Now that September is behind us, it’s time to get constructive on stocks. September is known to be ugly, and 2022 didn’t disappoint with a gruesome -9.2% return for the S&P 500 (SPX), states Lucas Downey of Mapsignals.com.

That’s the bad news.

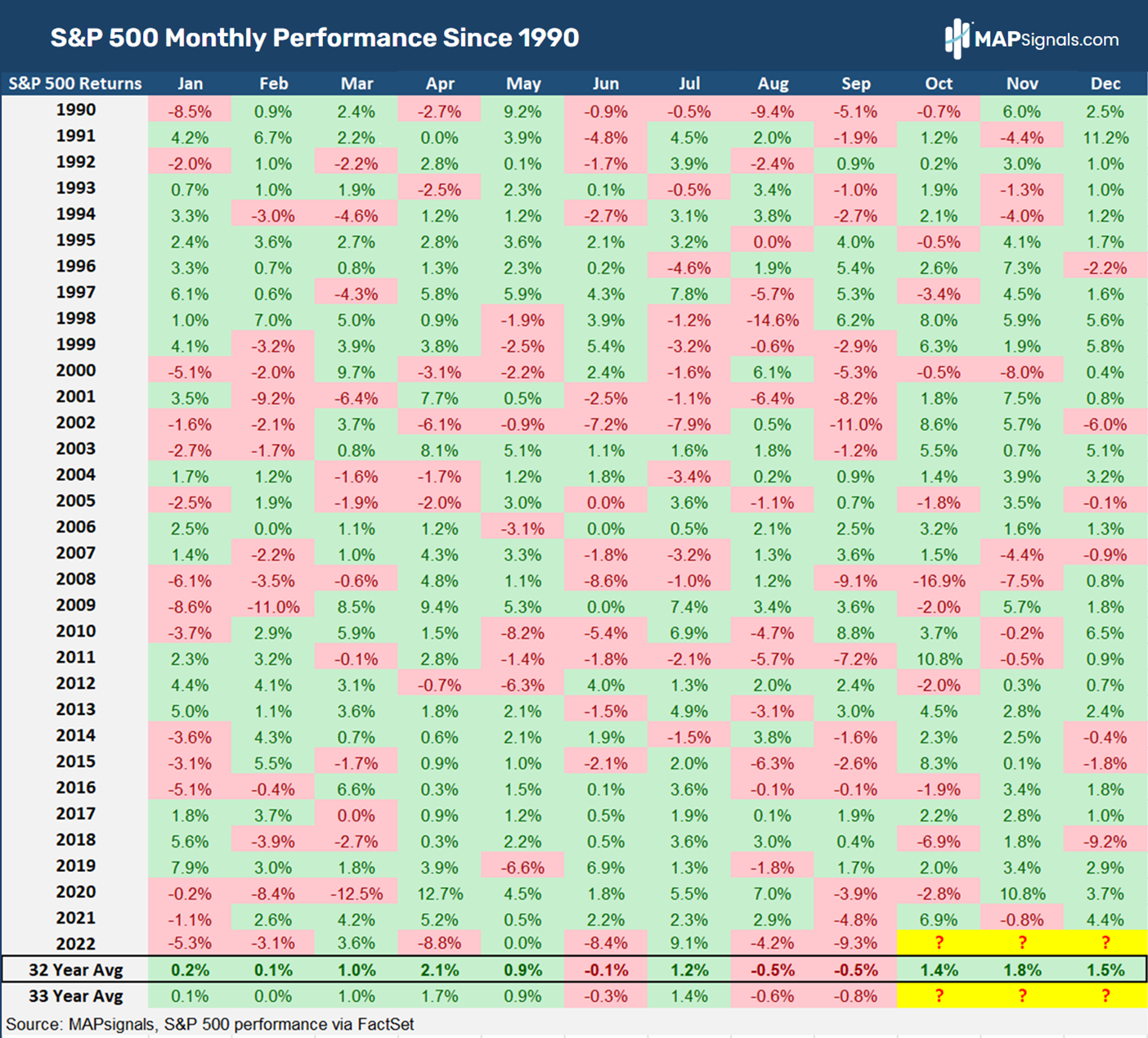

The good news is stocks tend to find firmer footing in the fourth quarter, beginning in October. Below lists the monthly returns for the S&P 500 going back to 1990. Notice how October, November, and December are very green months on average:

October averages a gain of 1.4%, followed by 1.8% for November and 1.5% in December. Not bad! And keep in mind those green shoots follow a seasonally negative time of year: August and September. Those months tend to fall .6% and .8% respectively.

