As markets gear up for the home stretch of an eventful year, a lot of key macro data in the US and Japan is due. One “Strong Buy” stock to consider trading is Marubeni Corp. (MARUY), writes John Blank, chief equity strategist at Zacks Investment Research.

The final leg of what's been a remarkable year for markets — and everyone else for that matter — is nigh. Traders enter the last quarter with a semi-warning from Federal Reserve Chairman Jay Powell about high stock market valuations ringing in their ears. But with rates expected to start dropping again soon, is anyone going to pay any notice?

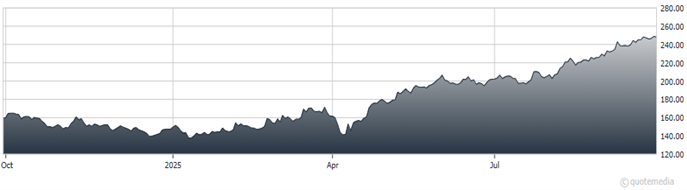

Marubeni Corp. (MARUY)

After another 7% rise in the third quarter, world stocks are now up close to 17%, or $15 trillion in hard cash terms, in 2025. Gold and Chinese tech remain the biggest winners, both adding almost 40%.

As for MARUY, it’s a $247 stock with a market cap of $40.8 billion. It is found in the Zacks Diversified Operations industry. There is a Zacks Value score of A, a Zacks Growth score of B, and a Zacks Momentum score of A.

Tokyo-based Marubeni purchases, distributes, and markets various industrial and consumer goods worldwide. It is involved in importing and exporting, as well as transactions in the Japanese market, related to food, textiles, materials, pulp and paper, chemicals, energy, metals and mineral resources, and transportation machinery.

The company's activities also extend to power projects and infrastructure, plants and industrial machinery, real estate development and construction, and finance, logistics, and information industry.

Recommended Action: Buy MARUY.