The epic volatility in 2025 is a great reminder of the importance of diversification. Adding gold to your portfolio gives you a smoother ride. I recommend trading it using an under-the-radar bullion ETF, SPDR Gold MiniShares Trust (GLDM), writes Alec Young, contributor at MoneyFlows.

Even after a recent 10% correction, gold is still up over 20% year-to-date. It’s beating everything from Bitcoin to large-, mid-, and small-cap stocks, international equities, and bonds of all stripes. Gold’s big ramp reflects a combination of trade and economic uncertainty, dollar weakness, record central bank buying, and geopolitical risk.

Today, you should buy the dip. Gold can be streaky. It does best during periods of heightened inflationary, geopolitical, and policy uncertainty. Conversely, gold can underperform when the macroeconomic backdrop is more benign.

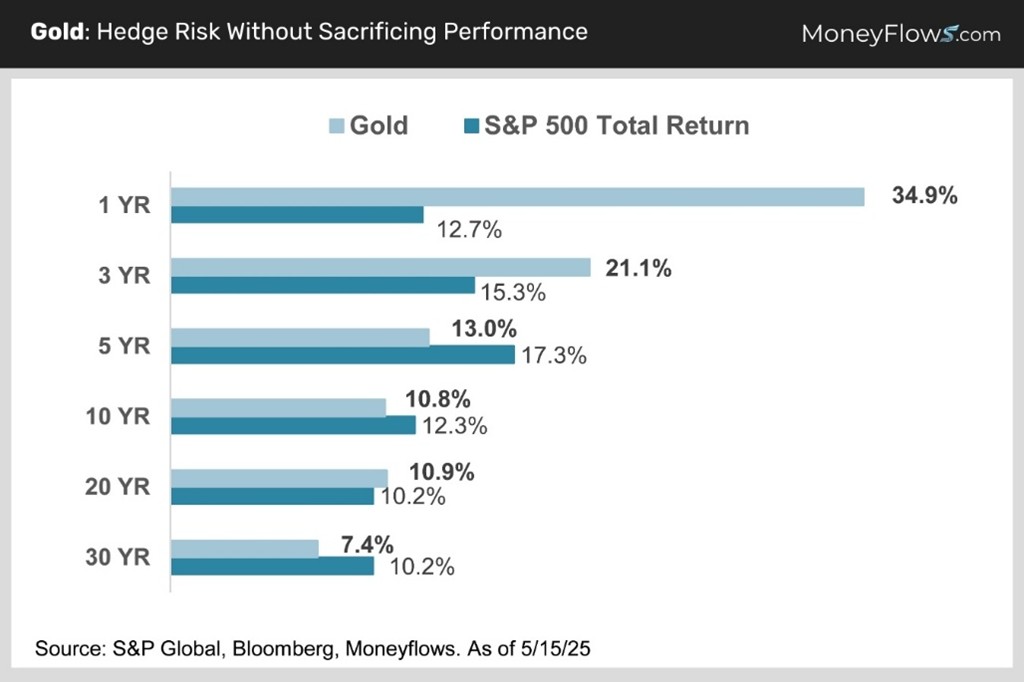

While short-term performance varies, over the long run, gold has crushed bonds and been very competitive with stocks. Specifically, over the last 20 years, gold has edged out the S&P 500:

The case for gold doesn’t stop at strong performance. The next best thing to strong returns is an investment that adds diversification to your overall portfolio.

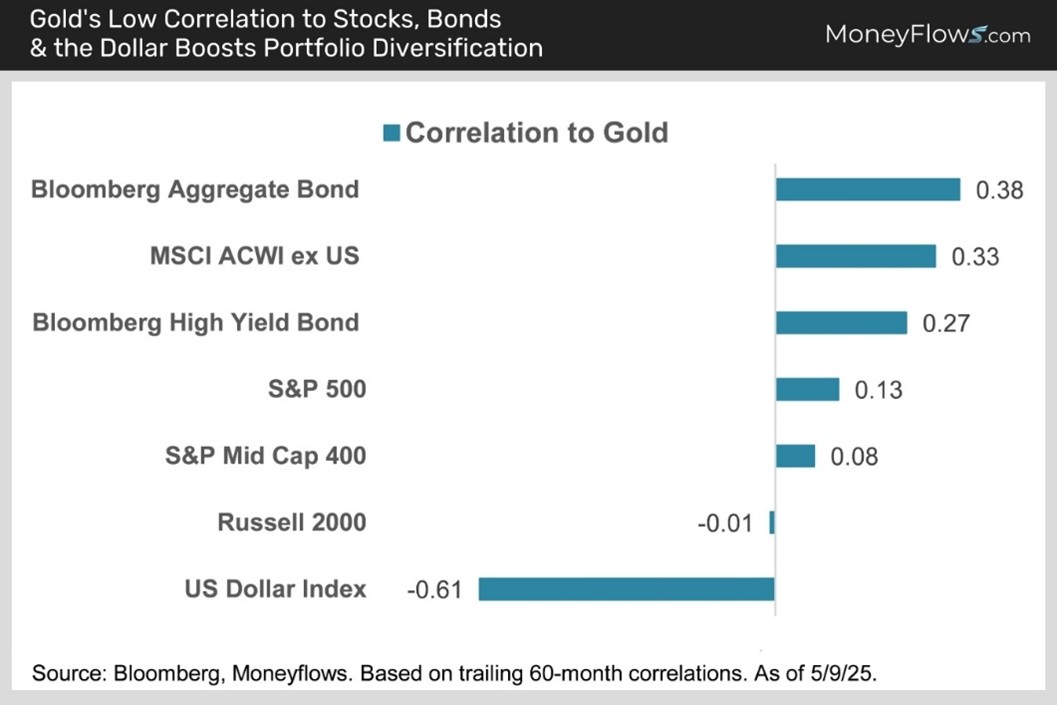

Gold has low correlations to everything from high-quality bonds to high-yield bonds, to large-, mid-, and small-cap stocks – and even dollar-denominated international equities. Best of all, gold is very negatively correlated to the dollar.

We’ve made a macro case for gold. Now, let’s tackle portfolio construction. Gold ETFs in tax deferred brokerage accounts are the way to go. But not all gold ETFs are created equal.

State Street launched the GLDM in 2020 to meet strong demand for a cheaper alternative. GLDM has all the great characteristics of the SPDR Gold Shares ETF (GLD), but with an expense ratio of only 0.1%.

Recommended Action: Buy GLDM.