Occasionally, we will close existing positions, even when we expect much higher prices in the longer term. This process is about managing the ebbs and flows of the market. But don’t worry about the future of tech stocks like Nvidia Corp. (NVDA), advises Joe Markman, editor at Digital Creators & Consumers.

Tech stocks traded sharply lower recently after a Wall Street Journal story implied that the $500 billion Stargate project, announced earlier this year, is proving to be more hype than reality. Sources told the WSJ that the actual project will begin as one smaller data center in Ohio.

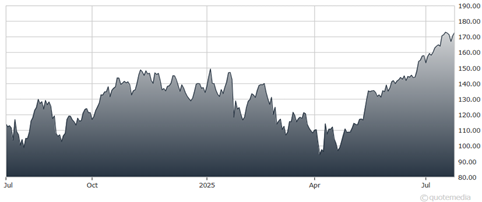

Nvidia Corp. (NVDA)

This story represents Artificial intelligence (AI) skeptics fighting back. However, they are still losing. The entire tech world is in the midst of a transformative change. AI is the most investable secular trend in a generation. Think of AI as the evolution of compute, built on the foundation of Internet, cloud, mobile, and edge networks. AI is what comes next, and it's only just getting started.

AI skeptics are quick to point to bubbles, like the 2000 internet era. Bearish investors blissfully compare the giant share price gains for Nvidia and Broadcom Inc. (AVGO) to 1999, when Cisco Systems Inc. (CSCO) shares were the hottest investment on the planet. In this grotesque conflation, we're supposed to believe that making routers and switches in 1999 is akin to the foundational gear now being snapped up by companies today.

The big problem with the bubble theory is that the non-believers are skipping over the actual bubble part of the 2000s. There was an actual Internet bubble back then, in software. The problem wasn’t that Cisco routers were in high demand and sales growth was off-the-charts. The issue was that investors, pumped up by Wall Street merchant bankers, were led to believe that fortunes were assured for any company with a dot.com extension.

But the current AI boom is in the early stages of the buildout phase. If the analogy to 2000 is legitimate, we are now in 1994, at least six years from the bubble.

The bottom line is that the AI story is full of skeptics and malcontents. Some investors, including a wide range of Wall Street analysts, have been bearish on Nvidia for a decade. Instead of getting on the right side of this secular trend and building huge wealth for clients, they are now vested in proving that AI must not be real.

They’re wrong.