Welcome to the Two to 100 Club. What we do here is identify the strongest growth stocks as they climb the market-cap ladder from small- to mid- to large- and, ultimately, to mega-cap status, states JC Parets of AllStarCharts.com.

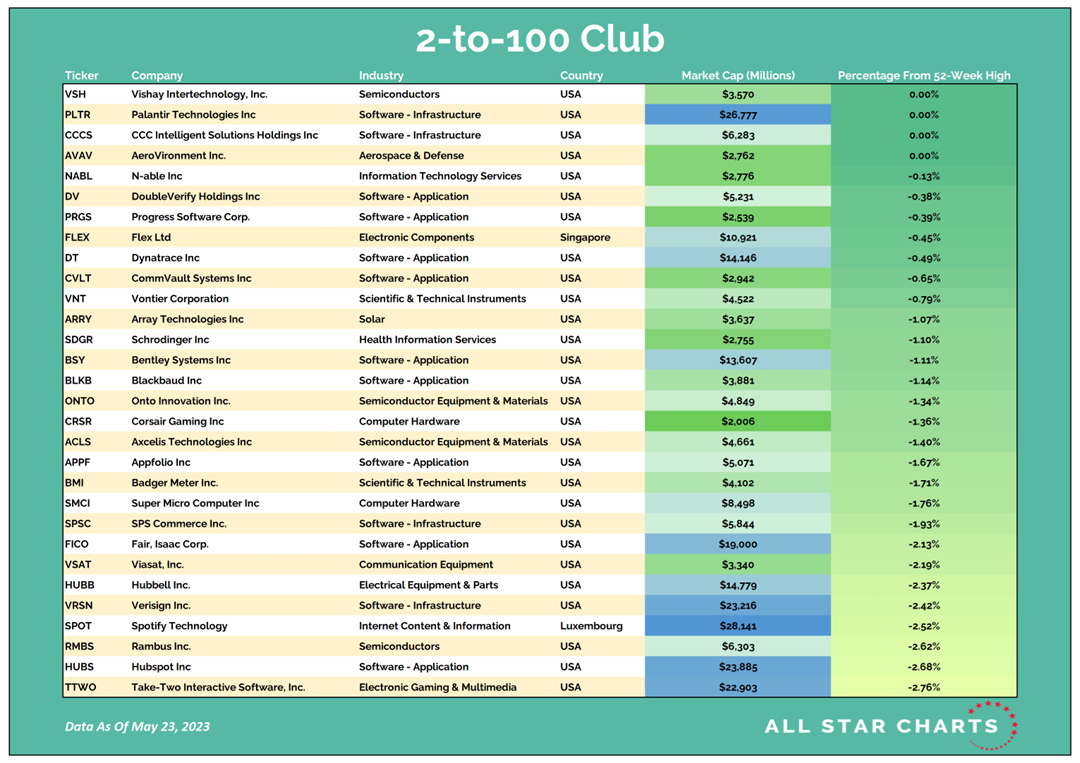

We only want to look at the strongest growth industries in the market, as that is typically where these potential 50-baggers come from. When you look at the stocks in our table, you’ll notice we’re only focused on technology and growth industry groups such as software, semiconductors, online retail, solar, etc. Then, like any good technician, we filter the list down to those closest to new highs. This allows the cream of these strong groups to rise to the top and helps streamline our mission to identify technical breakouts in the top-performing stocks. And we’re sorting by 52-week highs.

Here is this week’s list:

While stocks hitting $1 Trillion in market cap are getting all the attention, there are exponentially more opportunities in stocks scaling from the tiny $2-30 Billion bucket to $100 Billion and beyond. Even towards the higher end of that $2-30B range, a stock can still at least triple before reaching $100B. One stock in particular that's setting up manufactures and sells ground-mounting tracking systems for solar energy projects.

Here's Array Technologies (ARRY):

Array Technologies is threatening to break higher from a 24-month bearish-to-bullish reversal formation as the stock is coiled tightly at its pivot highs. The current level has acted as resistance several times since late last year, making it a great place to define our risk. We’re looking for strong follow-through this week to confirm the base breakout. On a relative basis, ARRY is working its way higher from a similar rounding bottom reversal pattern versus the broader market. If we’re above 24, we want to own ARRY with a target of 36 over the coming 2-4 months. If it's below 24, leave it alone!

To learn more about JC Parets, please visit AllStarCharts.com.