The trade relationship with China is the one thing that the markets had considered a primary risk for triggering a recession. The 90-day pause isn’t necessarily a long-term solution. But in terms of purely a financial market reaction, it could be the catalyst for a short-term run for risk assets, and one of my risk-on signals triggered, advises Michael Gayed, editor of The Lead-Lag Report.

The reaction has been classic risk-on: Stocks, especially small-caps, and the dollar rallying, while long-term Treasuries and gold move lower. I don’t believe this takes recession risk off the table altogether though. A 30% tariff is still enough to stifle demand – and we’ve already seen weakening in demand and factory output up to this.

That said, this will mitigate some of the risk in the near term and may take some pressure off of the Federal Reserve. If Chairman Jay Powell deems inflation to be less of a risk today when compared to a slowing economy, he may choose to pull the rate cut calendar forward in order to alleviate some of the pressure.

As for trading the news, here are details on my latest signal:

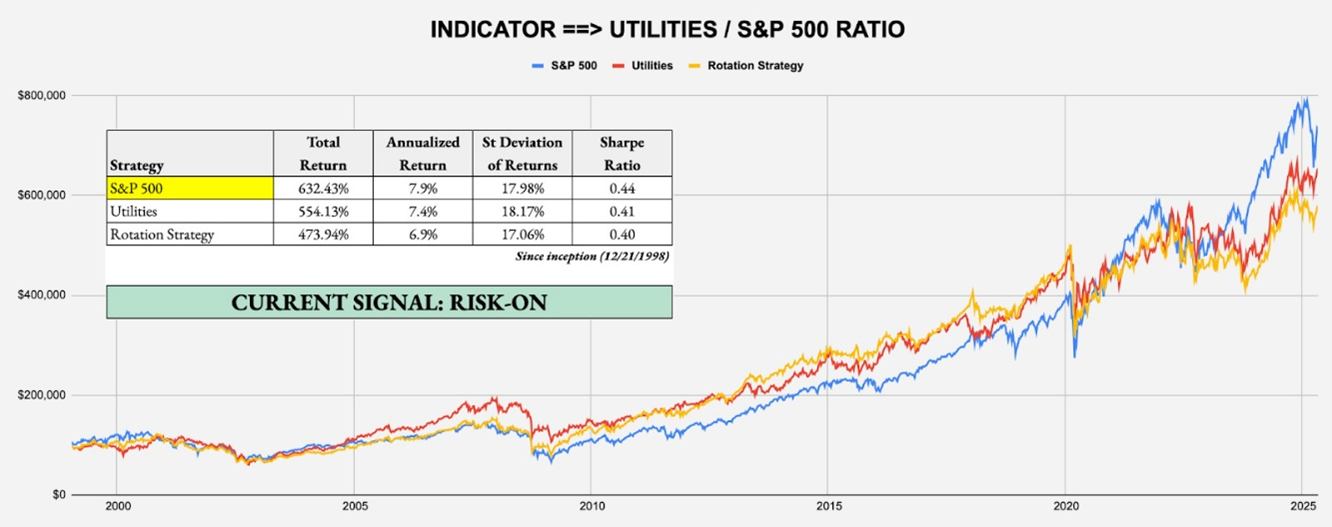

SHORT-TERM SIGNAL: UTILITIES/S&P 500 RATIO

Target Investor: Short-term traders with a higher risk tolerance interested in using an equity momentum strategy to anticipate changes in market risk tolerance.

Current Indicator: Risk-On

Strategy: Beta Rotation - Example: Invest in the SPDR S&P 500 ETF (SPY) over the Utilities Select Sector SPDR ETF (XLU)

Within each of my strategies, there is a risk-on and risk-off investment recommendation, with the risk-off option being the more conservative of the two.

When a particular signal indicates that investors should be risk-off, for example, subscribers should consider investing in the risk-off option and avoiding the risk-on option. The opposite, therefore, would be true when the signal flips to risk-on. In each strategy, you’d always be invested in one option or the other.