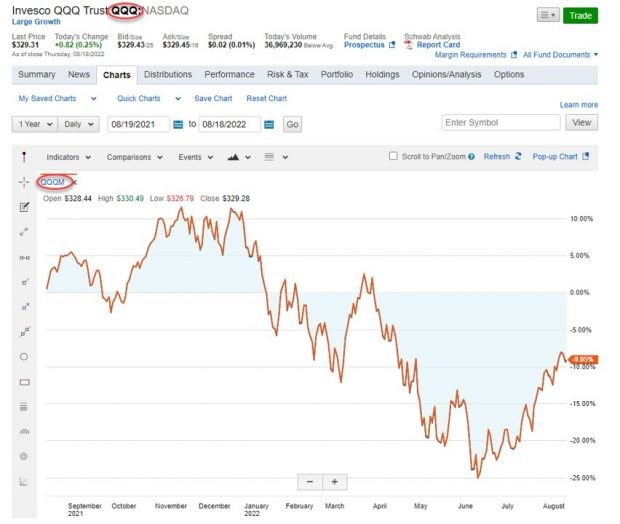

Price Performance Comparison Chart

Yes, there are two lines in this chart—no difference.

QQQ & QQQM One-Year Comparison Chart

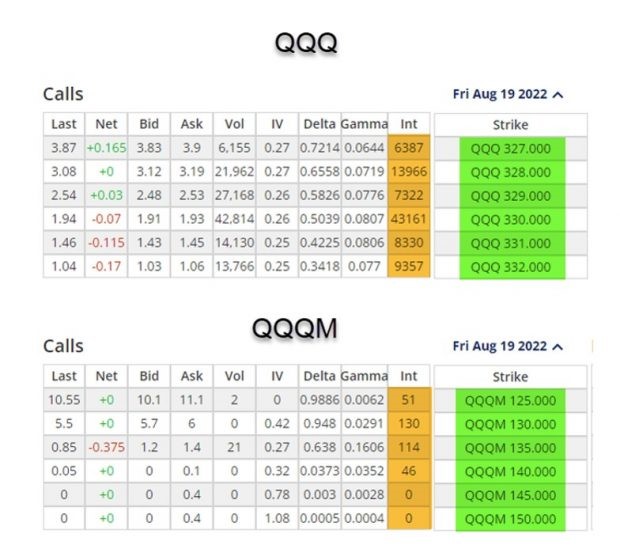

Implied Volatility Comparison (No Difference)

QQQ and QQQM Implied Volatility Comparison

Option Liquidity and Strike Choices (Advantage QQQ)

QQQ: Greater Liquidity and More Strike Choices Than QQQM

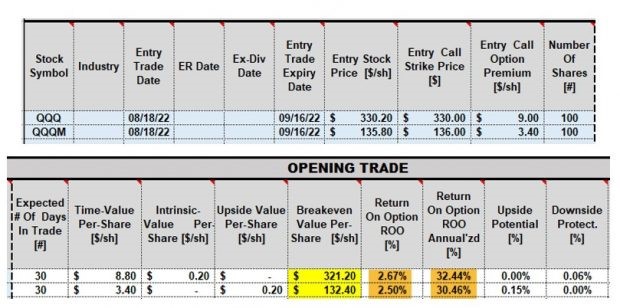

Return on Option (ROO)—No Significant Difference

QQQ and QQQM Initial Calculations

The BCI Trade Management Calculator shows a slight difference in the initial calculations (brown cells). This was due to one strike being slightly in-the-money: the other slightly out-of-the-money. Overall, there is no difference in expected returns.

Discussion

For short-term option-selling, an edge goes to QQQ because of its liquidity advantage and abundance of expiration choices. If capital is limited, QQQM may be a more practical selection. For long-term investing, a very slight edge to QQQM because of its lower expense ratio.

Learn more about Alan Ellman on the Blue Collar Investor Website.