Everything was coming up roses on Wall Street and in Washington. Until Thursday morning at 8:30 am Eastern, that is. That’s when the Producer Price Index (PPI) inflation data dropped for the month of July.

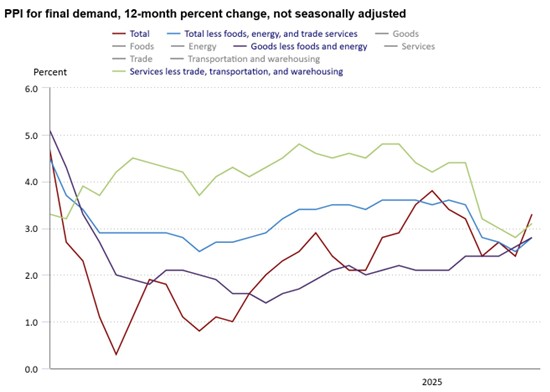

Unlike earlier RETAIL inflation figures, these WHOLESALE inflation numbers were downright ugly. The headline reading rose 0.9% month-over-month, more than 4X the increase economists were expecting. The year-over-year inflation rate surged to 3.3% from 2.4% in June, as you can see in the MoneyShow Chart of the Day here.

Source: Bureau of Labor Statistics

What about the “core” number that excludes food and energy? It also jumped 0.9%, pushing core PPI up to 3.7% YOY. Other measures like “services less trade, transportation, and warehousing” or “goods less food and energy” all moved higher.

What does it all mean?

First, Wall Street will pay even closer attention to what Federal Reserve Chairman Jay Powell says next week at the Fed’s annual gathering in Jackson Hole, Wyoming. He’ll have a chance to “frame” the interest rate debate ahead of the Fed’s Sept. 16/17 policy meeting.

Second, markets STILL think the most likely outcome at that meeting is a 25-basis point rate cut. That would lower the federal funds rate to a range of 4% - 4.25%.

Third, Wall Street would love nothing more than for another pair of cuts to follow in October AND December. Expectations for just such a scenario helped drive stocks higher earlier this week, including a HUGE two-day move in smaller-capitalization names.

But if this is the start of a series of reports suggesting greater pass-through effects from higher tariffs, that’s going to look more and more fanciful. And that could give both stock AND bond markets agita. Keep that in mind with stocks trading in rarefied air.