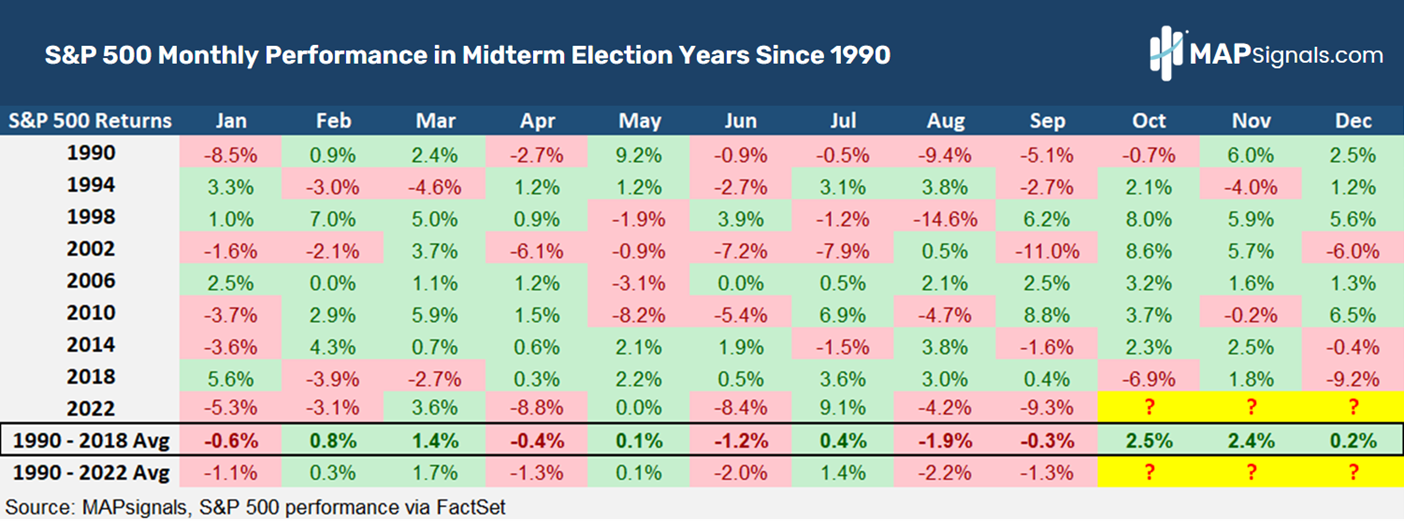

But get this, in midterm election years, the fourth-quarter gains are even more impressive. Below you’ll see what I mean. Going back to 1990, October and November soar 2.5% and 2.4% respectively:

No question, we are entering the bullish season for stocks. This knowledge alone should have bears on their toes, in the near term.

But this isn’t all there is to be excited about. At MAPsignals, we follow Big Institutional money flows. Big, unusual volumes in stocks can tip us off to positioning.

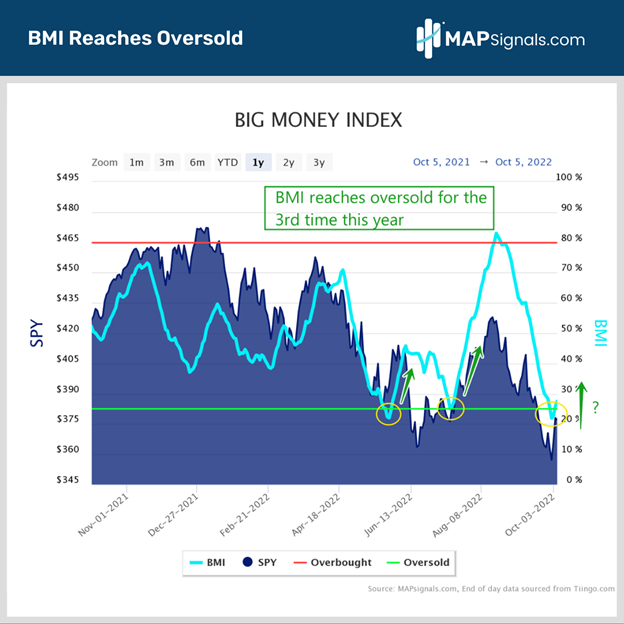

Just last week we saw some of the most extreme oversold readings all year. By our count, investors were dumping stocks hand over fist. And our Big Money Index briefly dipped into oversold territory as of Friday’s close.

Since then, the pendulum has been swinging upwards:

I circled what’s important: Each of the two oversold readings earlier this year prefaced a big near-term rally. And since September 30, this latest oversold trigger hit just before the S&P 500 ran up 5.5%. I wouldn’t be surprised if there’s more in the tank in the weeks to come.

