Did you see Applied Industrial Technologies, Inc. (AIT) tearing higher? This is a red hot alert for me and it creates a setup that offers a potentially lucrative opportunity, states Chuck Hughes of Hughes Optioneering.

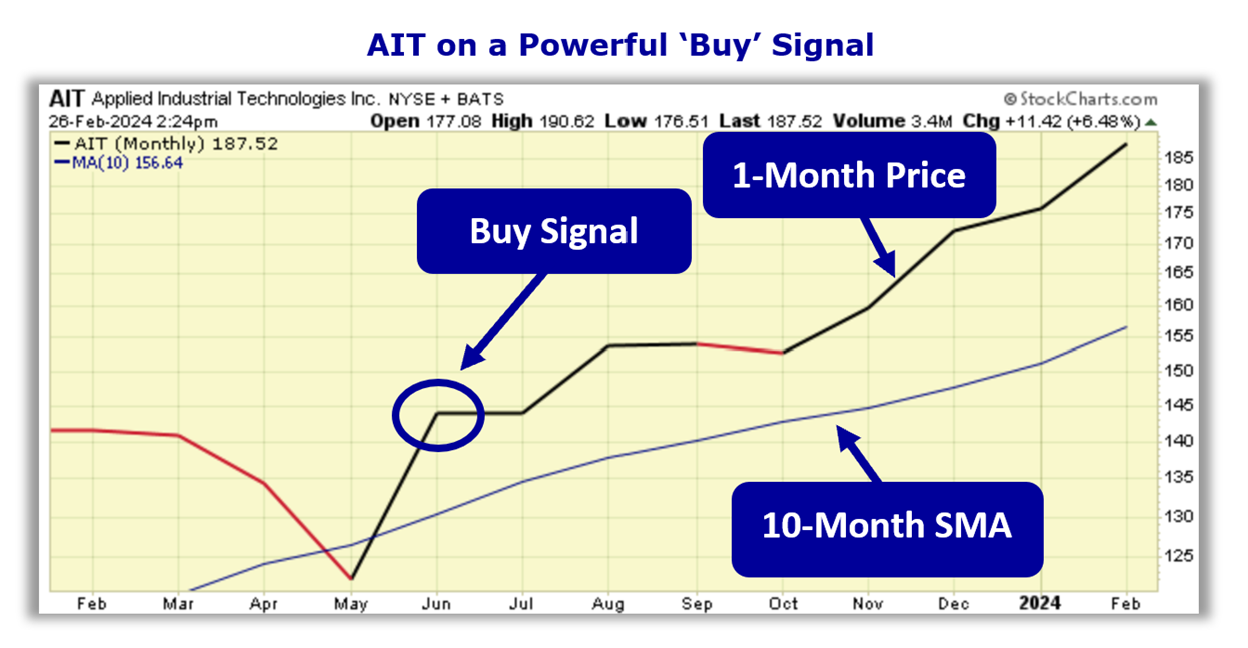

Applied Industrial Technologies, Inc. engages in the manufacture and distribution of industrial parts and products. It operates through the Service Center Based Distribution, and Fluid Power & Flow Control Business segments. Now, take a look at the chart below.

Time to Buy?

As the chart shows, in June, the AIT one-month price, crossed above the ten-month simple moving average (SMA). This created a PowerTrend 'Buy' Signal for AIT. Now, as you can see, the one-month price is still above the ten-month SMA. That means the bullish trend is still in play!

Boosting Potential Profit

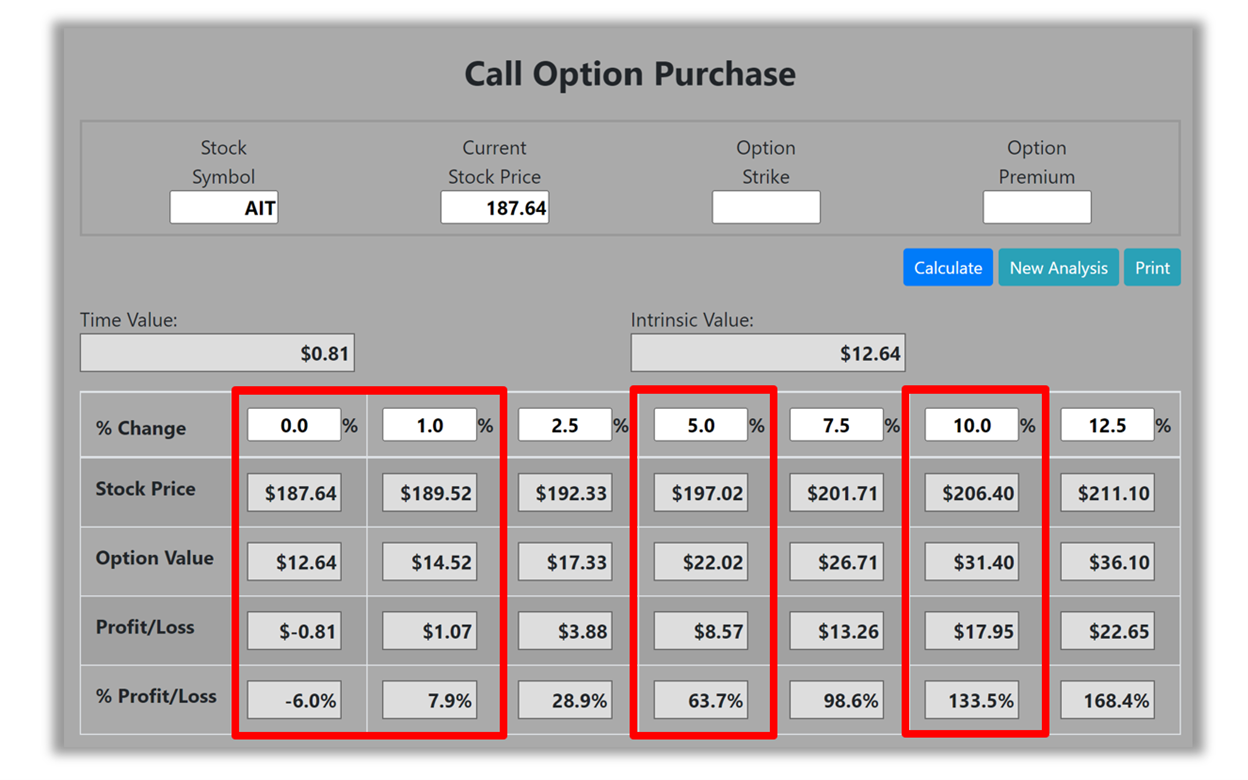

Since AIT is on a ‘Buy’ Signal, let’s use the Hughes Optioneering calculator to look at the potential returns for an AIT call option purchase. For this specific call option, the calculator analysis below reveals if AIT stock increases 5.0% at option expiration to 197.02 (circled), the call option will make 63.7% before the commission. If AIT stock increases 10.0% at option expiration to 206.40 (circled), the call option would make 133.5% before the commission and outperform the stock return by more than 13 to one. The prices and returns below were calculated based on the current stock and option pricing for AIT on 2/26/2024 before commissions.