Many traders are wondering if they should be trimming cyclical winners and leaning into depressed defensives like staples and health care. History suggests the strength of the economy and pace of Federal Reserve rate cuts will dictate equity investors’ sector preferences. Make sure you’re positioned accordingly, writes Alec Young, contributor at MoneyFlows.

We think the Fed will ease gradually moving forward. Despite a weaker labor market, the overall economy remains healthy thanks to the AI infrastructure boom and a resilient high-end consumer. Meanwhile, core inflation has been sticky near 3% for almost two years and many Fed governors worry that tariff price pressures have yet to hit fully home.

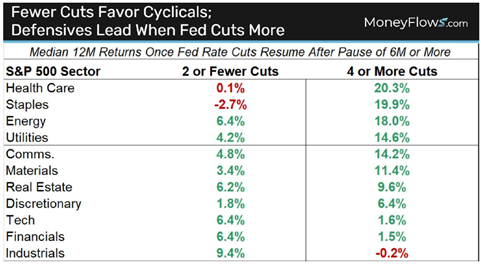

In the four cycles where the Fed delivered only one or two cuts after pausing, the economy was generally strong like it is today and cyclical sectors like industrials, tech, and financials outperformed. However, in cycles where four or more cuts were needed, the economy tended to be weaker and investors leaned more defensive, with health care and staples delivering the highest median returns.

Given our belief that the Fed will tighten gradually over the coming year, we maintain our long-standing cyclical sector bias. But we’re more open to a barbell sector strategy than we’ve been in a while. Stick with a healthy dose of cyclicals but start buying depressed, best-of-breed defensives with juicy dividends.

Bull markets rotate. It’s what they do. Look for today’s picks to include the usual tech, utilities, and industrial suspects, plus beaten-down health care blue chips seeing renewed inflows.