It’s time to pay close attention to government bond yields. In Japan.

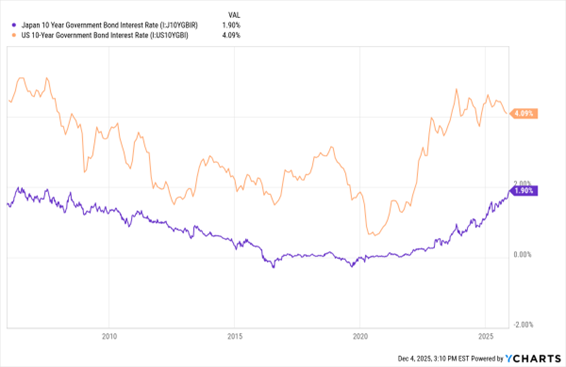

Check out the MoneyShow Chart of the Day. It shows the yield on the 10-year Japanese government bond. As you can see, it has been soaring lately. It recently topped 1.9%, its highest since July 2007. The equivalent yield here in the US is 4.09%.

Japanese 10-Year Vs. US 10-Year (Yield in %)

Data by YCharts

Rising inflation in a country known for decades of DEFLATION is one driving factor. Another catalyst is a series of comments from Bank of Japan governor Kazuo Ueda implying a rate hike could be coming. That runs counter to expectations for a rate CUT at next week’s Federal Reserve meeting in Washington.

So, let’s get to the million-dollar question: Why should you care?

First, because global bond markets are interconnected. The recent jump in Japanese yields put upward pressure on yields in the US, too – not to mention on yields elsewhere around the world.

Second, because Japan is the largest foreign holder of US government debt. Japanese investors have long poured money into US bonds (and stocks) to capture the higher yields and returns offered here versus at home. But if the yield divergence between Japanese and US bonds keeps narrowing, it could lead to capital flows out of US markets.

That would boost the Japanese yen versus the US dollar, while also increasing borrowing costs for US consumers and businesses. It could also put downward pressure on red-hot growth sectors like tech and AI.

So, yes, this is something to keep an eye on. I’ve long had a “Three ‘F’ Rule” when it comes to bond yields and stock prices. When yields rise far enough, fast enough, and for long enough, it can become a real problem for equities. That's true at home AND abroad!