The bullish tone of the market has continued relentlessly over the last couple of months, while volatility has become increasingly compressed. But the probability of some corrective action is increasing. The key is participation with discipline, observes Lance Roberts, editor of the Bull Bear Report.

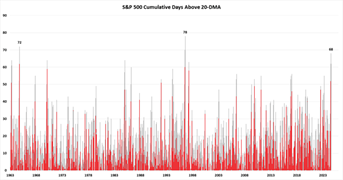

Historically speaking, the market has traded above the 20-DMA for a long stretch. This does not mean the market will crash, but a correction below the 20-DMA is becoming more likely.

Another reason we expect volatility to increase is that we are entering a seasonally weak period in the market, which corresponds with periods of increased volatility. This also explains why August and September are two of the weakest months of the year.

While all of this is historical data, none of it guarantees that the market will correct over the next two months. It only suggests that. As such, we recommend that risk management become increasingly important, a point we made in this past weekend’s update:

“The return of meme-stock euphoria is a stark reminder that complacency is again gripping markets. Whether it’s zero-day options, surging penny stocks, or speculative AI plays with no earnings, the current environment mirrors the excessive risk-taking seen in early 2021. Retail investors are chasing high-beta trades, while volatility remains suppressed and equity indices hover near all-time highs. This combination creates a seductive but dangerous backdrop for capital deployment.”