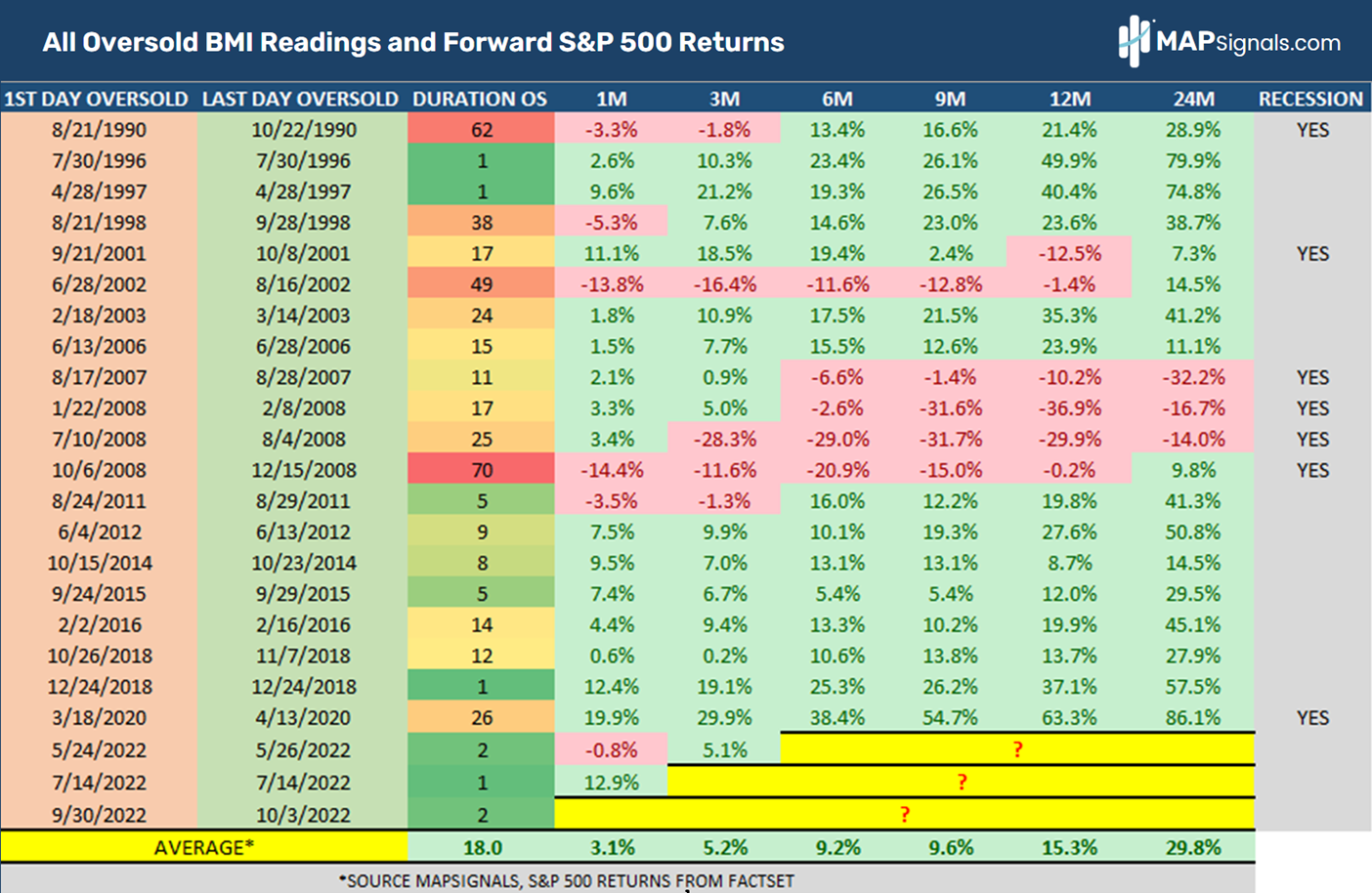

This latest dip into oversold territory marks the 23rd instance since 1990. It’s incredibly rare…but also, a great time to buy stocks. Below you’ll see all instances and the forward S&P 500 returns post the first day in the green zone:

The average gain for stocks 12 months after reaching oversold is a stunning +15.3%. The 24-month average return sits at 29.8%. If you ask me, that’s worth getting excited about.

Considering we’re entering a seasonally strong midterm election year, the bullish season for stock projection has even more credence.

Let’s wrap up.

Here’s the Bottom Line

As we enter the fourth quarter, history points to greener pastures for stocks. In midterm election years, October and November gain 2.5% and 2.4% respectively.

Add to it that we recently triggered an oversold Big Money Index, and we could be looking at more gains in the coming months. The last two oversold readings hit just before a near-term pop in the market.

Keep in mind, this isn’t an all-clear signal. However, the odds are certainly stacking up for improving sentiment and portfolio prices.

The bullish season for stocks is here.

To learn more about Lucas Downey, visit Mapsignals.com.