Runaway gains in big tech names. Circular spending deals that create bubble concerns. Big layoff announcements and sliding confidence readings. There are plenty of things to WORRY about as an investor. But here’s one reason NOT to: The bull market is still young!

Yes, you read that right. Young.

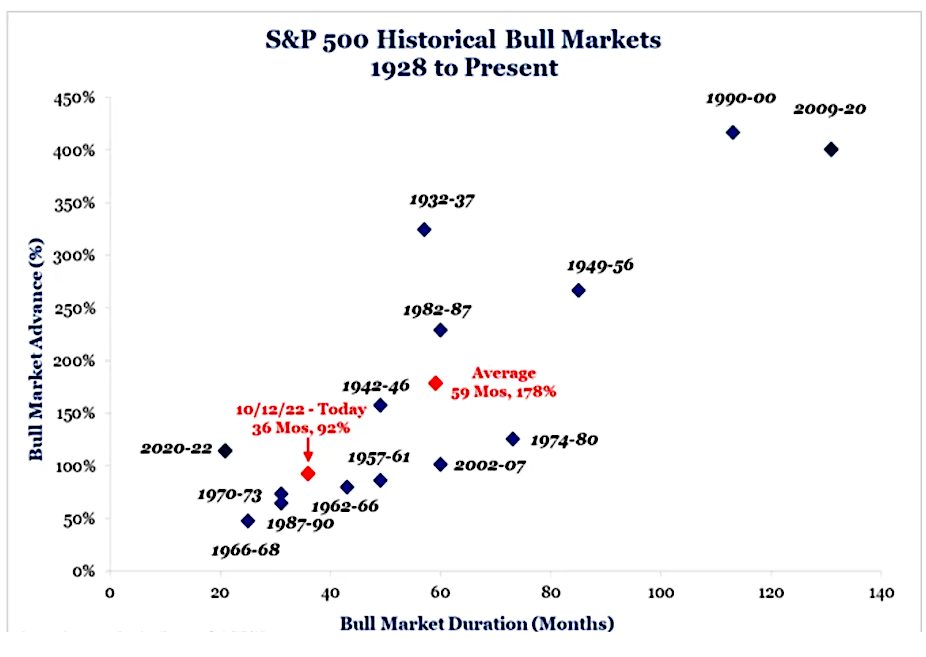

Take a look at the MoneyShow Chart of the Day, which comes courtesy of Strategas. It shows the average S&P 500 Index (^SPX) bull market lasts for 59 months. This one began in October 2022…meaning it’s only 36 months old.

Source: Strategas

Not only that. But we’ve "only" seen gains of 92% so far in this bull market. Sure, that’s a big number. But it’s relatively TAME by comparison to the average post-1928 bull market gain of 178%.

What about the worries I mentioned earlier? They are real. But Wall Street isn’t Main Street, as any experienced trader knows. If CORPORATE profits hold up – or even grow – because of cost-cutting moves like layoffs, stock prices can advance.

Investor sentiment isn’t off-the-charts giddy, either…even with the S&P trading to fresh highs. Plus, we’re entering one of the seasonally strongest periods of the year for stocks, historically speaking.

That doesn’t GUARANTEE markets will rally. After all, weak seasonality in August and September certainly didn’t hold the S&P back this year. But it is another potential tailwind through the rest of 2025.

Bottom line? We do have reasons to worry. But the age of the bull market isn’t one of ‘em.