We have become numb to the prospect of government shutdowns because they occur so frequently. Most often, continuing resolution bills are agreed upon before a shutdown anyway, thus enabling the government to continue operating. And from a stock market perspective, the 21 actual shutdowns have had a negligible effect, advises Lance Roberts, editor of the Bull Bear Report.

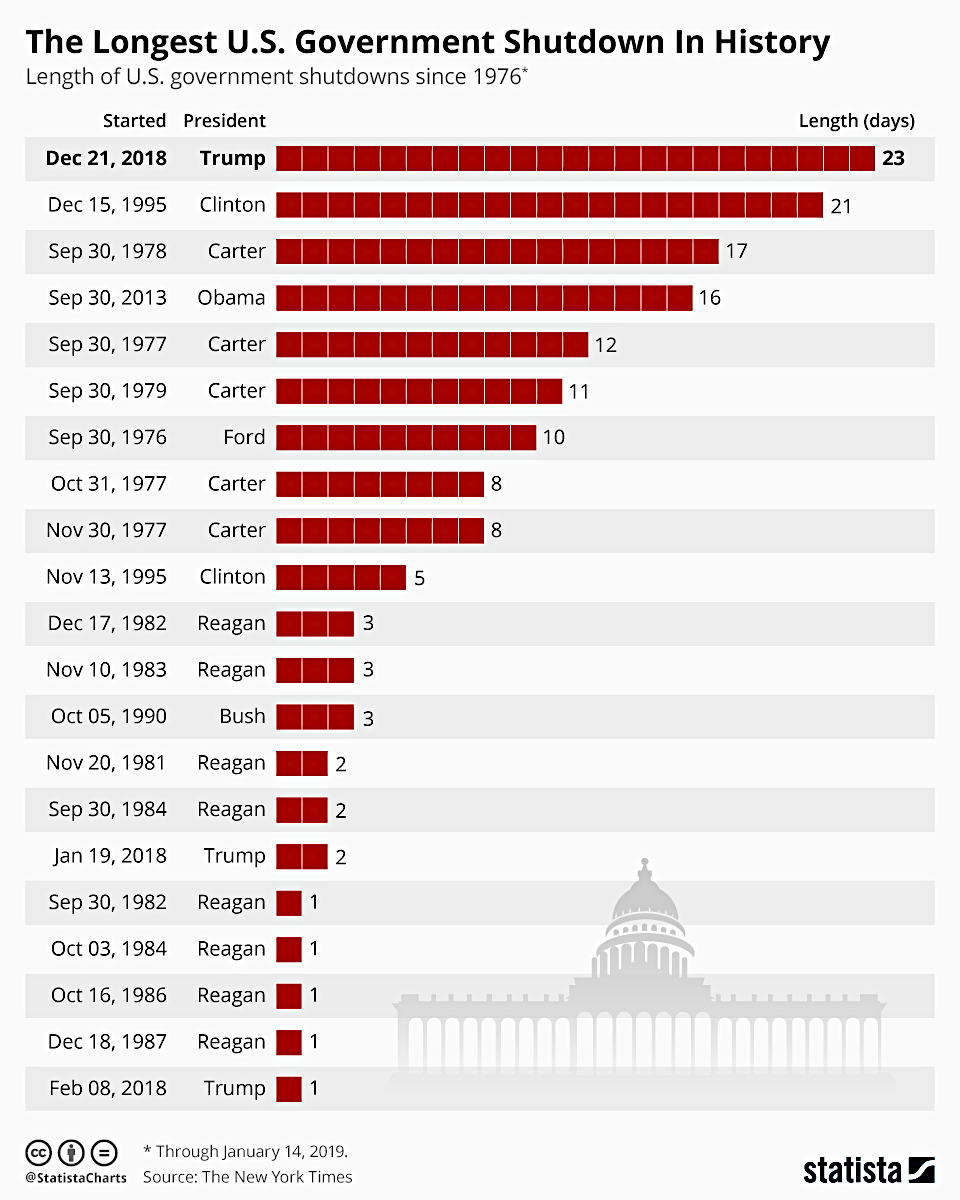

In all but three of the last 47 years, a continuing resolution bill has provided “temporary” funding. The year 1997 was the last one that Congress actually agreed upon a budget. Meanwhile, the graph here (courtesy of Statista) illustrates the 21 instances of government shutdowns that have occurred since 1976.

While a government shutdown may have negative consequences for government workers and employees working in industries closely tied to the government, the economic impact is likely to be minimal. This is especially true if the shutdown only lasts a few days.

As for markets, on average, the S&P 500 Index (^SPX) has GAINED 0.5% during shutdowns since 1976. The most recent, in December 2018, was the longest on record. Yet it also had the highest stock market return at 6.9%.

Of the 21 instances, the maximum loss over the shutdown period was 3.4% (Oct. 10, 1976). Moreover, 71% of the cases posted a positive return. Bottom line: Investors should not fear shutdowns.